Leverage Bcom Notes

Leverage Bcom Notes:-

In this post, you will get the notes of B.com 3rd year Financial Management, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. leverage bcom notes

Leverage

MEANING AND DEFINITION OF LEVERAGE

Leverage means action of or way of applying lever. The functions of lever is raised a heavy object with a minimum force. In financial management, the term ‘leverage’ is used to describe the ability of a firm in employing long-term funds having a fixed cost to enhance the return to its owners i.e.

equity shareholders. (leverage bcom notes) These fixed costs/returns may be assumed as the fulcrum of a lever. The presence of fixed cost has considerable influence on the earnings available to equity shareholders when the volume of output or sales is increased. Larger the presence of fixed costs higher is the leverage. If a firm is not required to pay fixed cost or fixed return, there will be no leverage.

According to Soloman Ezra, “Leverage is the ratio of the net rate of return on shareholders’ equity and the net rate of return on total capitalisation.”

According to James E. Walter, “Leverage may be defined as percentage return on equity to percentage return on capitalisation”.

According to Weston and Brigham, “In general usage, the leverage is defined as the ratio of total debt to total assets.”

leverage bcom notes

According to S.C. Kuchhal, “Leverage may be defined as meeting a fixed cost or paying a fixed return for employing resources or funds.”

Conclusion: Leverage is indicative of advantage or disadvantage due to which a slight increase or decrease in the volume of output or debt financing causes a much more increase or decrease in the profits of a company.

Leverage Bcom Notes Pdf

TYPES OF LEVERAGE

Leverages are of three types:

(i) Operating Leverage, (ii) Financial Leverage, and (iii) Composite Leverage.

(1) Operating leverage: Operating leverage may be defined as the tendency of the operating profit (EBIT) to vary disproportionately with the volume of sales. It occurs when a firms has fixed costs that must be paid regardless of volume of sales.

- Operating leverage is defined as “the use of fixed operating costs to magnify a change in profits relative to a given change in sales.”

-F. W. Walker and J. W. Pelty

- “The term operating leverage refers to the sensivity of operating profits to sales.”

-Ezra Soloman

- “If a high percentage of a firm’s total costs are fixed costs, then the firm is said to have a high degree of operating leverage.”

-E. F. Brigham

- “Operating leverage exists when changes in revenues produce greater changes in EBIT.”

-John, J. Hampton

Computation of Operating Leverage: The extent of operating leverage at any single sales volume is calculated as follows:

Operating Leverage (OL) = [Contribution / operating profit] or [C / EBIT or OP]

Where, Contribution = Sales – Variable Cost

Operating Profit = Contribution – Fixed Cost

Illustration 1: (i) If variable cost ₹ 2,00,000, contribution ₹ 7,00,000 and Fixed Cost ₹ 2,00,000, find out the EBIT.

(Meerut, 2014)

EBIT = Contribution – Fixed Cost

= 7,00,000 – 2,00,000 = ₹ 5,00,000

(ii) If selling price per unit ₹ 10, variable cost per unit 7, fixed cost ₹ 10,000, present sales ₹ 10,000 units. What is new EBIT if sales are increased by 40%?

Expected Sales = 10,000+ (10,000 x 40%) = 14,000 units

Contribution = 14,000x (10-7) = ₹ 42,000

EBIT = Contribution – Fixed Cost = 42,000 – 10,000 = ₹ 32,000

(iii) If selling price per unit ₹ 10, variable cost per unit ₹ 7, Fixed Cost 10,000, present sales = ₹ 10,000 units. What is new EBIT if sales are fall by 25%?

(Meerut, 2014)

Expected Sales = 10,000 (10,000 x 25%) = 7,500 units

Contribution = 7,500 x (107) = ₹ 22,500

EBIT = Contribution – Fixed Cost = 22,500 – 10,000 = ₹ 12,500

(iv) If EBIT ₹ 40,000, Fixed Cost ₹ 1,20,000, Variable Cost ₹ 2,40,000. Find out the contribution. Contribution = EBIT + Fixed Cost = 40,000 + 1,20,000= ₹ 1,60,000

Illustration 2: (i) If contribution is ₹ 5,00,000 and EBIT is ₹ 2,00,000. Fixed out the operating leverage.

Operating Leverage = Contribution + EBIT

= 5,00,000 ÷ 2,00,000 = 2.5

(ii) Annual Sales ₹ 6,00,000, Variable Cost ₹ 4,00,000, Fixed expenses ₹ 1,00,000. Find out the operating leverage.

(Meerut. 2013)

Contribution = Annual Sales – Variable Cost = ₹ 6,00,000 – 4,00,000 = 2,00,000.

