Structure of Commercial System in India Bcom Notes

Structure of Commercial System in India Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. (Structure of Commercial System in India Bcom Notes)

STRUCTURE OF COMMERCIAL SYSTEM IN INDIA

Oganisation and Structure of Commercial Banks

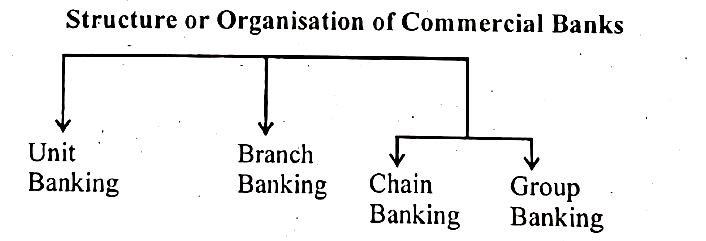

The organisation and structure of commercial banks is not the same in every country. In some countries there is unit banking while in some others there may be branch banking system. The structure of commercial banks will be one from amongst those given in the chart below. (Structure of Commercial System in India Bcom Notes)

Structure or Organisation of Commercial Banks

Structure of Commercial System in India Bcom Notes

(1) Unit Banking: It is prevalent in USA. In case of a unit bank, a single or individual banking company undertakes the whole business from a single office. Thus unit banking is a single office banking system. All unit banks are linked by a correspondent bank agency which provide many facilities to the unit bank. The unit banks mostly operate in cities and towns.

(2) Branch Banking: Under this system, a big bank establishes several branches in different parts of the country and undertakes banking business through these branches.

The branch banking system provides diversification and transfer of surplus funds and extends the banking system throughout the country. Transfer of funds is more easier and convenient. Because of its enormous size and resources, this system enjoys the confidence of the people. It also enjoys the economies of large scale operations. Inspite of the advantages, (Structure of Commercial System in India Bcom Notes) there are also certain shortcomings because it is difficult and expensive to supervise the branches of banks. Besides it may also lead to concentration of economic power and growth of monopolistic organisation, lack of co-ordination amongst the various branches, red-tapism and delay, unnecessary competition among branches etc.

Inspite of some shortcomings that may prevail in the branch banking system it is still found to be better than the unit banking system. In a vast country like India, branch banking seems to be more appropriate for industrial, commercial, agricultural and local development programmes. Branch banking system is endowed with huge resources, better staff and more facilities with the help of which it is possible to bring about the much needed regional development in a growing economy. The disadvantages of the branch banking system can eliminated by proper central banking controls and regulations.

- Chain Banking: Under this system of banking, a person or a group persons will have control over the existing banks. This system was prevalent in USA in 1925. In this system several incorporated banks are brought under common control by device rather than by a holding company. It is possible that some persons are directors of two or more banking companies. There may also be common ownership. In India the previous form of managing agency system was of this nature where services of managing agents were available to more than one bank. Under the chain banking system, integrated managerial services are possible. It can have economy in matters of operational expenses. It can also make higher profits, fully utilise funds, diversify risks and have all the advantages of a centralised control system. But the system suffers from certain demerits such as, it lacks flexibility in operation and management, lacks efficient supervision and management, breeds corruption and irregularities. (Structure of Commercial System in India Bcom Notes)

- Group Banking: When two or more banks are controlled by a corporation, trust, syndicate or association, such a system is known as group banking system. The banks are mostly under a holding company. This type of banking was operative in U.S.A. between 1925 and 1929. Under this system the holding company coordinates the working of the banks with regard to of employment and management of funds. The holding company may not necessarily be a banking company. Usually branch banking is the main system under group banking.

The group banking system combines the advantages of branch banking and unit banking. Each member bank maintains its identity but enjoys the advantages of the group, ensures liquidity to the member banks because funds can be transferred from one bank to another. Mutual help is possible under this system and member banks can get the advantages of research and development undertaken by the parent company.

Structure of Commercial System in India Bcom Notes

But this system also has certain shortcomings. The failure of one bank may affect the other member banks adversely. It may lead to monopoly in the banking business and the purchasing agency being common, may give scope for corruption.

Structure of Commercial System in India Bcom Notes

|

|||