Funds Flow Statement Bcom Notes

Funds Flow Statement Bcom Notes:-

In this post, you will get the notes of B.com 3rd year Financial Management, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. Funds Flow Statement Bcom Notes

Funds Flow Statement

Before discussing the Funds Flow Statement technique, it is essential to understand the two words used in it viz. (i) funds, and (ii) funds flow.

Meaning of Fund: In the context of funds flow statement the term ‘fund’ is used to describe ‘net working capital’ and net working capital refers to the excess of current assets over current liabilities. In brief:

Fund = Net Working Capital = Total Current Assets – Total Current Liabilities

Meaning of Funds Flow: The term ‘flow’ means movement and in this sense it includes both ‘inflow’ and ‘outflow’. On this basis the term ‘fund flow’ means ‘Change in Funds’ or ‘Change in Working Capital’. Any transaction will result in flow of funds only if there is any increase or decrease in net working capital. If any transaction does not make any change in working capital it means there is no flow in working capital, due to that transaction.(Funds Flow Statement Bcom Notes)

Transactions Affecting the Flow of Funds: The following transactions will bring the change in the working capital (funds):

1. The effect of transaction lies on a current asset and a fixed assete.g., sale or purchase of a fixed asset.

2. The effect of transaction lies on a current asset and a fixed liability e.g., issue of debentures for cash.(Funds Flow Statement Bcom Notes)

3. A current asset and capital are affected by the transaction e.g., issue of shares for cash.

4. A fixed asset and a current liability are affected by the transaction e.g., credit purchase of machine.

5. A current liability and a fixed liability are affected by the transaction e.g., issue of debentures for satisfying the claims of creditors.

6. The capital and the current liability are affected by the transaction e.g., issue of shares in payment to creditors, acceptance of bills payable for redemption of preference shares.

7. The net profit or net losses arising as a result of the business activities also generate the flow of funds, which is called funds from operations.

Transactions that will not affect the flow of funds: The following transactions will not bring any change in the working capital and thus, there will be no flow in funds:

Funds Flow Statement Bcom Notes

1. Where Both the Accounts affected in any Transaction belong to Current Assets Category: e.g., cash purchase of goods, cash sales, receipts from debtors, receipts of bills receivable from debtors, encashment of bills receivable etc. Such transactions only change the form of current assets, but the total amount of current assets and the net working capital remain unchanged.

2. Where the Change in Current Assets and Current Liabilities is in the same direction and in the same proportion e.g, payment to creditors, payment of bills payable, purchase of goods on credit etc. Such transactions result in equal reduction in the total of current assets and current liabilities but net working capital remains unchanged.

3. Where the Accounts Related to Fixed Assets and Long- term Liabilities or capital are affected in a same proportion e.g., purchase of fixed assets by issue of shares or debentures. (Funds Flow Statement Bcom Notes) Such transactions do not alter the accounts of any current asset or any current liability due to which the net working capital remains unchanged, i.e., there is no flow of funds.

Illustration 1.

During the year, a business was purchased by issue of ₹ 1,00,000 shares and ₹ 1,00,000 debentures. The business purchased had the following assets and liabilities:

Building ₹ 1,00,000, Stock 20,000, B/R ₹ 60,000, Creditors and B/P 20,000. Calculate the effect of this transaction on flow of funds.

Solution.

This transaction involves acquisition of current assets of ₹ 80,000 (Stock ₹ 20,000 and B/R ₹ 60,000) and current liabilities of ₹ 20,000 (Creditors + B/P). Thus, there is net inflow of ₹ 60,000 (80,000-20,000) in this transaction.

Funds Flow Statement Bcom Notes

Meaning and Definition of Funds Flow Statement

The funds flow statement is a financial statement to depict the position of flow of funds during the period between two balance sheets. Some of its definitions are as follows:

A statement of sources and application of funds is a technical Bevice designed to analyse the changes in the financial condition of a Dusiness enterprise between two dates.”

-Foulke

“The Funds Flow Statement describes the sources from which additional funds were derived and the use to which these funds were out.”

-Robert Anthony

Objectives of Funds Flow Statement: Funds flow tatement exhibites the sources and uses of funds bringing changes n capital structure of a firm between two Balance Sheet dates. The main objectives of such statement are as follows:

1. To find out the position of working capital on two dates of Balance Sheets.

2. To know the changes in working capital during this period.

3. To know the causes of changes in working capital.(Funds Flow Statement Bcom Notes)

4. To know the inflow of funds according to their sources.

5. To know the item-wise outflow of funds during this period

6. To understand the main features of financial operation and policies.

Limitations of Funds Flow Statement: 1. Ignores the non-fund items, 2. Historic Analysis, 3. Lack of original information, 4. No information of the changes in the cash position and 5 Inefficient in Analysis of various Items of Working Capital Separately.

