Process of Credit Creation Bcom Notes

Process of Credit Creation Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. (Process of Credit Creation Bcom)

PROCESS OF CREDIT CREATION

Creation of credit is a major function of a commercial bank. When a bank creates credit or advances loans, there tends to be a multiple expansion of credit in the banking system. Prof. Sayers remarks, “Banks are not merely purveyors of money but also, is an important, manufacturers of money.”

Process of Credit Creation Bcom

How Bank Create Credit?

Commercial banks are profit seeking institutions. They accept deposits from the public and knowing that all depositors will not withdraw money at the same time, they use these resources for advancing loans or for making investments in securities, shares etc, thereby earning a high rate of interest. Each bank, however, follows a customary cash reserve ratio for the sake of liquidity and safety. Some cash reserve are necessary in order to honour the cheques drawn on the demand deposits. Thus, the excess cash reserve can be used to create credit. The commercial banking system, as a whole, can expand credit many times over the initial excess reserve.

Process of Credit Creation

Money or deposits is said to be created by the banks through their lending activity which makes net addition of the total money supply in an economy. Therefore, the Central bank of every country keeps an eye on credit creation capacity of banks and uses various instruments to control credit. (Process of Credit Creation Bcom) Bank deposits may be of following two types:

- Primary Deposits: The bank creates primary deposits when bank opens a deposit account in the name of the customer, who deposits cash or cheques to be deposited in his account. These primary deposits do not make any net addition to the stock of money in the economy because till this stage no credit has been created. In fact, such deposits merely convert currency money into deposit money. (Process of Credit Creation Bcom) These primary deposits later on become the basic of credit and loans and advances granted by the bank.

- Active or Derivative Deposits: After keeping a few percentage of primary deposits in cash, the bank can utilize the balance for granting loans and advances to customers. At the time of making loans, the bank at the same time creates a new deposit into its books because the amount of loan is credited in the account of borrower as a deposit. Hence the well known maxim is that every loan creates a deposit.”

The process of credit creation can be explained with the help of following example:

Process of Credit Creation Bcom

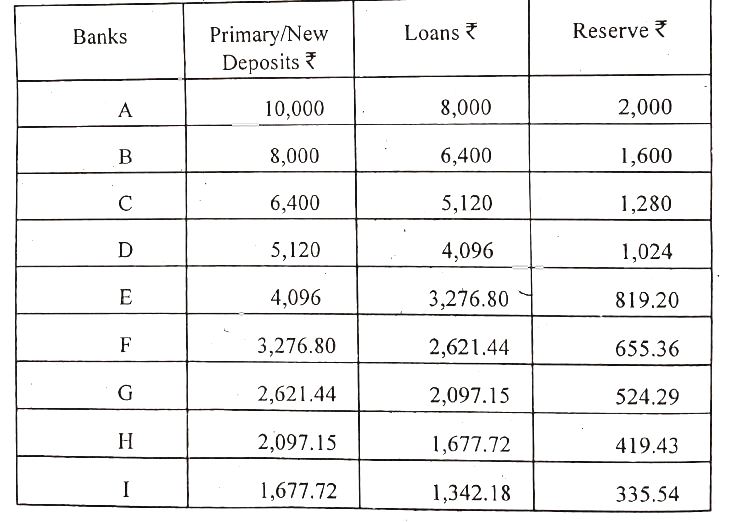

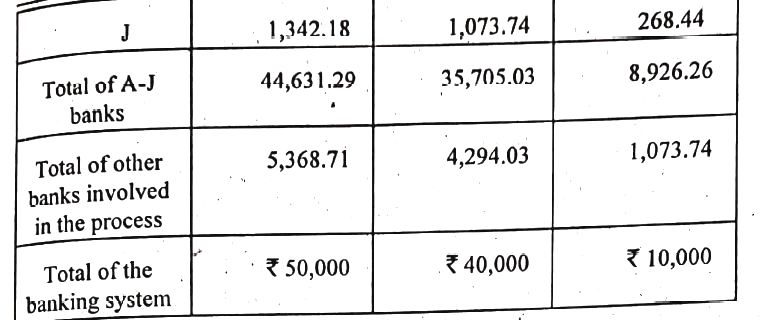

Let us assume that 20% is the customary cash reserve ratio observed by the commercial banks. Now if somebody deposits 10,000 in the Bank of India, the continuation of credit creation process can be summarised as follows:

