Commercial Banks Bcom Notes

Commercial Banks Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. Commercial Banks Bcom Notes

COMMERCIAL BANKS

Meaning and Definitions of Bank

In general speaking, bank is an institution which accepts deposits of money from the public with the purpose of lending or investing them and such deposits are repayable on demand to the respective depositors. Thus a bank is an institution which deals with money and credit. It accepts deposits from the public, makes the funds available to those who need them and helps in the remittance of money from one place to another. In fact, a modern bank perform such a variety of functions that it is difficult to give a precise and general definition of it. Some important definitions of bank can be given as follows:

Commercial Banks Bcom Notes

According to Hart, “A banker is one, who, in ordinary course of his business receives money which he repays by honouring cheques of persons for whom or on whose account he receives it.”

According to Indian Companies Act, 1949, “The accepting for the purpose of investment of deposits of money from the public repayable on demand or otherwise and withdrawls by cheque, draft order or otherwise.”

According to Sayers, “Bank is an institution, whose debts are widely accepted in settlement of other people debts.”

In short, the term bank in the modern time refers to an institution having the following features:

(i) It deals with money; it accepts deposits and advances loans.

(ii) It also deals with credit; it has the ability to create credit.

(iii) It is a commercial institution; it aims at earning profit.

(iv) It is a unique financial institution that creates demand deposits and manage the payment system of the country.

Functions of Commercial Banks

Commercial Banks perform several functions, which may be classified into three categories as follows:

(I) Primary Functions

Commercial Banks Bcom Notes

(II) Agency Functions,

(III) General Utility Functions.

(I) Primary Function: All commercial banks perform the following functions mainly:

(i) Accepting Deposits: The first important function of a bank is to accept deposits from those who can save but cannot profitably utilise this saving themselves. People consider it more rational to deposit their savings in a bank because by doing so they, on the one hand, earn interest, and on the other, avoid the danger of theft. To attract savings from all sorts of individuals, the bank maintain different types of accounts such as fixed deposit account, current account, saving account etc.

(ii) Advancing of Loans: The second important function of a bank is advancing of loans to the public. After keeping certain cash reserves, the banks lend their deposits to the needy borrowers. Before advancing loans, the banks satisfy themselves about the credit worthiness of the borrowers.

Bank grants loan in various forms such as overdraft, term loan, discounting of bills of exchange, cash credit etc.

(II) Agency Functions: Banks also perform certain agency functions for and on behalf of their customers:

(i) Remittance of Funds: Banks help their customers in transferring funds from one place to another through cheques, drafts, etc.

(ii) Collection and Payment of Credit Instruments: Banks collect and pay various credit instruments like cheques, bills of exchange, promissory notes, etc.

(iii) Execution of Standing Orders: Banks execute the standing instructions of their customers for making various periodic payments. They pay subscriptions, rents, insurance premium, etc. on behalf of their customers.

Commercial Banks Bcom Notes

(iv) Purchasing and Sale of Securities: Banks undertake purchase and sale of various securities like shares, stocks, bonds, debentures etc. on behalf of their customers. Banks neither give any advice to their customers regarding these investments nor levy any charge on them for their service, but simply perform the function of a broker.

(v) Collection of Dividends on Shares: Banks collect dividends, interest on shares and debentures of their customers.

(vi) Income Tax Consultancy: Banks may also employ income-tax experts to prepare income-tax returns for their customers and to help them to get refund of income-tax.

(vii) Acting as Trustee and Executor: Banks preserve the wills of their customers and execute them after their death.

(viii) Acting as Representative and Correspondent: Sometimes the banks act as representatives and correspondents of their customers. They get passports, traveller’s tickets, book vehicles, plots for their customers and receive letters on their behalf.

(III) General Utility Functions: In addition to agency services, the modern banks provide many general utility services as given below:

(i) Locker Facility: Banks provide locker facility to their customers. The customers can keep their valuables and important documents in these lockers for safe custody.

(ii) Traveller’s Cheques: Banks issue traveller’s cheques to help their customers to travel without the fear of theft or loss of money. With this facility , the customers need not take the risk of carrying cash with them during their travels.

Commercial Banks Bcom Notes

(iii) Letter of Credit: Letters of credit are issued by the banks to their customers certifying their creditworthiness. Letters of credit are very useful in foreign trade.

(iv) Collection of Statistics: Banks collect statistics giving important information relating to industry, trade and commerce, money and banking.

They also publish journals and bulletins containing research articles on economic and financial matters.

(v) Underwriting Securities: Banks underwrite the securities issued by the government, public or private bodies. Because of its full faith in banks, the public will not hesitate in buying securities carrying the signatures of a bank.

(vi) Gift Cheques: Some banks issue cheques of various denominations (say of Rs. 11, 21, 31, 51, 101, etc.) to be used on auspicious occasions.

(vii) Acting as Referee: Banks may be referred for seeking information regarding the financial position, business reputation and respectability of their customers.

Commercial Banks Bcom Notes

(viii) Foreign Exchange Business: Banks also deal in the business of foreign currencies. Again, it may finance foreign trade by discounting foreign bills of exchange.

(ix) Credit Creation: A unique function of the bank is to create credit. In fact, credit creation is the natural outcome of the process of advancing loan as adopted by the banks. When a bank advances a loan to its customers, it does not lend cash but opens an account in the borrower’s name and credits the amount of loan to this account.