Funds Flow Statement Bcom Notes

Procedure of Preparation of Funds Flow Statement

A fund flow analysis is normally done for a period of one year, although this period can be of two or more years. The essential figures for this analysis can be extracted from both the balance sheets (at the beginning of the year and at the end of the year). Some other relevant informations are extracted from other accounts. The following two statements are prepared for funds flow analysis:

1. Schedule of Statement of Changes in Working Capital.

2. Funds Flow Statement.

1. Schedule of Changes in Working Capital: This schedule portrays the changes in the working capital between two balance sheet dates. It is prepared with the help of current assets and current liabilities. The difference between current assets and current liabilities is called the working capital. Following points are to be kept in mind while computing the changes in the working capital:

1. If the current assets of the current year increase, the working capital increases;

2. If the current assets of the current year decrease, the working capital decreases,

Funds Flow Statement Bcom Notes

3. If the current liabilities of the current year increases, the working capital decreases;

4. If the current liabilities of the current year decrease, working capital increases.

On the basis of above given discussion it can be concluded that there is a direct relation of current assets with working capital while an inverse relation exists between current liabilities and working capital.

Illustration 2.

If net working capital in current year is ₹ 25,000, while it was (-) ₹ 40,000 in the previous year, what will be the amount of changes in net working capital.

Amount of Changes in Net Working Capital

= 25,000 – (- 40,000) = 25,000 + 40,000 = ₹ 65,000

Hence, there is an increase of 65,000 in net Working Capital over the previous year.

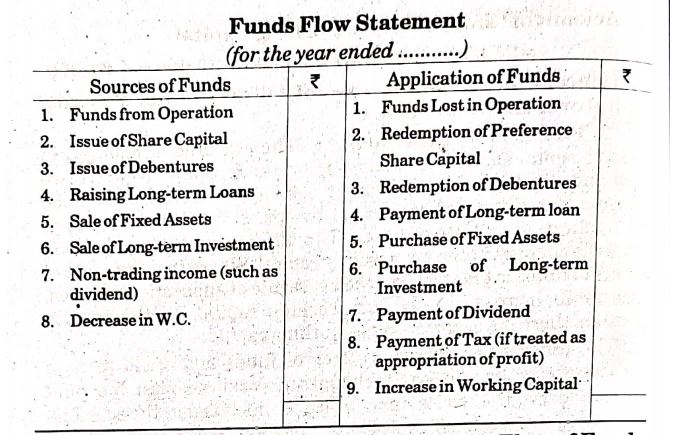

2. Funds Flow Statement: The schedule of changes in working capital shows the changes in working capital between two dates and the fund flow statement clarifies the reasons for such changes.(Funds Flow Statement Bcom Notes) This statement consists of two parts viz. Sources of funds and Application or Uses of funds. The difference between the two, shows the changes in the net working capital. Where the aggregate of sources of funds is greater than the aggregate of application of funds, there is an increase in the net working capital. In the reverse situation, there is a decrease in net working capital.

The difference between sources of funds and application of funds is exactly the same as the changes in working capital. It should be remembered that those items which are included in the schedule of changes in working capital (i.e., current assets and current liabilities) are not shown in Funds Flow Statement.

Sources of Funds: The transactions which result in the inflow of funds are called sources of funds. The detailed description of them is as follows:

(i) Funds received from business operations;

(ii) Increase in share capital;

(iii) Receipts or increases of long term loans;

(iv) Sale of fixed assets;

Funds Flow Statement Bcom Notes

(v) Non trading receipts;

(vi) Decrease in working capital.

Application of Funds: Following items are shown in the application of funds:

(i) Funds lost from business operations;

(ii) Purchase of fixed assets;

(iii) Redemption of preferential shares/debentures/loans;

(iv) Payment of dividend;

(v) Payment of non-trading expenses;

(vi) Increase in working capital.

