Cash Flow Statement Bcom Notes

Cash Flow Statement Bcom Notes:-

In this post, you will get the notes of B.com 3rd year Financial Management, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. Cash Flow Statement Bcom

Cash Flow Statement

Meaning of Cash Flow Statement: A cash-flow statement is a statement showing inflows (receipts) and outflows (payments) of cash during a particular period. It analyses the reasons for changes in balance of cash between the two balance sheet dates. The term ‘cash’ here stands for cash and cash equivalents. A cash-flow statement can be for the past or can be projected for a future period. Cash flow statement is undoubtedly a tool for assessing the liquidity and solvency of the enterprise.

Cash Flow Statement Bcom

The Institute of Chartered Accountants of India has issued Accounting Standard (AS)-3 Revised, for preparing a cash flow statement. This Accounting Standard has been made mandatory in respect of accounting periods commencing on or after 1st April, 2001, for certain enterprises. These enterprises are:

(i) Enterprises whose equity or debt securities are listed on a recognised stock exchange in India, and enterprises that are in the process of issuing equity or debt securities that will be listed on a recognised stock exchange in India.(Cash Flow Statement Bcom)

(ii) All other commercial, industrial and business enterprises, whose turnover for the accounting period exceeds 50 Crores. Objectives/Uses/Advantages or Importance of Cash Flow Statement:

- Analysis of Cash Position, 2. Useful for Short-term Cash Planning and Management, 3. Helpful in ascertaining Cash Flow from various activities separately, 4. Helpful in estimating future cash flows, 5. Comparison of Operating Performance, 6. Helpful in Making Dividend Decisions, 7. Helpful in the formation of policies and 8. Useful to outsiders.

Limitations of Cash Flow Statement: 1. Not suitable for judging the liquidity, 2. Possibility of window-dressing in cash position, 3. Non-cash transactions are ignored, 4. It ignores the accrual concept of accounting, 5. Not a substitute for Income Statement and 6. Historical in Nature.

Cash Flow Statement Bcom

Classification of Cash Flows

According to revised AS-3 cash flows can be categorised as follows:

- Cash Flows from Operating Activities.

- Cash Flows from Investing Activities.

- Cash Flows from Financing Activities.

- Cash Flows from Operating Activities: Operating activities are the principal revenue producing activities of a busines enterprise and include cash flows from those transactions and event that enter into the determination of net profit or loss.(Cash Flow Statement Bcom)

Examples of cash flows from operating activities are: (a) Cash receipts from sale of goods and rendering of service. (b) Cash receipts from royalties, fees, commission and other revenue.

(e) Cash payment to suppliers for goods and services. (d) Cash payment to and on behalf of employees. (e) Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities, and (f) Cash receipts and payments relating to future contracts forward contracts, option contracts and swap contracts when the contracts are held for dealing or trading purposes. There are two methods of calculating cash from operating activities:

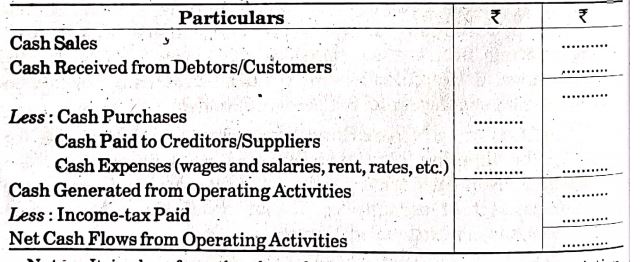

(a) Direct Method: Under this method cash receipts and cash payments related to operating activities are shown and the difference of these two results in cash flows from operating activities. The following format can be used for such calculation:

Cash Flow Statement Bcom

Calculation of Net Cash Flows from Operating Activities (Direct Method)

Note: It is clear from the above format that non-cash items (Depreciation, Goodwill written-off, Preliminary expenses written-off, etc.) and non-operating items (Profit or Loss on the sale of fixed assets and investments) are not required to be adjusted under Direct Method.

Various Adjustments for the Calculation of Cash creditors, outstanding and prepaid expenses are given in the question, certain adjustments are required to be made in order to find out cash receipts and cash payments. These adjustments are follows:

Cash Flow Statement Bcom

- Cash Inflow from Sales: Generally, the amount of sales given in Trading Account consists of both cash and credit sale. Hence, cash inflow from sales is computed as follows:

Cash Inflow from Sales = Cash Sales + Cash Collection

= Sales + Opening Debtors + Opening B/R-Closing Debtors-Closing B/R

- Cash Outflow on Purchases: The amount of purchase given in Trading A/c also consists of both cash and credit purchases. Hence, cash outflow on purchases is computed as follows:

Cash Outflow on Purchases = Purchases + Opening Creditors + Opening B/P Closing Creditors-Closing B/P

Cash Flow Statement Bcom

If the amount of cost of goods sold is given in the question then cost of Goods Sold – Opening Stock + Closing Stock will be used in place of purchases.

