Money and Functions of Money Bcom Notes

Money and Functions of Money Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post.

Money and Functions of Money Bcom Notes

MONEY AND FUNCTIONS OF MONEY

Meaning of Money

Money may be any commodity chosen by common constent as a medium or instrument of exchange. It is widely accepted in payment for goods and services and in settlement of debts. (Money and Functions of Money Bcom Notes) Money is given and received without reference to the standing of the person who offers it in payment. Besides, it is a commodity which is regularly taken with the idea of offering it in payment to others.

Moreover, money is a commodity which is accepted customarily without assay and other special tests of quality and quantity. Various economists have defined money in different ways. (Money and Functions of Money Bcom Notes) The definitions of money given by various economists can be grouped into two broad categories which are as follows:

Classifications of Definitions of Money

(A) Extension Based Definitions: These definitions can be classified under the following three categories on the basis of approach:

- Broad Definitions of Money: Definitions under this category lay much emphasis on the broadness of money as follows:

According to Hartley withers, “Money is what money does.” (Money and Functions of Money Bcom Notes)

According to Karl Helfferick, “We understand, therefore, by the term money, the complex of their objects, which in a given economic area and in a given economic system, have as their normal purpose of the facilitation of economic intercourse between economic individuals.”

Money and Functions of Money Bcom Notes

According to the above definitions we can include all those things in money which perform the functions of money. Thus, money does not comprise metallic coins and currency notes only. It also includes cheques, hundies, bills of exchange, etc., because they also perform the functions of money.

- Narrow Definitions of Money: This category includes all those definitions of money which narrows down the field of money. Accordingly only metallic money deserves to be called money in the strict sense of the term.

According to Price, “Coins, metallic coins, are alone true money.”

According to D. H. Robertson, “Money is a commodity which is used to denote anything which is widely accepted in payment of goods or in discharger of other business obligations.”

Money and Functions of Money Bcom Notes

- Ideal Definitions of Money: Following definitions can be included under this head:

According to Marshall, “All those things which are at any time and place generally current without doubt or special enquiry as a means of purchasing commodities and services and of defraying expenses included in the definition of money.”

According to J.M.Keynes, “Money is that delivery of which debt contracts and price contracts are discharged and in the shape of which a store of general purchasing power is held.”

According to these definitions only metallic money and paper money are included in money.

On analysing above definitions we get the following three main characteristics of money, namely:

(i) It is a medium of exchange, a standard of value and a store of value. (Money and Functions of Money Bcom Notes)

(ii) It is a commodity which is generally acceptable by the community in payment for anything.

(iii) The acceptance of money as a medium of exchange is voluntary.

Money and Functions of Money Bcom Notes

(B) Nature Based Definitions: The definitions of money on the basis of nature can be classified as follows:

- Descriptive Based Definitions of Money: These definitions of money are also called functional definitions as they point out the characteristics and functions of money. Following are the main definitions of money under this category.

According to Hartley Withers, “Money is what money does.”

According to W.A.L.Coulborn, “Money may be defined as means of valuation and payment.”

According to S.E.Thomas, “Money is a commodity chosen by common consent to be a measure of value and a means of exchange between all other commodities.”

According to Whittlesey, “If a particular unit is commonly employed to state values, exchange goods and services, or perform other functions, then it is money, whatever its legal or physical characteristics.”

Money and Functions of Money Bcom Notes

It is clear from an analysis of above definitions of money that they describe mainly functions and features of money but fail to explain the nature of money itself. Such definitions are not therefore, scientific.

- Legal Based Definitions of Money: The definitions of money, under this category are based on State Theory of Money and are called legal definitions as such. Following are the definition of money under this category:

According to Prof. F. Knapp, “Anything which is declared money by the state becomes money.”

According to Prof. Howtrey, “There are money-Firstly, Unit of Account and Secondly, Legal Tender.” two aspects of

The above definitions explain the lawyer’s viewpoint about what money is which is not correct. As a matter of fact, money should be having is itself the public confidence and is not be accepted as such under the pressure of law.