Thus, whenever a bank grants a loan, it creates an equal amount of bank deposit. Creation of such deposits is called credit creation which results in a net increase in the money stock of the economy. Banks have the ability to create credit many times more than their deposits and this ability of multiple credit creation depends upon the cash-reserve ratio of the banks.

(x) Promoting Cheque System: Banks also render a very useful medium of exchange in the form of cheques. Through a cheque, the depositor directs the bankers to make payment to the payee. Cheque is the most developed credit instrument in the money market. In the modern business transactions, cheques have become much more convenient method of settling debts than the use of cash.

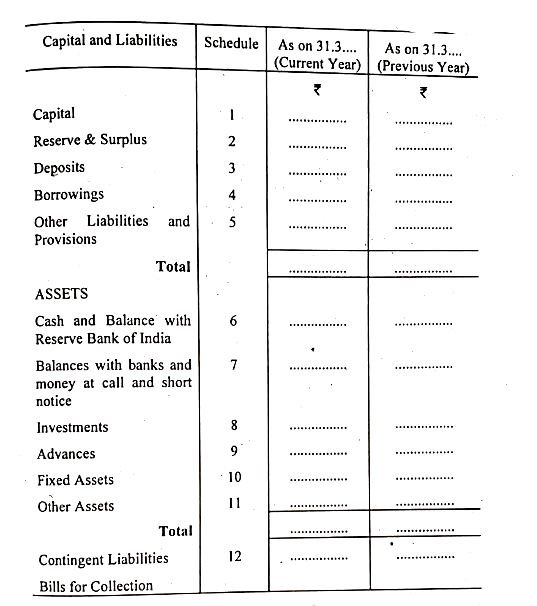

Balance Sheet of a Bank

According to section 29 of the Banking Regulation Act, 1949 a banking company is required to prepare its Balance Sheet and Profit & Loss Account in the forms set out in the third Schedule of Act. The formats have been revised effective from the accounting year ended 31st March, 1992. The following are the revised formats which include Form A Balance Sheet, Form B for Profit & Loss Account and sixteen schedules out of which the first twelve schedules pertain to Balance Sheet while the remaining four schedules concern Profit & Loss Account. (Commercial Banks Bcom Notes)

Evolution of SBI

The origin of the State Bank of India goes back to the first decade of the nineteenth century with the establishment of the Bank of Calcutta in Calcutta on 2 June, 1806. Three years later the bank received its charter and was re-designed as the Bank of Bengal (2 January 1809).A unique institution, it was the first joint-stock bank of British India sponsored by the Government of Bengal. The Bank of Bombay (15 April 1840) and the Bank of Madras (1 July 1843) followed the Bank of Bengal. These three banks remained at the apex of modern banking in India till their amalgamation as the Imperial Bank of India on 27 January, 1921.

Imperial Bank: The Imperial Bank during the three and a half decades of its existence recorded an impressive growth in terms of offices, reserves, deposits, investments and advances, the increases in some cases amounting to more than six-fold. The financial status and security inherited from its forerunners no doubt provided a firm and durable platform. (Commercial Banks Bcom Notes)

But the lofty traditions of banking which the Imperial Bank consistently maintained and the high standard of integrity it observed in its operations inspired confidence in its depositors that no other bank in India could perhaps them equal. All these enabled the Imperial Bank to acquire a pre-eminent position in the Indian banking industry and also secure a vital place in the country’s economic life.

When India attained freedom, the Imperial Bank had a capital base (including reserves) of Rs.11.85 crores, deposits and advances of Rs.275.14 crores and Rs.72.94 crores respectively and a network of 172 branches and more than 200 sub offices extending all over the country.

Emergence of State Bank of India

In 1951, when the First Five Year Plan was launched, the development of rural India was given the highest priority. The commercial banks of the country including the Imperial Bank of India had till then confined their operations to the urban sector and were not equipped to respond to the emergent needs of economic regeneration of the rural areas. In order, therefore, to serve the economy in general and the rural sector in particular, the All India Rural Credit Survey Committee recommended the creation of a statepartnered and state-sponsored bank by taking over the Imperial Bank of India, and integrating with it, the former state-owned or state-associate banks.

Commercial Banks Bcom Notes

An act was accordingly passed in Parliament in May, 1955 and the State Bank of India was constituted on 1 July, 1955. More than a quarter of the resources of the Indian banking system thus passed under the direct control of the State. Later, the State Bank of India (Subsidiary Banks) Act was passed in 1959, enabling the State Bank of India to take over eight former State-associated banks as its subsidiaries (later named Associates). Presently number of subsidiaries of State Bank of India is 5.

The State Bank of India was thus born with a new sense of social purpose aided by the 480 offices comprising branches, sub offices and three

Local Head Offices inherited from the Imperial Bank. (Commercial Banks Bcom Notes)The concept of banking as mere repositories of the community’s savings and lenders to creditworthy parties was soon to give way to the concept of purposeful banking sub serving the growing and diversified financial needs of planned economic development. The State Bank of India was destined to act as the pacesetter in this respect and lead the Indian banking system into the exciting field of national development. The SBI acts as an agent of the RBI at the places where the RBI has no branch.

Management of SBI

The head office of the bank is located in Mumbai, & bank has the local offices at Kolkata, Mumbai, Chandigarh, Chennai, New Delhi, Lucknow, Ahmedabad, Hyderbad, Patna, Bhopal, Bhubaneshwar, Guwahati & Bangalore.

Commercial Banks Bcom Notes

|

|||