Money Supply Bcom Notes

Money Supply Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. Money Supply Bcom Notes

MONEY SUPPLY

Meaning of Money Supply

The term ‘supply of money’ refers the total stock of money held by the public in spendable form. The term ‘public’ refers to the individuals and the business firms in the economy, excluding the central government, the central bank and the commercial banks. Thus, balances held by the central government, the central bank and the commercial banks do not form money supply because they are not in actual circulation.

Money supply is a stock as well as a flow concept. When money supply is viewed at a point of time, it is a stock, and when viewed over a period of time, it is a flow. Money supply at a particular moment of time is the stock of money held by the public at a moment of time. It refers to the total currency notes, coins and demand deposits with the banks held by the public.

Money Supply Bcom Notes

Over a period of time, money supply becomes a flow concept. It may be spent several times during a period of time. The average number of times a unit of money passing from one hand to another during a given period is called the velocity of circulation of money. Thus, the flow of money supply over the period of time can be known by multiplying a given stock of money held the public by the velocity of circulation of money. In Fisher’s equation, PT-MV, MV refers to the flow of money supply over a period of time, where M stands for the stock of money held by the public and V for the velocity of circulation of money.

Components (Constituents) of Money Supply

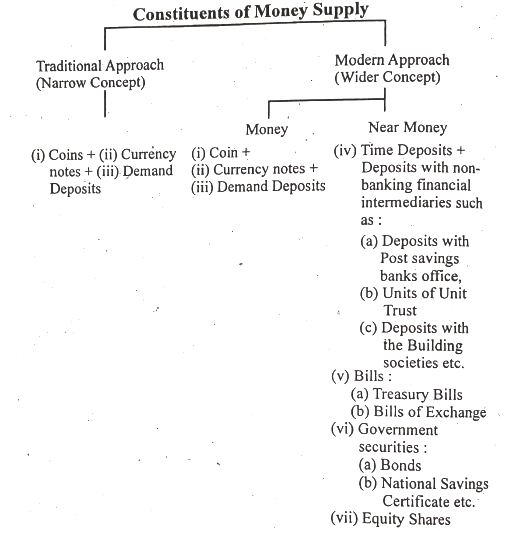

Monetary economists hold different views regarding the constituents of money supply. Broadly, there are two views the traditional view and the modern view.

- Traditional Views: According to the traditional view, money supply is composed of (a) currency money and legal tender, i.e., coins and currency notes, and (b) bank money, i.e., chequable demand deposits with the commercial banks.

- Modern Views: According to the modern view, the phenomenon of money supply refers to the whole spectrum of liquidity in the asset portfolio of the individual. Thus, in the modern approach, money supply is wider concept which includes (a) coins, (b) currency notes, (c) demand deposits with the banks, (d) time deposits with the banks, (e) financial assets, such as deposits with the non-banking financial intermediaries, like the post-office saving banks, building societies, etc., (f) treasury and exchange bills (g) bonds and equities.

Money Supply Bcom Notes

Constituents of Money supply can be depicted with the help of following chart:

Constituents of Money Supply

The basic difference between the traditional and modern views is due to their emphasis on the medium of exchange function of money and the store of value function of money respectively. While the acceptance of medium of exchange function of money supply gives a narrow view of money supply, the recognition of the store of value function of money provides a broader concept of money supply and allows for the substitutability between money (which is traditionally defined as a medium of exchange) and the whole spectrum of financial assets.

Money Supply Bcom Notes

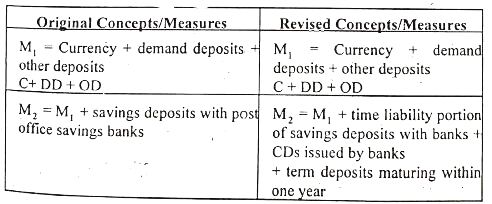

Alternative Measures of Money Supply In India

Till 1967-68, the Reserve Bank of India used to adopt only the narrow measure of money supply defined as the sum of currency and demand deposits, both held by the public. From 1967-68, it started publishing additionally a broader measure of money supply, known as aggregate monetary resources (AMR), which includes time deposits of banks held by the public in the money supply along with currency and demand deposits. From April, 1977, the RBI has adopted four alternative measure of money supply known as M1, M2, M3, and M4 which consists of following items:

M₁ Currency held by public (C) + Net demand deposits of banks (DD) + Other deposits of the RBI (OD)

(Other deposits of the RBI include demand deposits of quasi-government institutions (like IDBI), Foreign Central banks and government, the IMF and the World Bank etc.)