EBIT Contribution – Fixed Expenses = 2,00,000 – 1,00,000 = 1,00,000 = ₹

OL = Contribution ÷ EBIT = 2,00,000 ÷ 1,00,000 = 2

(ii) If output (units) ₹ 50,000, selling price per unit ₹ 10.00, Variable Cost per unit ₹ 4.00 and Fixed Cost ₹ 2,00,000. Find out the operating leverage.

(Meerut, 2014)

Contribution = Annual Sales – Variable Cost = ₹ 6,00,000 – 4,00,000 = ₹ 2,00,000.

OL = Contribution ÷ EBIT = 2,00,000 ÷ 1,00,000 = 3

(iv) A firm sells products at 10 per unit. Its variable cost ratio is 70%. Fixed cost 10,000, present sales 10,000 units. What is the degree of operating leverage?

(Meerut, 2014)

Variable cost per unit 10×70% = ₹ 7

Contribution = 10,000x (10-7) = ₹ 30,000

EBIT = Contribution – Fixed Cost = 30,000-10,000 = ₹20,000

Degree of OL= Contribution ÷ EBIT = 30,000 ÷ 20,000 = 1.5

Leverage Bcom Notes Pdf

DEGREE OF OPERATING LEVERAGE

The degree of operating leverage measures more precisely the extent of impact on operating profit (OP) of a given change in sales. In other words, it is the percentage change in OP or EBIT which results from a given percentage change in sales. It can be measured as follows:

Degree of Operating Leverage (DOL) = [% Change in OP (EBIT) / % Change in sales]

Illustration 3. (a) If operating leverage is 2 and sales increase by 50%, then by what percentage of EBIT will increase?

(b) If operating leverage is 3 and firm wants to double its EBIT, ( leverage bcom notes )how much rise in sales would be needed on a percentage basis?

Solution.

(a) Given: Operating Leverage = 2, Increase in sales = 50%

We know that Degree of Operating Leverage:

= [Percentage change in EBIT / Percentage change in Sales]

by putting the given values, we get:

2 = [Percentage change in EBIT / 50%]

Percentage change in EBIT = 2 x 50%-100%

leverage bcom notes

It becomes clear from the above that if sales increases by 50%, then EBIT will increased by 100%.

(b) Given: Operating Leverage = 3, The firm wants to double its EBIT, i.e., a 100% rise:

We know that Degree of Operating Leverage:

= [Percentage change in EBIT / Percentage change in Sales]

by putting the given values in above formula, we get:

3 = [100% / % change in sales]

% change in sales = [100% / 3] = 33.33%

Therefore, if the firm wants to double its EBIT, i.e., a 100% rise, then a 33.33% rise in sales will be required.

Leverage Bcom Notes Pdf

(2) FINANCIAL LEVERAGE

Financial leverage is concerned with the effects of changes in EBIT on the earnings available to equity shareholders.

- “Financial leverage exists whenever a firm has debts or other sources of funds that carry fixed charges.”

-Hampton

- “Financial leverage is defined as the tendency of the residual net income to vary disproportionately with operating profit.”

-Soloman Ezra

- “Financial leverage refers to the mix of debt and equity used to finance the firm.”

-Ezra Soloman

Computation of Financial Leverage: The computation of financial leverage can be done according to the following methods: (I) When Capital Structure Consists of Equity Share Capital and Debt: In such a case, following formula can be used to compute the financial leverage:

Financial Leverage = [OP or EBIT / EBT]

Where, OP operating profit or earnings before interest and tax

leverage bcom notes

EBT Earnings before tax.

Illustration 4. (i) If EBIT 15,00,000. Tax Rate 50%, 14% Debentures 10,00,000. Find out the profit after tax (PAT or EAT).

(Meerut, 2014)

EBT = EBIT-Interest on Debentures

= 15,00,000 – (10,00,000 x 14%) = ₹ 13,60,000

PAT-EBT-Tax @ 50% 13,60,000-6,80,000 6,80,000

- ii) Sales = ₹ 1,000, Variable Cost = ₹ 300, Contribution = ₹ 700,

Fixed Cost = 400, Interest100. Find Financial Leverage.

(Meerut, 2014)

EBIT = Sales – Variable Cost – Fixed Cost

= 1,000 – 300 – 400 = ₹ 300

FL = [EBIT / EBIT – INT] = [300 / 300 – 100] = [300 / 200] = 1.5

(iii) Contribution ₹ 1,00,000, Fixed Cost ₹ 20,000, Interest ₹ 20,000 and Tax Rate is 50%. Find out the Financial Leverage.