There is no prescribed format for this statement, but it can be prepared either in account form or in statement form. Specimen of Account Form is as follows:

Funds Flow Statement Bcom Notes

Funds Flow Statement

Discussion of Important Items Related to the Flow of Funds

1. Profit or Loss from Business Operations or Funds: from Operations: This is the most important source of funds. The incomes in a business may arise from both the trading and non-trading activities. To exhibit the business efficiency, only the funds or profits from business operations are shown in the funds flow statement. In the trading activities only the incomes arising from sale and purchase of goods or from main business activities are included, where as non-trading incomes include interest or dividend received from investments, profits on sale of assets, rents received from house property, incidental incomes etc.

(Funds Flow Statement Bcom Notes)

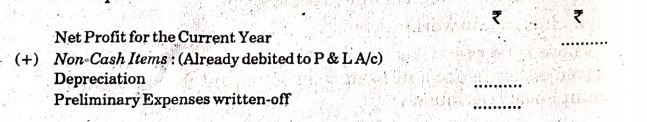

The profit or loss exhibited by the profit and loss account cannot be regarded as suitable for fund flow statement as profit or loss from business operations because there are various items in the profit and loss account which have no relation with the business operations. Other than this there are some items included in the profit and loss account which do not have any effect on working capital. Hence, while computing the funds from operations, some adjustments are made to the net profits, exhibited by the profits and loss account. In short, it can be computed as follows:

Illustration 3.

(i) If net profits are 40,000 and non-cash charges are 5,000, then find out the amount of funds from operations.

Funds from Operation = Net Profit + Non-Cash Charges

= 40,000 + 5,000 = ₹ 45,000

(ii) Net Profit = ₹ 40,000; Depreciation ₹ 10,000 and Security Premium ₹ 25,000. What will be funds from Operations?

Funds From Operations = Net Profit + Depreciation

40,000 + 10,000 = ₹ 50,000

Funds Flow Statement Bcom Notes

(iii) If a firm earned a profit of 18,000 after following adjustments-proposed dividend 7,000, provision for taxation 6,000, income tax refund 3,000, then find out the amount of funds from operations.

Funds from Operation = Net Profit + Proposed Dividend + Provision for Taxation – Income Tax Refund

= 18,000 + 7,000 + 6,000 – 3,000 = 28,000

(iv) After following adjustments a company earned a profit of ₹ 3,00,000 during the year 2014-15, Depreciation on fixed assets ₹ 65,000, Preliminary expenses written off ₹ 7,000, Bad debts ₹ 1,000, Loss on sale of furniture ₹ 1,500, Profit on sale of long-term investments ₹ 5,000. Calculate Funds from Operations.

Funds from Operation = Net Profit + Depreciation + Preliminary expenses + Loss on sale of furniture – Profit on sale of investments

= ₹ 3,00,000 + ₹ 65,000 + ₹ 7,000 + ₹ 1,500 – ₹ 5,000 = ₹ 3,68,500

(v) Net Profit of the year ₹ 80,000, transfer to General Reserve ₹ 5,000, Goodwill written off ₹ 5,000, Preliminary expenses written off ₹ 2,000, Depreciation charged during the year ₹ 10,000, Profit on sale of Assets ₹ 4,000. Find out the amount of Funds from Operations.(Funds Flow Statement Bcom Notes)

Funds from Operations = Net Profit + Transfer to G.R. + Goodwill written off + Preliminary Exp. + Depreciation – Profit on Sale of Assets

= 80,000 + 5,000 + 5,000 + 2,000 + 10,000 – 4,000 = ₹ 98,000

(vi) Abhishek Ltd. earned a profit of ₹ 2,50,000 for the year 2015 after following adjustments: Depreciation for 2015, ₹ 1,12,500, Discount on issue of debentures ₹ 25,000, Loss on sale of long-term investments ₹ 5,125, Dividend received ₹ 1,250 and profit on sale of fixed assets ₹ 1,550. Calculate the funds from Operations.

Funds from Operations:

= 2,50,000 + 1,12,500 + 25,000 + 5,125 – 1,250 -1,550 = ₹ 3,89,825

(vii) Net Loss ₹ 1,00,000, Depreciation on Plant ₹ 2,50,000, Profit on sale of land ₹ 45,000, Goodwill written off ₹ 25,000, Loss on sale of furniture ₹ 20,000, Provision for bad and doubtful debts ₹ 12,500 and refund of tax ₹ 2,000. Calculate the funds from operations.(Funds Flow Statement Bcom Notes)

Funds from Operations:

= (2,50,000 + 25,000 + 20,000) – (45,000 + 2,000 + 1,00,000)

= 2,95,000 – 1,47,000 = ₹ 1,48,000

2. Increase or Decrease in Share Capital: The increase or decrease in share capital is regarded as the source or an application of fund subject to changes in working capital. When share capital is issued to finance the purchase of fixed assets or debentures are converted into equity shares, there is neither any source nor an application of working capital. Further the issue of bonus shares is not an applications of funds. If there is an increase in share capital in current year or at the end of year then difference will be treated as source of funds i.e., in such case it is assumed that shares have been issued.