Money Supply Bcom Notes

M2 = M1 + Saving deposits with post office saving banks.

M3 = M1 + Net time deposits of banks.

M4 = M1 + Total deposits with post office (excluding National Savings Certificates)

Generally, My measure of money supply is used in India. M₂ and M₁ are rarely used for policy purposes because post office deposits whether savings or total have a little importance on overall price level. It will be observed from it that in M, notes and coins are most important part accounting for nearly 60% of total M₁. But if cash in hand with the banks is deducted from it, notes and coins in circulation accounted for 37% of M, of narrow money, the rest is accounted by demand deposits.

RBI’s New Measures of Money Supply

The RBI’s working group since 1998 has redefined the parameters for measuring money supply. A change is introduced in M₂. Ma is totally abolished. Accordingly, now there are only three monetary aggregates that is: M₁, M₂ and M3. Following table brings out the difference between the new and earlier measures of money supply:

Money Supply Bcom Notes

In the revised measures M1, remains unchanged.

M4 had no practical significance over in the earlier monetary aggregates or measures.

Money Supply Bcom Notes

Sources of Money Supply

Money supply is influenced mainly by the central bank of the country, the government and the commercial banks. All the agencies through their actions directly or indirectly affect the total supply of money.

Central Bank: It is the monetary authority of a country and therefore enjoys the monopoly to issue currency. Each central bank issues currency based on certain principles. The R.B.I. follows the minimum reserve system. Under the rule, R.B.I. should have a reserve of Rs. 200 crores for issuing currency. Of the Rs.200 crores; 115 crores are in gold and the remaining 85 crores in securities.

This is the minimum requirement, fulfilment of which qualifies the R.B.I. to issue the currency as required by the economy. Central bank besides issuing currency also influences the credit creating ability of commercial banks through its credit policy. A dear money policy through increased bank rate, higher cash reserve ratio and sale of securities through open market operations reduces the total quantity of money. Similarly a cheep money policy expands the total supply of money.

Money Supply Bcom Notes

Government: In India, the government issues one rupee notes and coins. They are the standard currency and of unlimited legal tender. In any country even if the government does not issue currency, it still influences money supply through its budgetary policies. Deficit budget financed by borrowing from the Central Bank or Commercial Banks increases money supply.

A surplus budget which collects more money from the public and spends less, reduces the quantity of money in the economy. Government raising loan by selling its securities or repaying debt by purchasing its own securities from the public or commercial banks influence the cash balance of banks which in turn affects their power to create credit. Budgetary policy of the government in modern times invariably has resulted in an increase in, money supply.

Commercial Banks: Commercial banks, create demand deposits on the basis of primary deposits. The ability of commercial banks to create credit depends on:

(i) Primary deposits received from the public.

(ii) Ratio of cash to bank deposits.

(iii) Demand for bank credit and

Money Supply Bcom Notes

(iv) Credit policy of the Central Bank.

All the above factors influence the total credit created by the banking system.

Actions of each of the above agencies influence the total money supply. Their actions include:

(i) Issue of more currency by Central Bank.

(ii) Monetary policy of the Central Bank.

(iii) People’s preference for cash or bank deposits and Commercial Banks’ expansion of credit.

(iv) Government’s budgetary policy.

Money Supply Bcom Notes

Main Determinants of Money Supply in an Economy

Cash in circulation and demand deposits are the basic components of money supply. Cash money is issued by the central bank and demand deposits are created by the commercial banks. In this regard, Chandler states that the major determinants of the quantity of money in an economy are:

- The size of the monetary base;

- Community’s choice regarding cash and credit proportions in holding money;

- Extent of monetisation and;

- The cash reserve ratio;

- Government Budgetary Policy of Monetary Finance. (Money Supply Bcom Notes)

- Monetary Base: An important determinant of the extent of the money supply in a modern economy is the magnitude of monetary base. The term “monetary base” here refers to the group of assets which empowers the monetary authorities-the central bank-to issue high-powered money (the currency money) for use in the economy, from time to time. The monetary base, in general, is composed of the following:

- monetary gold stock;

- reserve assets, such as government securities, bonds and bullion, foreign exchange reserve, etc., with the central bank and

- amount of central bank credit outstandings.

