Dividend Policy Bcom Notes

Dividend Policy Bcom Notes:-

In this post, you will get the notes of B.com 3rd year Financial Management, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post.(Dividend Policy Bcom Notes)

Dividend Policy

Dividend: Dividend refers to that part of net profits of a company which is distributed among sharesholders as a return on their investment in the company. Dividend is paid on preference as well as equity shares of the company. On preference shares, dividend is paid at a predetermined fixed rate. But decision of dividend on equity shares is taken for each year separately. Dividend can be paid in the form of bonus shares or cash.

Dividend Policy Bcom Notes

DIFFERENT TYPES OF DIVIDEND

- Cash Dividend – Most of the companies make payment of dividend in cash only. Payment of dividend in cash depends on availability of cash balance with the company. Cash dividend reduces the reserves and assets of the company. (Dividend Policy Bcom Notes)

- Stock Dividend or Bonus Shares – Stock dividend means the issue of bonus shares to the existing shareholders in a fixed proportion. along with cash dividend or in place of cash dividend. Stock dividend decreases the reserves of the company but increases the share capital of the company.

- Interim Dividend: Dividend declared between the two annual general meetings of the company is called ‘Interim Dividend’.

- Property Dividend: Under this form, company pays dividends in the form of assets other than cash. For example, a watch manufacturing company may give watches to its shareholders as property dividend. This form of dividend is not prevalent in India.

- Scrip or Bond Dividend: When a company does not have sufficient funds to pay dividend in cash, it may issue notes or bonds for amounts due to the shareholders. The objective of scrip dividend is postponement of payment of immediate dividend in cash. Such form of dividend is not prevalent in India.

Dividend Policy Bcom Notes

The most widely used method of distribution of earnings among the shareholders is to distribute by way of cash dividends. However, another form of dividend payment is the issue of bonus shares or Stock Dividend.

Legal Aspects Regarding Declaration and Payment of Dividend:

(1) Dividend can be declared and paid out of profits not out of capital. 2. Amount of dividend including interim dividend shall be deposited in a separate bank account within 5 days from the date of declaration. (3) Dividend may be paid out of accumulated profit owing to inadequate profit or absence of profit, (4) Dividend is to be paid after transfer of prescribed percentage to the reserve, (5) Dividend is to be paid only in cash. (6) Dividend is to be paid to registered shareholders, (7) Dividend is to be paid within 30 days of declaration (The period has been reduced from 42 days to 30 days by the companies (Amendment) Act, 2000). (Dividend Policy Bcom Notes)

Where a dividend has not paid within 30 days from the date of the declaration then within 7 days from the date of expiry of the said period of 30 days, the company must deposit the unpaid dividends to a separate bank account to be opened by the company in a Scheduled Bank, to be called “Unpaid Dividend Account of Ltd.” If the money remains unpaid/unclaimed in this account for a period of 7 years from the date of transfer, then such money shall be transferred by the company to the Investor Education and Protection Fund.

(8) A company is not prohibited from capitalisation of profit or reserve for the purpose of issuing fully paid bonus shares, (9) Company not to declare dividend on equity shares if the company fails to comply with section 73 and 74.

Dividend Policy Bcom Notes

DIVIDEND POLICY

Dividend Policy means that decision of the management through distributed as dividend among the shareholders and how much to be retained in the business. In addition to dividend payout ratio, a whole lot of other economic, legal and procedural constraints are also to be considered while framing a dividend policy for the firm. The management of a firm must have a dividend policy which helps in maximising the market price of the share.

Dividend Policy Bcom Notes

According to Weston and Brigham, “Dividend policy determines the division of earnings between payments to shareholders and retained earnings”.

TYPES OF DIVIDEND POLICY

- Conservative or Strict Dividend Policy: Under this policy. companies retain a large part of profits to finance their expansion and development programmes and distribute minimum dividend to the shareholders.

