Capital Market and Financial Intermediaries Bcom Notes

Capital Market and Financial Intermediaries Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. (Capital Market and Financial Intermediaries Bcom)

CAPITAL MARKET AND FINANCIAL INTERMEDIARIES

Meaning of Capital Market

Capital market is the market for long term funds. It refers to all the facilities and the institutional arrangements for borrowing and lending term funds (medium-term and long-term funds). The demand for long-term funds comes mainly from industry, trade, agriculture and government. The central and state government invest not only on economic overheads such as transport, igation, and power supply but also on basic and consumer goods industries and hence require large sums from capital market. The supply of funds comes largely from individual savers, corporate savings, banks, insurance companies, specialized financial institutions and government.

Capital Market and Financial Intermediaries Bcom

Significance (Or Role) Of Capital Market In Economic Development

Capital market has a crucial significance to capital formation. Adequate capital formation is indispensable for a speedy economic development. The main function of capital market is the collection of savings and their distribution for industrial development. This stimulates capital formation and hence, accelerates the process of economic development. The significance of capital market in economic development is explained as follows:

- Mobilisation of Savings: Capital market is an organized institutional network of financial organizations, which not only mobilizes savings through various instruments but also channelises them into productive avenues. In other words, the resources that would have been normally used for consumption purpose are being released for productive purpose through capital market. By making available various types of financial assets, the capital market encourages savings. By providing liquidity to these financial assets through the secondary markets capital market is able to mobilise large amount of savings from various sections of the people. (Capital Market and Financial Intermediaries Bcom)

- Channelisation of Funds into Investments: Capital market plays a crucial role in the economic development by channelising funds in accordance with development priorities. The financial intermediaries in the capital market are better placed than individuals to channel the funds into investment which are more favourable for economic development. It raises efficiency of investment with its specialized knowledge, expertise, information and huge amount of resources. It undertakes this in the following ways: (Capital Market and Financial Intermediaries Bcom)

(a) It allocates resources to the most viable projects, which improves allocation of resources.

(b) It reduces the cost of transferring resources from lenders to borrowers related to contract, risk of default, etc. Thus it provides high returns to savers and reduces the charges to borrowers.

(Capital Market and Financial Intermediaries Bcom)

- Industrial Development: Capital market contributes to industrial development in the following ways:

(a) It provides adequate, cheap and diversified finance to the industrial sector for various purposes.

(b) It provides funds for diversified purposes such as for expansion modernization, upgradation of technology, establishment of new units etc.

(c) It provides a variety of services to entrepreneurs such as provision of underwriting facilities, participating in equity capital, credit rating, consultancy services, etc. This helps to stimulate industrial entrepreneurship.

- Modernisation and Rehabilitation of Industries: Capital market can contribute towards modernisation, rationalisation and rehabilitation of industries. For example, the setting up of development financial institutions in India such as IFCI, ICICI, IDBI and so on has helped the existing industries in the country to adopt modernisation and replacement of obsolete machinery by providing adequate finance. Further, they have also enabled the industrial units to solve the problems of foreign exchange by channelising the funds obtained from international agencies like International Finance Corporation. They also participate in the equity capital of industries. (Capital Market and Financial Intermediaries Bcom)

- Technical Assistance: An important bottleneck faced by entrepreneurs in developing countries is technical assistance. By offering advisory services relating to the preparation of feasibility reports, identifying growth potential and training entrepreneurs in project management, the financial intermediaries in the capital market play an important role in stimulating industrial entrepreneurship. This helps to stimulate industrial investment and thus promotes economic development.

- Encourage Investors to invest in Industrial Securities: Secondary market in securities encourage investors to invest in industrial securities by making them liquid. It provides facilities for continuous, regular and ready buying and selling of securities. Thus, industries are able to raise substantial amount of funds from various segments of the economy. (Capital Market and Financial Intermediaries Bcom)

- Reliable Guide to Performance: The capital market serves as a reliable guide to the performance and financial position of corporates, and thereby promotes efficiency.

Structure Of Capital Market In India

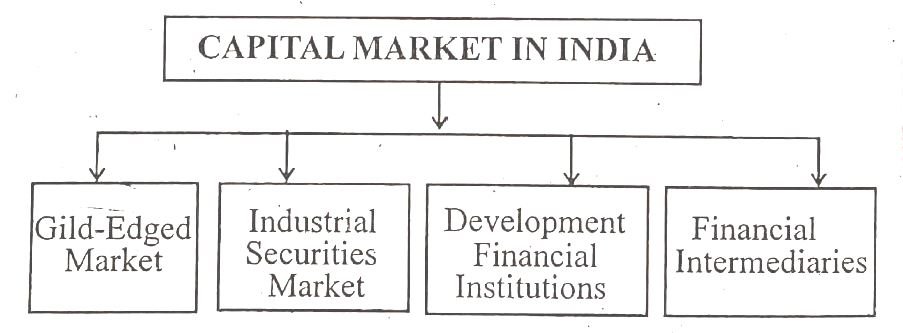

The capital market, like any market, is composed of those who demand funds (i.e. borrowers) and those who supply funds (i.e. lenders). Indian capital market is broadly composed of (1) Gild-edged market (i.e. government securities market), (2) Industrial securities market, (3) Development financial institutions, and (4) Financial intermediaries. It can be depicted as follows:

CAPITAL MARKET IN INDIA

Capital Market and Financial Intermediaries Bcom

- Gild-Edged Market: It deals in government and semi-government securities. These securities carry fixed interest rates. The investors in government securities are mainly financial institutions like commercial banks, LIC, GIC and provident funds. These institutions are often compelled by law to invest a certain percentage of their funds in these securities. Therefore, they are often referred to as the captive market for government securities, RBI plays a very important role in this market through open market operations.