- Community’s choice: The relative amounts of cash and demand deposits which the community wishes to hold have a great significance in this regard. If the community chooses to make payments by cheques rather than by cash in a greater proportion, then the total volume of money that will be maintained by a given monetary base will be larger. (Money Supply Bcom Notes) This is because, one rupee in the hands of the public supports only itself, that is, one rupee of money; while one rupee with a commercial bank, in its reserves, can support several rupees of money in the form of derivative demand deposits (due to the multiple extension of credit in the banking system). Thus, the same amount of monetary base can support a larger stock of aggregate money supply in and economy with banking development than in an economy without adequate banking facilities or with least banking habit among the people. ( Money Supply Bcom Notes)

- Extent of Monetisation: Monetisation refers to the use of money the system of exchange in an economy. A barter economy is non-monetised. Monetisation implies conversion of barter into the monetary economy. The degree of monetisation is, thus, an index of a country’s monetary development. The extent of monetisation, thus determines the need for the expansion of money supply. A fully monetised economy apparently needs more money supply than a partially monetised economy of the same order.

- Cash Reserve Ratio: The cash reserve ratio is also an important determinant of the quantity of money in a modern economy because it determines the multiplier coefficient of credit creation by banks. (Money Supply Bcom Notes)The cash reserve ratio refers to the ratio of a bank’s cash holdings to its total deposit liabilities. It is customarily or statutorily fixed by the central bank.

when commercial banks grant credit, the money supply expands in the form of bank money or credit money. This tends to be a multiple expansion of credit in the banking system as a whole, so the flow of money supply increases over the period of time when banks create credit. (Money Supply Bcom Notes) The process of credit creation by banks technically depends on the cash reserve ratio, since the cash reserve ratio determines the excess funds with a bank (i.e., surplus over bank’s cash holdings to maintain liquidity) on the basis of which it can grant loans.

- Government Budgetary Policy of Monetary Financing: Fiscal attitude and action of the government have monetary impact on the economy. When government expenditure exceeds public revenue, the fiscal gap is to be filled up through public borrowings. The government can borrow from the banking and non-banking sources. When government takes loans from the non-banking sources it pumps out money supply from the public and the same is pumped in when it spends such borrowed money. But, when the government resorts to the banking sector and borrows from the central bank, the net central bank credit to the government is termed as deficit financing. (Money Supply Bcom Notes) It implies monetised deficit or monetary financing through public debt. This leads to a rise in money supply, because monetised deficit involves and increase in the stock of money to that extent by the central bank. In essence, monetised deficit leads to an increase in monetary base and consequently the increase in money supply. The effects of treasury’s fiscal operations on the money supply may be summarised as under:

(i) The collection of taxes or the sale of securities to the public directly reduces the money supply with the public to the extent of the amount involved.

(ii) When the treasury spends money by drawing cheques upon its balances with the central bank, the money supply with the public and the cash reserves of the commercial banks will increase. (Money Supply Bcom Notes)

(iii) A favourable budgetary policy by the government will reduce the money supply and a deficit budget will increase the money supply with the public.

(iv) Deficit financing always leads to an increase in the money supply, which usually has an inflationary impact.

It follows that, the monetary and financial policies should be co-ordinated for effective monetary management.

Money Supply Bcom Notes

Meaning of High Powered Money

High powered money is a determinant or a base for money supply. It is really the cash held by the public and the banks. It is composed of:

(i) Currency in circulation with the public- that is coins and currency held by the general public designated as (C). This is the total amount of notes and coins issued and circulated by RBI less the amount held by banks as cash in hand.

(ii) Deposits with RBI by a select group of privileged individuals, like ex-governors and deputy governors of RBI and a few others, this form of money is designated as ‘other deposits’ (OD). (Money Supply Bcom Notes)

(iii) Cash reserves of banks (CR) which are actually composed of two parts –

(a) Cash reserves kept by banks with themselves and.