If there is any direct or indirect information given regarding the issue of shares at discount or at premium then to calculate the amount of net proceeds of shares issued, we will make an adjustment in face value for discount and premium. If the share capital is issued for the purchase of current assets (particularly for purchase of stock) then the issue of share capital will also be treated as sources of funds. Generally decrease in share capital is impossible.

It may only be in case of redeemable preference shares. If there is decrease in preference share capital in current year or at the end of year then it will be assumed that the company redeemed the preference shares. Redemption of preference shares is an application of funds. Preference shares can be redeemed by the company either at premium or at discount.

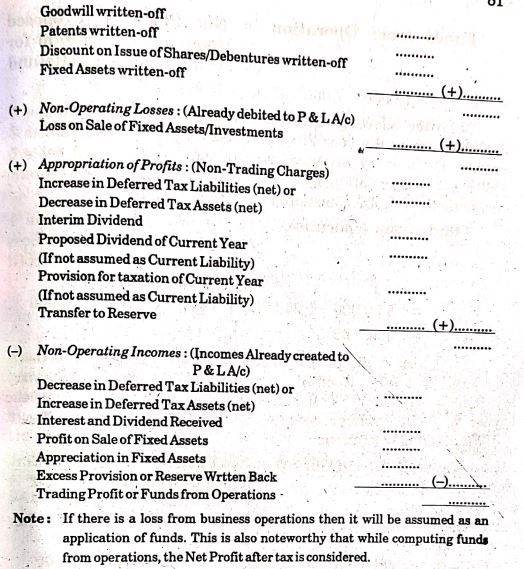

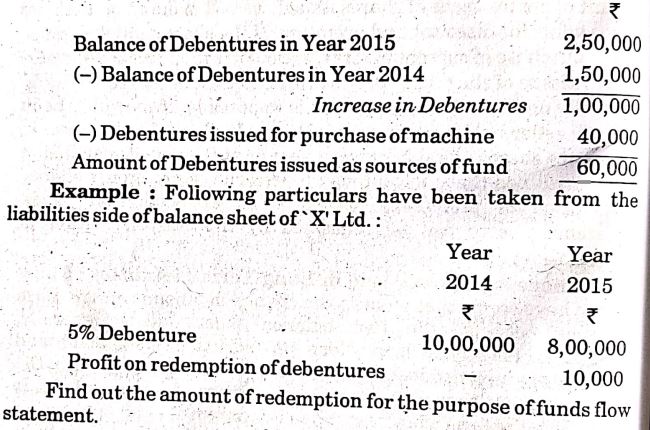

3. Increase or Decrease in Long -Term Liabilities: Under this we have to see that what is the change in amount of long-term liabilities between the two balance sheet dates. Generally, debentures, long term loans, loan on mortgage, bank loans and mortgage are included in long term liabilities. If this change is in the form of increase then it is assumed as sources of funds and if this change is in the form of decrease then it is assumed as an application of funds. Here it is to be remembered that we have to see carefully that whether the increase or decrease in long-term liabilities is not due to transactions of non-current items.

If it is so then increase/decrease in long term liabilities will not be treated as sources/applications of fund. If the debentures have been issued for the purchase of fixed assets or debentures have been redeemed by the conversion into equity shares then increase/decrease in debentures is neither any source or application of working capital and therefore such type of transactions will not affect the flow of fund in any way.

Funds Flow Statement Bcom Notes

Hence it is very clear that if debentures have been issued for cash or for some other current assets, only then it will be treated as sources of fund. It should be noted that only the actual proceeds from the issue of debentures (i.e., including premium or excluding discount, any) will be considered as inflow of funds. In the same way, if their i decrease in the amount of debentures i.e., in case of redemption of debentures, actual amount paid will be shown as application in the Funds Flow Statement.