Infact, the potential credit expansion or creation of derivative demand deposits through loan and investments of the bank is determined by the credit multiplier co-efficient, which is the reciprocal of the cash reserve ratio, thus

Process of Credit Creation Bcom

The credit multiplier coefficient = 1 / Cash Reserve Ratio

In the above example, credit multiplier coefficient = 1 / 20%

Thus, total demand deposits will be 5 times of the initial reserves, i.e., 10,000×5 = Rs. 50,000.

It is a fact that such activity creates deposits and the net increase in credit is more than initial deposits. However, there is another presumption to above example that the borrower will not withdraw entire amount and therefore every time credit is granted, deposits is credited with further power to the bank to create more credit. As per process of bank when the borrower is granted a loan/credit by the bank, the loan money is credited to his deposit account.

Process of Credit Creation Bcom

The borrower can withdraw the entire loan money either at once or in smaller instalments according to his requirement. Let us suppose that the borrower pays to his creditor, in connection with some business transaction, a cheque is drawn on his account with the bank and the creditor deposits the cheque in another bank in his account. The other bank now receives the primary deposit in the form of cheque. After transferring cash for CRR and SLR he can create credit from the balance.

In the same way, the second borrower may make the payment out of the account to another creditor by cheque, creating deposit in the third bank. The third bank will now create credit on the basis of deposit so created. The process will go on and the total volume of derivative deposits created by all the banks would be a multiple of the initial amount created by the first bank.

Thus, over all credit creation by Rs. 10,000 initial deposits, will be many times of primary deposits.

Limitations on Power of the Banks to Create Credit Commercial banks do not have unlimited powers of credit creation, as their activities in this direction are subject to a number of restrictions as follows:

- Amount of Cash: The first important factor on which the extent of credit creation depends is the amount of cash which commercial bank possess. The banks can create credit only on the basis of cash received from the public in the form of primary deposits. If the primary deposits are large, then the derivative deposits credited on their basis will also be large. (Process of Credit Creation Bcom)

- Banking Habits of the People: If the people of the country conduct most of their, business transactions in cash rather than through cheques, then multiple credit creation will be rather limited. There will be frequent withdrawls of cash which will curtail the bank’s power to create credit.

- Cash Reserve Ratio: Credit creation is the reciprocal of the cash reserve ratio. Higher the percentage of cash reserve ratio to be kept, the smaller would be the volume of credit creation by the banks.

- External Drain: External drain refers to the cash withdrawal from the banking system by the public. Every rupee that is withdrawn from the banking system, lowers the reserves of the banks and reduces the powers of credit creation. (Process of Credit Creation Bcom)

- Willingness of Customers to Borrow: The amount of borrowing by the customers sets a limit to the expansion of credit. If no customer comes forward to borrow, there is no expansion of credit. Credit creation depends on the demand for loans, which in turn, depends upon the nature of business conditions. Credit creation, therefore, will be larger during a period of business prosperity and smaller during a depression.

- Banks Reserves with the Central Bank: The Central Bank keeps on changing the percentage of bank’s reserve from time to time. When the Central Bank increases the percentage of these reserves, the power of the commercial banks to create credit is reduced in the same proportion.

- Monetary Policy of the Central Bank: The Central bank has the power to influence the volume of money in circulation and through this, it can influence the volume of credit created by the bank. In addition, the Central Bank has also certain powerful weapons like the bank rate and the open market operations with the help of which it can exercise control on the expansion and contraction of credit by the commercial banks.

- Supply of Collateral Security: The availability of good securities places one more limitation on the power of banks to create money. Every loan made by a bank is secured by some valuable form of wealth, bills, share, stocks etc. If these collateral securities are not available in sufficient number, the bank cannot expand their lending activities and consequently, cannot expand credit in the economy.

Process of Credit Creation Bcom

Process of Credit Creation Bcom

|

|||