Money and Functions of Money Bcom Notes

- General Acceptability Based Definitions of Money: General Acceptability becomes the central point of such definitions of money which are included under this category. Some main definitions are as follows: According to Seligman, “Money is one thing that possesses general acceptability.”

According to D. H. Robertson, “Money is a commodity which is used to denote anything which is widely accepted in payment of goods or in the discharge of other business obligations.

According to Ely, “Money consists of those things which within a society are of general acceptability.”

Money and Functions of Money Bcom Notes

According to Kent, “Money is anything which is commonly used and generally accepted as a medium of exchange or as a standard of value.” All the above authors have taken general acceptability as the main characteristic of money. Apart from this, these definitions also point out the following salient features of money:

(1) Money should be voluntarily accepted.

(2) Money should be accepted in general by all. (Money and Functions of Money Bcom Notes)

(3) Money is regarded not only as a medium of exchange but standard of value at the same time.

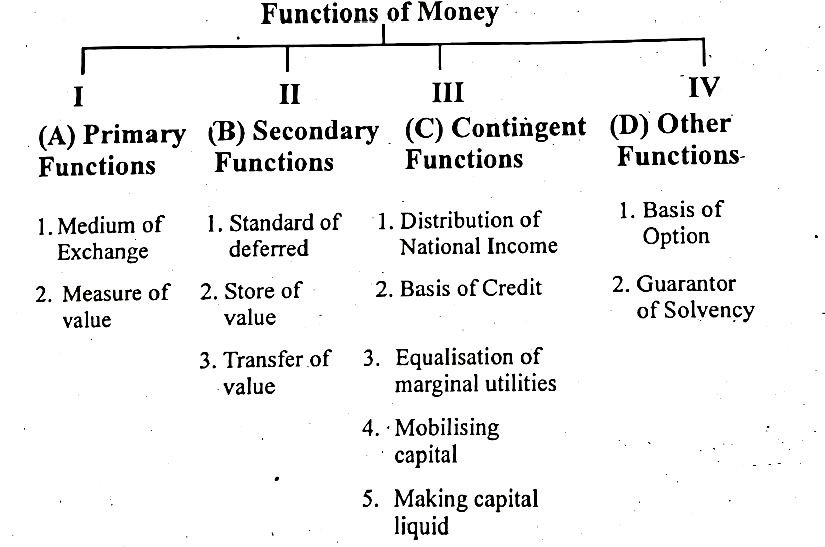

Functions of Money

Money and Functions of Money Bcom Notes

(A) Primary Functions: These are also referred to as original functions of money. Following are the main functions of money:

- Medium of Exchange: Money has the quality of general acceptability. As such all exchange take place in terms of money. In the modern exchange system money acts as the intermediary in sales and purchases. It is on this account that money is referred to as medium of exchange. (Money and Functions of Money Bcom Notes)

- A Measure of Value: The second important function of money is that it measures the values of all goods and services. Money is, thus, looked upon as a collective measure of values.

Relationship between the Two Functions: A close relationship exists between the above two functions of money Actually, these two functions are performed simultaneously and at the same point of time. One cannot be performed without the other. Of the two functions, the second one is performed first i.e. it first measures the value of commodities and services which are to be exchanged, (Money and Functions of Money Bcom Notes) only then it functions as a medium of exchange at a pre-determined rate or value. In other words, these two functions of money take place at the same time.

(B) Secondary Functions: The following are the secondary functions of money:

(1) Money is a Standard of Deferred Payments: Credit transactions or borrowing and lending operations were not possible in barter system. But in money exchange system, such types of transactions are done very frequently. Thus money acts as a standard of deferred payments. It acts so because of the following three reasons:

Money and Functions of Money Bcom Notes

(i) As compared to other commodities, the value of money is stable,

(ii) Money is more durable than any other commodity, and

(iii) It has general acceptability hence it is always needed by all.

(2) Money is a Store of Purchasing Power: As money has purchasing power, goods and services can be purchased by money at any time in present or in future because it can be stored without much loss in value. This was not possible in barter system of exchange, because commodities could not be stored without any appreciable loss in value of these commodities.