(b) Banker’s deposits with RBI which banks maintain with RBI as cash reserve.in/ die dag indre

Thus, High powered money or Reserve money

=C + OD + CR

This means that reserve money is held partly by the public (C and OD) and partly by banks (CR). Thus, high powered money is the reserve money produced and issued by RBI and held by the general public and commercial banks.

Money Supply Bcom Notes

Main Sources of High Powered Money

High Powered Money is a crucial factor influencing the stock of money in India. The main source of High powered money in India are the following:

- RBI credit to the government sector: It consists of the Reserve bank’s holdings of treasury bills, dated securities of the Central Government, rupee coins, and the Bank’s loans and advances to state Government. Net RBI credit to the government is obtained when government deposits are deducted from RBI credit to government.

- RBI credit to commercial sector: It comprises the Bank’s loans and advances to financial institutions such as NABARD, IDBI ARDC, investments in shares/bonds of financial institutions and internal bills purchased and discounted by the RBI. (Money Supply Bcom Notes)

- RBI credit to the banking sector: It includes bills rediscounted by the banks and advances made by the RBI to them against government securities, usance bills of promissory notes.

- Net foreign exchange assets of the RBI: These include gold coin and bullion foreign securities and balances held abroad offset by IMF A/C No.1.

- Government’s currency liabilities to the public: These are comprising rupee and small coins in circulation.

- RBI’s All non-monetary Liabilities: These liabilities are represented by capital and reserves, contribution of national funds, RBI Employee’s provident/pension Fund, Co-operative guarantee funds, bills payable, other liabilities, etc.Offset by other assets such as building, furniture and fittings, dead stock, suspense account etc.

Money Supply Bcom Notes

Comparison between High-powered money and Common money (m₁)

Common money (m,) refers to currency with the public.

This consists of two components:

(i) Currency component: Currency notes +Rupee and small coins (c)

(ii) Deposit component:

(a) Demand deposits held by the general public with all banks (DD)

Money Supply Bcom Notes

(b) Demand deposits held by some people in the Reserve Bank of India, commonly known other deposits’ OD.

(Money Supply Bcom Notes)

Thus, M = C + DD + OD

The above formula shows that the money supply with the people (M,) at any given time consists of (a) net currency notes and coins in circulation (C), that is the total money issued by RBI minus cash held by the banks in their premises. Plus (b) demand deposits (DD) with banks which people consider as their cash, and plus (c) ‘other deposits with RBI which is also considered as cash by the deposit holders. On comparing both high powered money and common money,

Hm = C + OD + CR

(Money Supply Bcom Notes)

M1 = C+ DD + OD

Thus, C and OD are common in both equations .There is only one difference that Hm includes CR and M1 includes DD.

Now CR = Cash reserves of banks held partly in their premises and partly held with RBI under statutory requirements.

DD = Demand deposits of the general public held in banks.

Money Supply Bcom Notes

Main Components of Money Supply in India

The money supply in India includes following components:

(1) Currency with Public: Currency with public is an important component of both money supply and monetary base. The term public includes all economic units (households, firms and institutions), except the producers of money. The Reserve Bank of India issues currency notes of the denomination of rupees two and above and the Government of India issues rupee notes, rupee coin and coins of smaller denomination. The supply of currency is subject to certain statutory restrictions and variations in currency are not possible except over comparatively long period. Thus, changes in currency do not play an important role in the formation of monetary policy. (Money Supply Bcom Notes)

(2) Other Deposits of Reserve Bank of India (OD): ‘Other deposits’ of the Reserve Bank include demand deposits of quasi government institutions like (the IDBI), Foreign Central banks and government, the IMF and the World Bank, etc. These other deposits constitutes a proportion of money supply. Therefore, they do not have any significant role to play in the monetary policy formulation. very small

(3) Demand Deposits of Banks: Demand deposits are payable on demand to the customers. These deposits are mostly held the business firms and are used for making payments. (Money Supply Bcom Notes) Interbank deposits are to be excluded in order to arrive at the net demand deposits of the banks.

(4) Time Deposits of Commercial Banks and Co-operative Banks: Time deposits are repayable after the expiry of the stipulated period.

Thus Money Supply = Currency with Public + Other Deposits of RBI + Demand Deposits of Banks + Time Deposits of Bank.

Money Supply Bcom Notes

|

|||