- Liberal Dividend Policy: Under liberal dividend policy, a large part of profits is distributed as dividend among the shareholders. The dividend payout ratio under this policy exceed 80%. (Dividend Policy Bcom Notes)

- Sound or Stable Dividend Policy: Stable dividend policy refers to a dividend policy which ensures regular payment of a certain minimum amount as dividend irrespective of fluctuation in earnings from year to year. Its main advantages are as follows:

(i) It is sign of continued normal operations of the company.

(ii) It stabilises the market value of shares.

(iii) It creates confidence among the investors.

Dividend Policy Bcom Notes

(iv) It provides a source of livelihood to those investors who view dividends as a source of funds to meet day-to-day expenses.

(v) It meets the requirements of institutional investors who prefer companies with stable dividends.

(vi) It improves the credit standing and makes financing easier.

Factors Affecting/Determining the Dividend Policy: (1) Magnitude and Trend of Earnings, (2) Liquidity Position of the Company, (3) Financial needs of the company. (4) Nature of Industry, (5) Age of the Company, (6) Cyclical Variations, (7) Structure of Ownership, (8) Attitude of Management, (9) Investment opportunities, (10) State of Capital Market, (11) Legal Restrictions, (12) Taxation Policy, (13) Objective of Maintaining Control, (14) Stability of Dividends and Stability of Earnings.

DIVIDEND THEORIES/MODELS

- Relevance Concept of Dividend Myron Gordon, James walter, John Linter and Richardson are mainly associated with the relevance concept of dividend. They hold that there is a direct relationship between the dividend policy of the company and its value in terms of market price of its shares. Those firms which pay higher dividends, will have greater value as compared to those which do not pay dividends or have a lower dividend payout ratio. We have examined below two theories representing this notion:

(i) Walter’s Approach, and (ii) Gordon’s Approach. (Dividend Policy Bcom Notes)

(i) Walter’s Model of Dividend Policy: A theory known as Walter Model was presented by James E. Walter for determining dividend policy. An optimum dividend policy will have to be determined by the relationship of r and c.

Thus, in Walter’s model, the dividend policy of the firm depends on the availability of investment opportunities and the relationship between the firm’s internal rate of return (r) and its cost of capital (c). Thus:

Dividend Policy Bcom Notes

(i) Retain all earnings when r>c

(ii) Distribute all earnings when r<c

(iii) Dividend (or retention) policy has no effect when r = c.

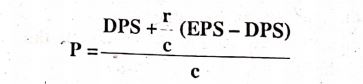

Walter’s Formula for Determining the Value of a Share: Prof. Walter has given the following formula to ascertain the market price of a share:

Where, P stands for Theoretical market value of the company’s equity shares

DPS stands for Dividend per share

r stands for Internal rate of return on investment

c stands for Rate of capitalisation in the market

EPS stands for Earning per share

Dividend Policy Bcom Notes

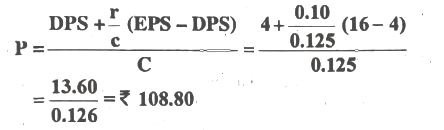

Illustration 1: (i) EPS= 16, Capitalisation Rate = 12.5%, Yield to return = 10%, Dividend 4. Find out the market value of share as per Walter Model.

(Meerut, 2014)

(ii) A company which earns 5 per share, is capitalised at 10% and has a return on investment of 12%, using Walter’s Model determine the price of share.

Note: In the absence of clear information, payout ratio has been assumed as 100%.

(ii) Gordon Model: This is another important theory of dividend evolved by M.J. Gordon. According to this model current dividend as well as the future expected dividends, are relevant for determining the value of a firm. This model is based on the following assumptions.

(i) The firm is an all-equity firm;

(ii) No external financing is available or used. Only retained earnings are used to finance the investment programmes;

(iii) The internal rate of return (r) and the capitalisation rate or cost of capital (k) is constant;

(iv) Cost of Capital (k) is greater than growth rate (br):

(v) The retention ratio (b) once decided upon is remains constant. This implies that the growth rate (g or br) is also constant;

(vi) Corporate taxes do not exist;

(vii) The firm has perpetual or long life.