Moreover, the storing of commodities required a lot of space which was not always possible. Thus savings in terms of commodities were not permanent. Invention of money has removed this difficulty. (Money and Functions of Money Bcom Notes) Now, money is saved and stored for its future use. Savings now can be accumulated and stored permanently in terms of money. This quality of money has made the capital accumulation possible which can be used in the economic development of the country.

(3) Transfer of Value: The economic development extended the field of exchange. The markets extended their boundaries from local to national or even international. The purchase and sale of goods now extended to distant lands. It therefore, became possible to sell goods and services at one place and to purchase the other necessary goods and services at other place because of the money. This was not possible under barter system. As money has the quality of general acceptability, the purchasing power can easily be transferred from one person to another or from one place to another. Borrowing and lending operations are also possible only due to this quality of money.

Money and Functions of Money Bcom Notes

(C) Contingent (Modern) Functions:

- Money as basis of Contribution of National Income: Money measures the contribution of each factors of production and subsequently helps in distributing income accordingly. Money thus facilitates to determine the share of each factor should receive, and all these distributions are done through the medium of money. Thus money becomes the basis of distribution of national income.

- Money as basis of Credit: One of the characteristics of the present day world is the use of credit, and money forms the basis of credit. Today not only credit system is followed between individuals, traders, firms but also between countries. The expansion and contraction of credit depends simultaneously upon the expansion and contraction of the supply of money. (Money and Functions of Money Bcom Notes) Credit instruments like, cheque, draft, bills of exchange, promissory-note etc. depend upon the parent-base of money.

- Equalises the Marginal Utilities: As we know, every consumer wants to equalise the marginal utilities of various commodities in order to get the maximum satisfaction out of his income. It is possible because the prices of all commodities are expressed in money. Likewise, a producer can also equalise the marginal productivities of all factors of production with a view to get the maximum production because the productivities of different factors are measured in terms of money. Each factor is paid according to its marginal productivity. (Money and Functions of Money Bcom Notes)

- Helpful in Mobilising Capital: It is only money which has helped in the mobilisation of capital. Different factors that contribute to the formation of capital get a general value when it is measured in terms of money. Money has helped in mobilising capital because of its nature of ‘high value in low bulk’. This feature has helped in the transfer of capital from one place to another.

- Helpful in Making Capital Liquid: Money is the most liquid form of money. Universal acceptability of money has made capital liquid. Money as capital can be put to any use according to the will of user. Money helps in making capital liquid and this function is considered as an important function of money.

Money and Functions of Money Bcom Notes

(d) Other Functions: Money also serves some other functions which are as follows:

- Bearer of Option: Savings in the form of money can be put to any use in times to come. Since money is the only universally accepted medium of exchange, it can be exchanged with anything of his choice. (Money and Functions of Money Bcom Notes) Thus options can be made possible with the help of money.

- Guarantor of Solvency: Money sets the limit about the solvency of a person or institution. Every firm has to keep some amount of liquid money in its assets to safeguard repayment capacity.

Advantages of Money or Importance of Money in Modern Economy

Money occupies a central position in a modern economy. It is an accepted fact that money facilitates and motivates all economic activities in a country. The widespread use of money and credit and the changes in the value of money have profound influence on the economic activities. Money is a powerful instrument for capital formation both in the developed and developing countries of the world. Money occupies such a unique position that today’s economy is rightly called as the money economy.

The importance of money can be better understood in the following words of G. Crowther, “Every branch of knowledge has its fundamental discovery, …………………., similarly, in Economics, in the whole commercial side of man’s existence, (Money and Functions of Money Bcom Notes) money is the essential invention on which all the rest is based.”The importance of money can be studied as under:

- Overcoming the Inconveniences of Barter System: Difficulties of barter led to the introduction of money, and today money removes all the inconveniences of barter exchange. Its importance is in the fact that it serves as a medium of exchange, a measure of value, a store of value and a standard of deferred payments. Money not only helps to overcome the difficulties of barter, but it also helps to develop the economy faster. With the help of money the world has today moved into a space age.