(Meerut, 2013BP)

EBIT = Contribution – Fixed Cost = 1,00,000 – 20,000 = ₹ 80,000

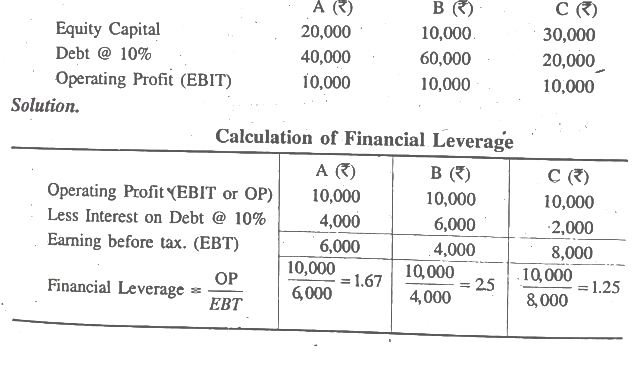

Illustration 5. A company has a choice of the following three financial plans. You are required to calculate the financial leverage in each case and interpret it.

Leverage Bcom Notes Pdf

Interpretation: It becomes clear from the above calculation of financial leverage that an increase or decrease in the EBIT will cause an increase or decrease of 1.67 times, 2.5 times and 1.25 times respectively in earnings before tax under the execution of A, B and C financial plans.

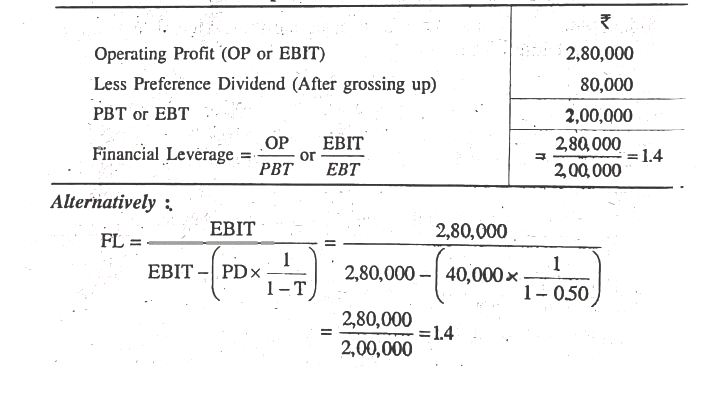

(II) When Capital Structure Consists of Equity Share Capital and Preference Share Capital: In such a case, the amount of preference dividends will have to be grossed up (as per the tax rate applicable to the company) and then deducted from the earnings before interest and tax. (leverage bcom notes)

It is computed as:

Illustration 6. The capital structure of a company consists of the following securities:

8% Preference share capital ₹ 5,00,000

Equity share capital (10 per share) ₹ 5,00,000

The amount of operating profit is 2,80,000. The company is in 50% tax bracket.

You are required to calculate the financial leverage of the company.

Solution.

Leverage Bcom Notes Pdf

Computation of Financial Leverage

Leverage Bcom Notes Pdf

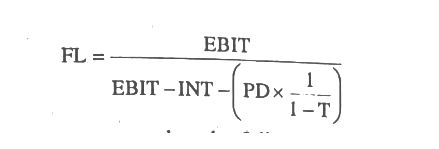

(III) When Capital Structure Consists of Equity Share Capital, Preference Share Capital and Debt: In such a case the financial leverage is calculated after deducting both interest and preference dividend from operating profit on a pre-tax basis. Symbolically:

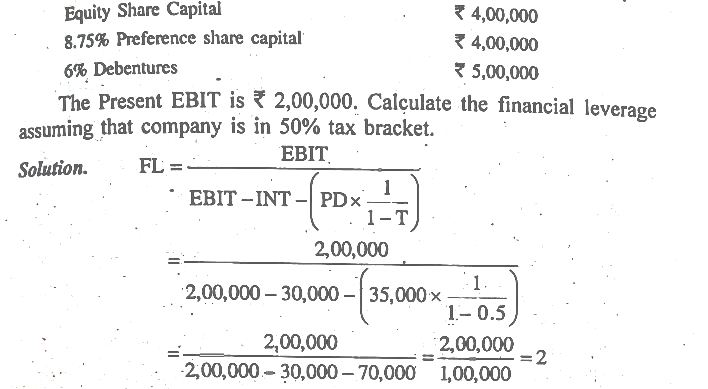

Illustration 7. A company has the following capital structure:

leverage bcom notes

DEGREE OF FINANCIAL LEVERAGE

The degree of financial leverage (DFL) can be computed by measuring percentage change in taxable profits caused by a given percentage change in EBIT. This can be expressed as follows:

DFL= [% change in EBT / % change in EBIT]

It should be noted that financial leverage exists only when the quotient as per the above equation is more than one.

