Development Banks Bcom Notes

Development Banks Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. (Development Banks Bcom)

DEVELOPMENTS BANKS

Meaning of Development Bank

Development bank is essentially a multi-purpose financial institution with a broad development outlook. These are specialised financial institutions which perform twin function of providing medium and long term finance to private entrepreneurs and of performing various promotional roles conclusive to economic development. Their promotional role may take a variety of forms like provision of risk-capital, underwriting of new issues, arranging for foreign loans, identification of investment projects, preparation and evaluation of project reports, provision of technical advice, market information and management services etc.

According to Boskey, “Development bank is a financial intermediary supplying medium and long term funds to bankable economic development projects and providing related services.”

Development Banks Bcom

Functions of Development Banks

Development Banks have certain distinct-characteristics which distinguish them from commercial banks and other financial institutions. First, they do not accept deposits from public as ordinary banks do. Second, they specialise in providing long term finance whereas the commercial banks have specialised in providing short-term finance. Third they do not perform ordinary banking functions but perform promotional development and innovative functions.

Some of the functions of development banks are as follows:

- They provide risk capital.

- They subscribe to the issue of stocks, shares, bonds and debentures of industrial concern.

- They grant medium or long term loans or advances. (Development Banks Bcom)

- They underwrite the issue of stocks, shares, bonds and debentures of industrial concerns.

- They guarantee deffered payment of loans in connection with the purchase of capital goods or machinery within and outside the country.

- They guarantee loans raised from within and outside the country.

- They provide assistance for modification, renovation and modernization of existing plants and machinery.

- They provide assistance for the expansion of existing units.

- They provides assistance for setting up new industrial projects.

- They develop capital market by trying to broaden ownership and by mother devices.

- They assist in finding technical and entrepreneurial partners for local clients or for foreign investors.

- They formulate specific proposals for new enterprises.

- They arrange for general industrial surveys and feasibility studies for specific projects.

- They help in the dispersal of industries and development of backward areas.

- They sponsor programmes for the upgradation of managerial skills and professionalism of management. (Development Banks Bcom)

- They provide necessary guidance, training and other facilities like project identification, project formulation, project implementation, etc. to new entrepreneurs.

- They provide consultancy assistance in respect of technical know-how and market information to new entrepreneurs.

Structure of Development Banks In India

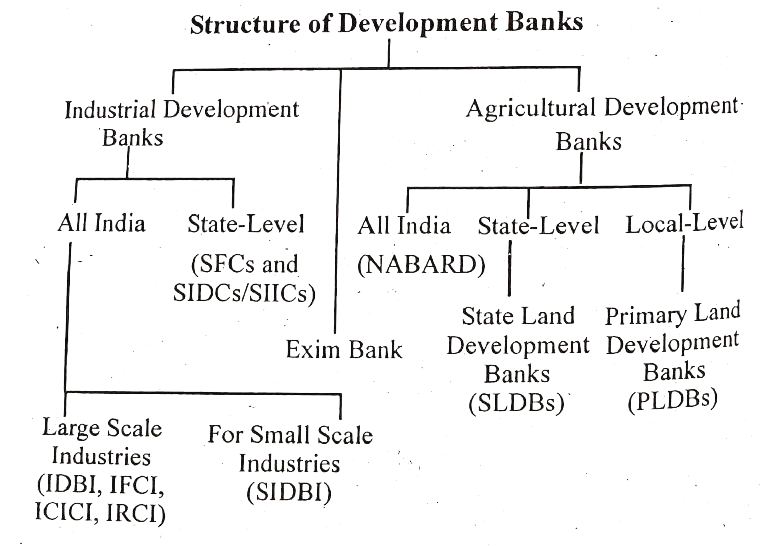

Structure of Development Banks

On the one hand, we have all India institutions like IDBI, ICICI, IFCI, IRCI, NABARD, SIDBI, Exim and NHB. On the other hand, we have state level institutions like SFCS, SIDCS and SIICS, SLDBS etc. Of late however ICICI has already converted itself into a Universal Bank and IDBI is also on the same path. An Universal Bank is one which gives all the financial services under one roof i.e. It is a commercial bank, a development bank, a mutual fund, an insurance company etc. (Development Banks Bcom)

The financial assistance to industry is given in the following four main forms:

(i) Term loans and advances,

(ii) subscriptions to shares & debentures,

(iii) under-writing of new issues,

(iv) Guarantees for term loan and deferred payments.

The first two forms place funds directly in the hands of companies as subscription to shares and debentures are subscription to new issues. The last two forms facilitate the raising of funds from other sources.

Development Banks Bcom

Main Institutions Supplying Industrial Finance in India

Its paid-up capital was initially 5 crore divided into equal parts of 5,000 each. Presently the authorized capital of the corporation is 1,000 crore.

- Industrial Finance Corporation of India (IFCI): It was the first development bank established in India in 1948 to meet the long-term credit needs of industries for creation of fixed assets. Its paid up capital was initially 5 crore divided into equal parts of 5,000 each. Presently, the authorised capital of the corporation is 1,000 crore. Finance is made available for new projects as also for modernisation, expansion and diversification. The finance is provided at concessional terms; initial moratorium and total repayment periods allowed are quite long. Its assistance takes the following forms:

(i) Long-term loans in rupee/foreign currency.

(ii) Underwriting share/debenture issues.

(iii) Subscribing to share/debenture issues.