- Helps Consumer to Maximise Satisfaction: Money has facilitated consumers to purchase the commodities of their choice. A consumer while purchasing a commodity desires to derive maximum satisfaction. If he is able to derive this satisfaction, then only he will prepare to buy a commodity. If he gets the things of his choice, he has got maximum satisfaction. Thus money enables consumers to maximise their satisfaction.

- Accelerates Market Extension & Industrialisation: Barter being limited to local markets, a producer was always hesitant to produce more, even though he had capability to do so. He intended to produce only that much, which could be bartered in the local markets. Later on, to meet the increased needs of the society large scale production of commodities became a necessity. (Money and Functions of Money Bcom Notes) Thereby more and more producers and entrepreneurs came into the industrial field. Money ensured him the sale of his products and has further resulted in the starting up of more and more industries. Money has also facilitated division of labour. Industrialisation combined with division of labour or specialisation is thus the result of the development of money.

- Facilitates Increased Credit Transactions: Credit transactions became a reality with the advent of money. Today transactions and deferred payments are undertaken quite conveniently with the help of money. (Money and Functions of Money Bcom Notes) Money-lenders, financial institutions and banks advance loans to producers, businessmen and traders. Thus, money facilitates increased credit transactions.

- Helps in Capital Formation: Money as a store of value helps in savings. Savings and investments result in capital formation. It enables the entrepreneur to harness the factors of production to achieve maximum profit. Thus, savings in the form of money increases production and thereby boost the economic development of a country. The more the capital formation, the better the economic development of people. (Money and Functions of Money Bcom Notes)

- Helps in Increasing Trade and Commerce and Social Contacts: Exchange activities to distant places can be undertaken with the help of money. This has introduced internal and external trade. Contacts with different regions of the world has caused to change the life pattern and broaden and outlook of the people.

- Promotes National Wealth & Social Welfare: Money has served the economy as an extremely valuable social instrument for the growth of national wealth. Every country of the world is trying to raise the level and prosperity of the masses, their standard of living and happiness. Social and welfare activities for its population depends on the extent of the growth of national income, i.e., the countries that have become prosperous and have industrially developed can contribute better to the economy than the underdeveloped countries. (Money and Functions of Money Bcom Notes)

- Serves Different Economies: Irrespective of the economic system followed by a country, money is of equal importance to all the economies. In a capitalist society, money is of great importance because the base of the economy depends on its price mechanism. In a Socialist economy, money does not function as a master, but as a servant. In a mixed economy it plays a unique role for the existence of private sector. In the public sector, it helps in economic calculation thereby enables to allocate the resources.

Money: A Pivot for Economic System

Money is the pivot for all economic activities. In all branches of economics-consumption, production, exchange, distribution and public finance, money plays a significant role.

According to Marshall, “Money is the pivot around which all economic science clusters.”

The following points highlight the importance of money in various branches of economics:

(i) In the Field of Consumption: The consumer can postpone his demand today if he so desires. The purchasing power implicit in money can be utilised by the consumer at his option. Apart from this, money helps the consumer to equalise the marginal utilities accruing from diverse commodities.

Money and Functions of Money Bcom Notes

(ii) In the Field of production: Money helps the individual producer in a variety of ways, such as, buying raw-materials, borrowing capital, advertising finished products and in combining the various factors of production. Without money, production activities cannot be carried on.

(iii) In the Field of Exchange: The use of money has sought to remove the difficulties and inconveniences of the direct method of exchange or the barter system such as double coincidence of wants, lack of a common measure of a value, difficulty of sub-division and lack of the means of storing value.

(iv) In the Field of Distribution: Money has helped in increasing the economic welfare of a country by giving a more equitable distribution of national income. The payment of remuneration to various factors of production is done only in terms of money. (Money and Functions of Money Bcom Notes)

(v) In the Field of Public Finance: It is quite inconceivable to talk of equating income and expenditure by the government in the absence of money. The important sources of public finance are taxes and public debts which are received only in money from the public.