EPS Approach of Financial Leverage

Degree of Financial Leverage (DFL) = [% change in EPS / % change in EBIT]

Illustration 8. (a) If financial leverage is 1.5 and EBIT increase by 10%, then what percentage of EBT will increase?

(b) If financial leverage is 2 and EPS increase by 10% , then what percentage of EBIT will increase ?

Solution.

(a) Given: Financial Leverage = 1.5, Increase in EBIT = 10%

We know that Degree of Financial Leverage:

leverage bcom notes

= [% Change in EBT / % Change in EBIT]

by putting the given values, we get:

15= [% Change in EBT / 10%]

% Change in EBT=15×10=15%

If EBIT increase by 10% then EBT will increase by 15%.

(b) Given: Financial Leverage = 2, Increase in EPS = 10% We know that Degree of Financial Leverage:

= [% Change in EPS / % Change in EBIT]

by putting the given values, we get:

2= [10% / Change in EBIT]

% Change in EBIT = [10%/2] = 5%

If EPS increase by 10%, then EBIT will increase by 5%.

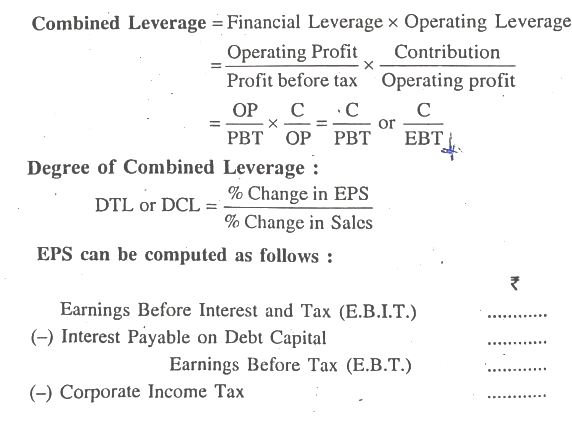

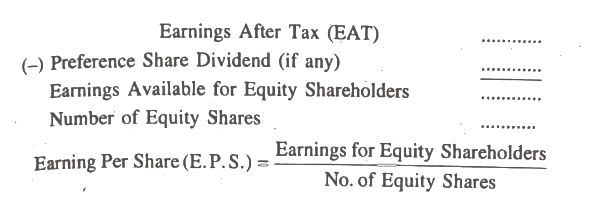

(3) Composite or Combined Leverage: Composite leverage expresses the relationship between revenue on account of sales (ie. contribution or sales less variable cost) and the taxable income. It helps in finding out the resulting percentage change in taxable income on account of percentage change in sales. This can be computed as follows:

Combined Leverage = Financial Leverage x Operating Leverage

Illustration 9: (i) If operating leverage of a firm is 2.5 and financial leverage is 2, then find out the Combined Leverage.

leverage bcom notes

(Meerut, 2013)

Combined Leverage = OL × FL=2.5 × 2 = 5

(ii) A company’s operating leverage is 3.5 and financial leverage is 4. Find out the combined leverage.

(Meerut, 2013 BP)

Combined Leverage = OL × FL=3.5 × 4 = 14

(iii) If EBIT ₹ 5,00,000, contribution ₹ 8,00,000, PBT ₹ 4,00,000, then find out the Combined Leverage.

(Meerut, 2014)

Combined Leverage = Contribution / PBT = 8,00,000 / 4,00,000 = 2

(iv) If Sales ₹ 4,00,000, Variable Cost ₹ 2,80,000, fixed cost ₹ 80,000, 10% interest on debt of ₹ 2,00,000. Find out the Combined Leverage.

(Meerut, 2013)

Contribution = S – V = 4,00,000 – 2,80,000 = ₹ 1,20,000

EBIT = Contribution – Fixed Cost = 1,20,000 – 80,000 = ₹ 40,000

EBT or PBT = EBIT – Interest on Debts

= 40,000 – (2,00,000 x 10%) = ₹ 20,000

Combined Leverage = Contribution ÷ PBT

= 1,20,000 ÷ 20,000 = 6

(v) Combined leverage 2.8, what percentage of taxable income will increase if sales are increased by 4%.

DCL = [% Change in Taxable Income (EBT) / % Change in Sales]

% Change in Taxable Income = DCL × % Change in Sales = 28 × 4 = 11.2%

Leverage Bcom Notes Pdf

|

|||