Gordon’s formula for Determining the Value of a Share at the beginning of year:

Dividend Policy Bcom Notes

P = [E(1-b) / (k-br)]

where, P stands for Value equity shares

E stands for Earning per share

b stands for Retention Ratio Or Percentage of Earnings Retained (1- b) = D/P ratio i.e., percentage of earnings distributed as dividends

r = Rate of return earned on investments made by the firm

br stands for Growth rate of earnings and dividends

k stands for Cost of Capital Or Capitalisation Rate Or Rate of Return required by shareholders

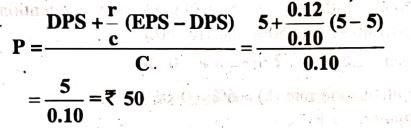

Illustration 2. The following data are given in respect of a company:

- Earning per share [₹ 5]

- Rate of Return on Investments [r = 8%]

- Capitalisation Rate/Cost of Capital [6%]

On the basis of the above information, compute the value of company’s shares using Gorden’s Model under each of the following retention ratios: (i) 20%. (ii) 40%, (iii) 50% and (iv) 60%.

Dividend Policy Bcom Notes

Solution. Given EPS (E) = 5;r=8% = 0.08

Capitalisation rate (k)= 6% = 0.06

Situation r > k

It is clear from the above calculations that increase in retention ratio (b) has a favourable impact on the market value of shares.

- Irrelevance Concept of Dividend: Modigliani and Miller & Solomon Ezra are mainly associated with the irrelevance concept of dividend. According to this concept, dividend decision has no effect on the wealth of the shareholders or the prices of the shares and hence it is irrelevant as far as the valuation of the firm is concerned.

MODIGLIANI AND MILLER MODEL

Modigliani-Miller hypothesis provides the irrelevance concept of dividend in a comprehensive manner. According to them, the dividend policy of a firm is irrelevant since it does not have any effect on the price of shares of a firm, i.e., it does not affect the shareholder’s wealth.(Dividend Policy Bcom Notes) They expressed that the value of the firm is determined by the earning power of the firm’s assets or its investment policy and not by the dividend decisions.

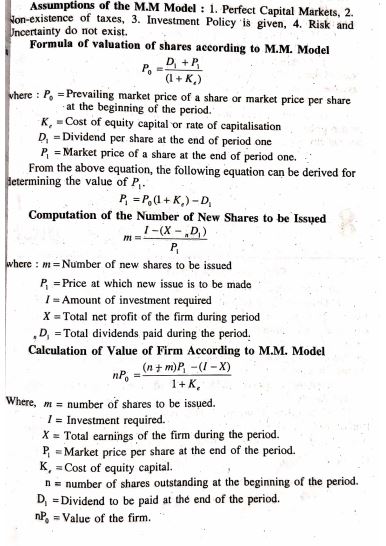

Assumptions of the M.M Model: 1. Perfect Capital Markets, Non-existence of taxes, 3. Investment Policy is given, 4. Risk Uncertainty do not exist.

Dividend Policy Bcom Notes

According to M.M. Model, the dividend policy of a firm is irrelevan as it does not affect the value of the firm.

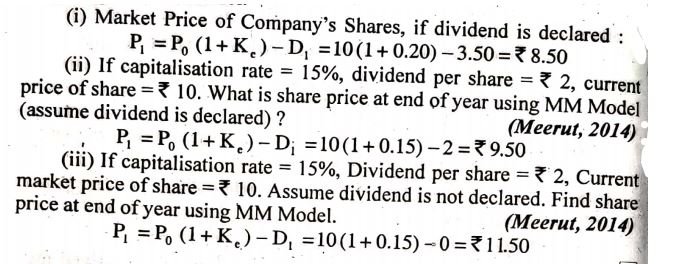

Illustration 3. (i) Ram has 50,000 shares of 10 each. These are currently listed at par. Dividend, is 3.50 per share. Capitalisation rate is 20%. If dividend is declared, find out the market value per share according to M.M. Model.

(Meerut , 2013)

|

|||