Evils of Money

Though money plays a very significant role in the modern economic life but money is not without evils. If money is not managed properly, it may lead to several evils effects.

Money and Functions of Money Bcom Notes

“Money is a valuable though dangerous invention.”

“Money is a good servant but a bad master.”

“Money is a necessary evil.”

“Money, which is a source of so many blessings to mankind, becomes also, unless we control it, a source of peril and confusion.”

The following are the main evils associated with money:

(A) Economic Evils,

(B) Social Evils.

(A) Economic Evils

(i) Money has Promoted Economic Inequalities: Emergence of monopolies and concentration of wealth in the hands of a few, made life difficult for the rest of the society. Social injustice and economic inequality is the outcome of money. Money has proved a convenient tool for acquiring wealth and the exploitation of the poor by the rich. It has created a big gap between the rich and the poor.

Money and Functions of Money Bcom Notes

(ii) Money Creates Class Conflict: Money has been the basis of the birth of a capitalist society. In a capitalist society the means of production, factories, farms etc. are in the hands of the private individuals and firms. Capitalism has given rise to ‘class-conflicts’. The society is divided into two classes the ‘haves’ and the have nots’. The exploitation of the have-nots by the haves has given rise to social unrest which is considered to be an evil of modern times.

(iii) Money Strengthens Capitalism: It is money which has given birth to credit. On account of credit, the rich businessmen can obtain borrowed funds for expanding their enterprises. Capital gets concentrated in the hands of a few rich people. This gives rise to glaring inequalities in the distribution of income and wealth in the economy.

Money and Functions of Money Bcom Notes

(iv) Instabiling of Money: A serious defect of money is that its value or purchasing power does not remain stable or constant. Different sections of people in the country are affected differently because of fluctuations in the value of money. (Money and Functions of Money Bcom Notes) For instance, a fall in the value of money (inflation) leads to distortion, in the distribution of income since the rich become richer while the poor become poorer; a rise in the value of money, meaning fall in prices and employment, may lead to general pauperisation of all classes of people.

(v) ‘Over Capitalisation’ and ‘Over-Production’: Money encourages over capitalisation. With the invention of money, borrowing and lending operations in business have became common. (Money and Functions of Money Bcom Notes) Some businesses utilise more capital than necessary that given rise to the problem of over-capitalisation. Over-capitalisation results in over-production which creates a number of problems in the economy like steep fall in prices,

(vi) Money Generates Trade Cycles: The trade cycles are always in unemployment and recession. operation in a capitalist economy. Boom period follows slump and slump follows boom. This generates instability in economy as a result of which different sections of the community are put to difficulties and inconveniences. In fact, money is responsible for the operation of the trade cycle.

Money and Functions of Money Bcom Notes

(B) Social Evils

Following are the social defects of money:

(1) Money is directly responsible for the decline of spiritualism in modern society.

(ii) Money has encouraged greed and acquisition.

(iii) Money has encouraged fraud, thefts, dacoity, murder etc.

(iv) Money creates in men the desire and urge to exploit others.

Money has thus become the root cause of all social evils. It has resulted in a serious decline of moral standards. In fact money has become a curse for the society. But the fault lies not in money but in human nature.

Money is a Good Servant but a Bad Master: Money in itself is not bad, but its possession in a wrong way leads to many evils. Money serves our society in innumerable ways. Money is made for man, and not man for money. (Money and Functions of Money Bcom Notes) If we are able to give money its proper place, it cannot become a bad master.

Money has removed all the inconveniences of barter. Money has proved as an extremely valuable instrument beneficial to the society in general. It possesses many of the elements of good money. But money suffers from several disadvantages and evils, most important being inflation or rise in prices. But this problem can be eliminated or reduced to the minimum, if money material is properly managed. The evils of money, of course has highlighted the need for putting the country’s fiscal conditions in order.

Money and Functions of Money Bcom Notes

Money and Functions of Money Bcom Notes

|

|||