(iv) Guaranteeing deferred payments for imported/indigenous machinery.

(v) Guaranteeing of loans raised by industrial concerns.

The scope of financial assistance provided by IFCI has been enlarged over the years. IFCI provides assistance to a limited company in public, private or joint sector or to a co-operative society registered in India and engaged or proposed to be engaged in the specified industries. Assistance is available for setting up of new project, expansion, diversification, renovation or modernisation of existing projects. To achieve regional and balanced growth, financial assistance at concessional rate is available to set up industrial projects in notified industrially less developed areas.

The IFCI also renders financial services viz. merchant banking and .allied services. It also offers wide ranging promotional services which include technical consultancy, risk capital assistance, venture capital, technology development etc. (Development Banks Bcom)

- Industrial Credit and Investment Corporation of India (ICICI): It established in 1955 mainly to channelise world Bank funds and to establish a capital market in India. It specialises in foreign currency loans. The main functions undertaken for assisting industries are:

(i) Granting long-term loans.

(ii) Subscribing to and underwriting shares and debentures.

Development Banks Bcom

(iii) Merchant Banking Functions including financial counselling.

(iv) Foreign Currency Loans.

It generally grants loans between 5 lacs to one crore. It raises its foreign resources from credit from World Bank, foreign currency loans from international capital markets, and rupee resources from debenture issue and borrowing from IDBI.

- Industrial Development Bank of India (IDBI): It was established in July 1, 1964 as a wholly owned subsidiary of the Reserve Bank of India and made an autonomous body in 1976. As on May 2010 the authorised of the IDBI was 1,250 crore and the paid-up capital 725 crore. (Development Banks Bcom) The need to establish IDBI took roots in the failure of IFCI and ICICI in meeting completely the needs of the fast-growing industrial sector. At present IFCI, UTI and SIDBI are its subsidiaries.

At present it is the apex body for term industrial finance in India. It co-ordinates the operations of various term lending institutions. The assistance to industrial sector takes the following shapes :

(i) Direct loans to industrial unit/setting up industrial estates.

(ii) Refinancing of term loans granted by commercial banks, SFCs and IFCI etc.

(iii) Rediscounting of bills.

(iv) Subscribing to shares/debentures of financial institutions.

(v) Technical consultancy.

(vi) Guranteeing of deferred payments/loans.

Development Banks Bcom

It used to undertake export finance functions also before EXIM Banko was established in March, 1982.

It draws its resources from issuance of bonds, drawing on the National Industrial Credit (Long-term operations) Fund of R.B.I. and short-term borrowings from R.B.I.

- Small Industries Development Bank of India (SIDBI): With a view to ensuring larger flow of financial and non-financial assistance to small scale sector, Small Industries Development Bank of India (SIDBI) was set up by the Government of India under a special Act of the Parliament in April 1990 as a wholly owned subsidiary of IDBI. The SIDBI commenced its operations with an initial paid-up capital of Rs. 250 crores. Presently, its paid-up capital is 450 crore and authorized capital is 1,000 crore.

The major activities of SIDBI are:

(i) Refinance of loans and advances.

Development Banks Bcom

(ii) Discounting and re-discounting of bills.

(iii) Extension of seed capital/soft loans.

(iv) Granting direct assistance and refinancing of loans.

(v) Providing services like factoring, leasing etc., and

(vi) Extending financial support to State Small Industries Development Corporations.

- State Financial Corporations (SFCs): They are similar to IFCI but their area of operation is limited to the respective States. These have been established in various States pursuant to the passing of SFC Act in 1951. There are at present 18 SFCs in the country.

The SFCs have been established as State level agencies to finance small and medium scale units within the State concerned. The objectives of SFCS differ widely from State to State due to different levels of industrial growth. The authorised capital of a SFC has been raised from Rs. 50 lakhs to Rs. 5 crores. The SFC renders financial assistance in the form of long-term loans, debentures and guarantees. It also underwrites shares. A SFC also acts as an agent for the Central Government, the Industrial Financial Corporation and any other agency approved by the Government.

Development Banks Bcom

- State Industrial Development Corporations: There was complete lack of balanced and co-ordinated industrial development, before independence. Therefore, for accelerating industrial development, wholly owned State Industrial Development Corporations (SIDCs) were established in various States. There are 28 SIDCs functioning in India. (Development Banks Bcom)

The SIDCS concentrate on promotional activities rather than financing industries. These include conducting techno-economic surveys, project identification, preparation of feasibility studies and training of entrepreneurs. SIDCs also promote joint sector projects in collaboration with private promoters.

SIDCS also develop industrial estates. They construct sheds and provide infrastructural support for the establishment of industries.

SIDCS are entitled to refinance facilities from IDBI. Besides, they issue bonds and accept deposits. They also act as an agent of the State Government.

- Indian Investment centre: It was established in June 1961. Its head office is in U.S.A. Its principal objective is to help Indian industrialists in procuring Foreign Capital and industrial technology.

- Industrial Investment Bank of India LTD (IBIL): The erstwhile Industrial Reconstruction Bank of India (IRBI) has been reconstituterd into a full fledged all-purpose development bank on March 27, 1997. It is now known as Industrial Investment Bank of India Ltd. At present, Authorised capital of IIBIL is Rs. 1,000 crore. Its headquarters is situated at Kolkatta.

Development Banks Bcom

|

|||