Explanation by an Illustration: In the balance sheets of year 2014 and year 2015 of X’ Ltd., Debentures were ₹ 1,50,000 and ₹ 2,50,000 respectively. It is informed that 1,000 debentures of ₹ 100 each have been issued in the year 2015 and out of which 400 debentures were issued to a vendor for purchase of a machine. Find out the amount of debentures issued for the purpose of funds flow statement.

Solution.

Funds Flow Statement Bcom Notes

4. Increase or Decrease in Fixed Assets and Long-term Investments: If during the year there is any increase in fixed assets and long-term investments, it is purchase of fixed assets/Long-term investments and constitutes, outflow of funds. However, if such purchase is made against the issue of shares or debentures there will be no outflow of funds. On the other hand any decrease in fixed assets and long-term investments will be sale of fixed assets and long-term investment.

The proceeds on account of such sale becomes a source of funds. However, if there is no additional information about fixed assets, then decrease in the amount of land is treated as sale, while decrease in other assets is treated as depreciation.(Funds Flow Statement Bcom Notes) If there are indications of purchase or sale of fixed assets or depreciation charged on these assets in the information given after balance sheets, it is desirable to prepare accounts relating to such fixed assets and to find out hidden information (about purchase, sale or depreciation), if any.

Illustration 4.

(i) The balance of fixed assets of a company at cost at the end of 2014 and 2015 were ₹ 6,00,000 and ₹ 8,20,000 respectively. Depreciation for the year amounting to ₹ 60,000. Find out the purchase of fixed assets. Purchase of Fixed Assets

= 8,20,000 + 60,000 – 6,00,000 = ₹ 2,80,000

(ii) The balance of fixed assets of a company at cost at the end of 2014 and 2015 were ₹ 5,70,800 and ₹ 6,15,300. During the year 2015 a machinery costing ₹ 60,000 was sold. Find out the purchase of fixed assets.(Funds Flow Statement Bcom Notes)

Purchase of Fixed Assets

= 6,15,300 + 60,000 – 5,70,800 = 1,04,500

(iii) The Balance Sheets of X Ltd. as at 31st December, 2014 and 2015 disclose investments in shares of ₹ 2,000 and ₹ 3,000 respectively. ₹ 100 being pre-acquisition dividend has been credited to investments account. Find out the purchase of investments.

Purchase of Investments = 3,000 + 100 – 2,000 = ₹ 1,100

(iv) Cost of Sold Plant = ₹ 50,000, Accumulated Depreciation = ₹ 30,000, Profit on Sale = ₹ 6,000. What will be the selling price of plant?

Selling Price of Plant = (50,000 – 30,000) + 6,000 = ₹ 26,000

5. Provision for Taxation: (a) As a Current Liability: In such a case, the amounts of provision for tax given in Balance Sheets are shown in ‘Schedule of Changes in Working Capital’ and further treatment is required while preparing the funds flow statement.

Moreover, any additional information relating provision or payment of tax is also ignored.

(b) As an Appropriation of Profits: In such a case, the provision mad during the year is added back to reveal the funds from operations and actual tax payment is shown in the application side of the funds flow statement. For knowing hidden information regarding either amount of tax paid or provision for taxation charged to the current year’s profit, it is desirable to prepare ‘ Provision for Tax Account.(Funds Flow Statement Bcom Notes)

As per Revised Accounting Standard-3 provision for tax should be considered a non-current item and, therefore, it must be created & an appropriation of profits.

Example: Provision for tax at beginning = ₹ 10,000, Provision for tax at the end = ₹ 15,000 and tax paid during the year = ₹ 12,000. What will be the amount of provision for tax charged during the year? Amount of Provision for Tax Charged during the Year:

= 15,000 + 12,000 – 10,000 = ₹ 17,000

6. Goodwill: If the amount of goodwill increases during current year, the difference is treated as purchase of goodwill. If this purchase is on cash basis, it is shown as application of funds in funds flow statement. However, if shares or debentures have been issued for such purchase, that will be ignored because there is no flow of funds in such transaction. On the contrary if the amount of goodwill decreases during current year it will treated as written off and is added back to the given amount of net profit of the current year for the calculation of funds from operations.

Illustration 5.

The Balance Sheet of Mr. Vibhav shows that the opening balance of capital in the business is 80,000 and closing balance of capital is 1,20,000. During the year he has withdrawn 8,000 for his personal use. Find out the amount of net profit during the year.

Net Profit of the Year

= 1,20,000 + 8,000 – 80,000 = 48,000

Funds Flow Statement Bcom Notes

Funds Flow Statement Bcom Notes

|

|||