- Industrial Securities Market: It deals with shares and debentures of old and new companies. This market is further divided into new issues market i.e. primary market and old issues market i.e. secondary market. The primary market helps to raise new capital through shares and debentures. The secondary market deals with securities already issued by the companies. The secondary market operates through stock exchanges. (Capital Market and Financial Intermediaries Bcom)

- Development Financial Institutions (DFIs): These institutions were set up mainly to provide medium and long-term financial assistance to industries in the private sector. Thus, to provide financial assistance to industrial sector government set up the Industrial Finance Corporation of India (IFCI) in 1948, the Industrial Credit and Investment Corporation of India (ICICI) in 1955, the Industrial Development Bank of India (IDBI) in 1964, the Industrial Reconstruction Bank of India (IRBI) in 1971 which was renamed as Industrial Investment Bank of India Ltd (IIBI) in 1995, the Export and Import Bank of India (EXIM Bank) in 1982 and so on. (Capital Market and Financial Intermediaries Bcom) At the state level government set up State Financial Corporations (SFCS), State Industrial Corporations (SIDCs) and so on. All these institutions have been called public sector financial institutions or term lending institutions. The Narasimham Committee (1991) called them Development Financial Institutions.

These institutions have been doing very useful work in subscribing to the shares and debentures of new and old companies in giving loan assistance, in underwriting new issues, and so on. At present, many of them have become powerful shareholders in many prominent companies. LIC and UTI mobilize resources from the public and place them at the disposal of the capital market. On the other hand, the Development Financial Institutions (DFIs) are engaged in providing funds to the private sector enterprises.

- Financial Intermediaries: They consist of merchant banks, mutual funds, leasing companies, venture capital companies and others. They help in mobilising savings and supplying funds to the capital market. (Capital Market and Financial Intermediaries Bcom) Merchant banks in India manage and underwrite new issues, and advise corporates clients on fund raising and other financial aspects. Leasing companies provide financial for acquiring plant and machinery specially for small and medium sized enterprises. Mutual funds mobilise the savings of the general public and invest them in stock market. The venture capital companies provide financial support to new ideas and for the introduction and adaptation of new technologies. There is a high degree of risk involved in venture capital financing.

Types of Capital Market

Capital market can also be classified into primary and secondary market. A brief description of both of these can be made as follows.

1. Primary Market in India: It is a market for new issues and therefore it is also called the New Issue Market. It deals with the raising of fresh capital in the form of equity shares, preference shares, debentures, bonus, deposits, miscellaneous loans, etc. by companies, government and semi-government bodies, public sector units, etc. It includes all institutions dealing in the issue of fresh claims. (Capital Market and Financial Intermediaries Bcom)

The resources mobilised from the primary market can be broadly classified into two categories i.e.

(i) Equity issues and

(ii) Debt issues.

(i) Equity Issues: They include issue of ordinary shares and preference shares of corporates, units of mutual funds, and funds mobilised in the form of equity shares from overseas. There is no assurance on the rate of return to the investor in equities.

(ii) Debt Issues: They include fixed deposits, bonds of all types and debentures (both convertible and non-convertible) and funds mobilised in the form of debt from overseas. They involve a fixed interest cost to the corporate and the commitment to repay on maturity. The funds mobilised in the primary market in the form of equity and debt reveal investor preference.

Capital Market and Financial Intermediaries Bcom

2. Secondary Market in India: It deals in securities already issued or existing or outstanding. The primary market mobilises savings and supplies fresh or additional capital to business units. Eventhough secondary market does not contribute directly to the supply of additional capital, does so indirectly by rendering securities issued on the primary market liquid. This takes place through stock exchanges.

The stock exchange provide facilities in the form of infrastructure for buying and selling of securities and help to develop a secondary market for them. They help in discovering the price of an underlying asset and in providing liquidity to the investor. (Capital Market and Financial Intermediaries Bcom) Stock exchanges provide the platform for transaction to large number of buyers and sellers of the securities with the help of brokers and other market intermediaries.

The secondary market in India has shown maturity by registering enormous growth in the recent years in terms of number of listed companies, market capitalisation, market value of listen companies to GNP, number of shareholders, and so on. There are 23 recognised stock exchange in the country. The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) are the two premier stock exchanges in India. They provide efficient and transparent platform for trading of equities, preference shares, debentures, warrants, etc.

Capital Market and Financial Intermediaries Bcom

The SEBI has been set up to ensure that stock exchanges dischange their self regulatory role properly. To prevent malpractices in trading and to protect the rights of investors, the SEBI has taken up the monitoring function, requiring the brokers to be registered and stock exchanges to report on their activities.

Capital Market and Financial Intermediaries Bcom

|

|||