- Cash Outflow on Expenses: Only such amount of operating expenses is shown, which has actually been paid in cash. In this context following points are important:

(a) All non-cash items such as depreciation, loss on sale of fixed assets, transfer to reserve, goodwill written-off, etc. are ignored.

(b) In case of outstanding expenses, cash outflow is calculated as follows:

Cash Flow Statement Bcom

Cash Outflow on Expenses = Expenses + Outstanding in the beginning – Outstanding at the end

(c) In cash of prepaid expenses, cash outflow is calculated as follows:

Cash Outflow on Expenses = Expenses-Prepaid in the beginning + Prepaid at the end

(Cash Flow Statement Bcom)

Illustration 1.

Total Sales ₹2,00,000; Opening Debtors ₹15,000; Closing Debtors ₹28,000; What will be the cash sales?

Solution.

Cash Sales = Total Sales + Opening Debtors-Closing Debtors

= ₹2,00,000+ ₹15,000 – ₹28,000= ₹1,87,000

Illustration 2.

Opening Stock ₹7,000; Closing Stock ₹10,000; Cash Purchase ₹82,000; Sales ₹1,25,000 including credit sales of ₹18,000. Find the cash generated from operation.

Solution.

Cash from Operation = Sales-Credit Sales-Cash Purchase

= 1,25,000 18,000-82,000= 25,000

Illustration 3.

Cash Sales ₹2,40,000; Opening Debtors ₹28,000; Closing Debtors 32,800 then what will be the amount received from customers?

Solution.

Cash Flow Statement Bcom

Cash Receipts from Customers = Sales + Debtors at the beginning-Debtors at the end

= ₹2,40,000 + ₹28,000 – ₹32,800 = ₹2,35,200

Illustration 4.

Cost of goods sold ₹1,55,000; Creditors at the beginning ₹12,000; Creditors at the end ₹14,600; Opening Stock ₹16,800 and Closing Stock ₹23,000, then what will be the amount paid to suppliers?

Solution.

Cash paid to Suppliers = Cost of goods sold + Creditors at the beginning + Stock at the end – Creditors at the end-Stock at the beginning

= 1,55,000+ 12,000+23,000-14,600-16,800 = ₹1,58,600

Illustration 5.

Administrative and office expenses shown in Profit and Loss Account ₹13,000; Outstanding expenses at the beginning ₹1,200 and outstanding expenses at the end ₹800, then what will be the amount paid for administrative and office expenses during the year?

Cash Flow Statement Bcom

Solution.

Payment of Admn. And Office Expenses

| ₹ | |

| Admn. And Office Expenses shown in P/LA/c | 13,000 |

| (=) Outstanding Expenses at the Begining | 1,200 |

| 14,200 | |

| (-) Outstanding Expenses at the end | 800 |

| Payment of Admn. And Office expenses | 13,400 |

Illustration 6.

Total Sales ₹5,00,000; Credit Sales ₹2,25,000; Total Purchases ₹2,48,000; Credit Purchases ₹1,08,000; Cash Operating Expenses ₹40,000, then find out the cash from operation.

Solution.

Cash Sales = Total Sales-Credit Sales

Cash Flow Statement Bcom

= ₹5,00,000 – ₹2,25,000 = ₹2,75,000

Cash Purchases = Total Purchases-Credit Purchases

= ₹2,48,000 – ₹1,08,000 = ₹1,40,000

Cash from Operation = Cash Sales – Cash Purchases – Cash Operating Expenses

= ₹2,75,000 – ₹1,40,000 – ₹40,000 = ₹95,000

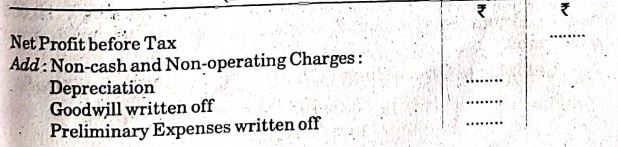

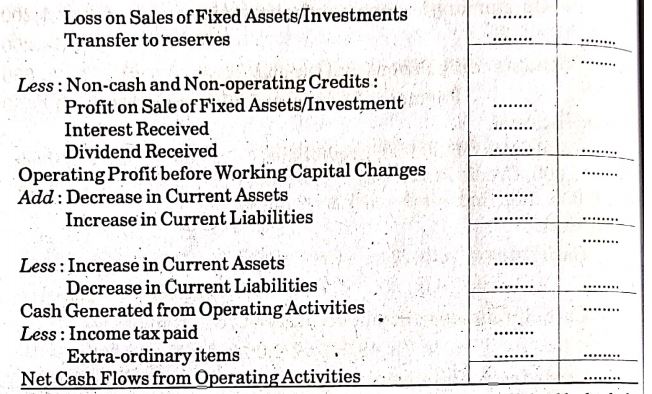

Indirect Method: In this method, we start with the net profit before tax and extraordinary items. The figure of net profit disclosed by profit and loss statement cannot be taken as cash from operating activities because there are some items of expenses in the profit & loss statement which do not result in the outflow of cash. Such items are added back to net profits. Similarly, there are some items of incomes which are shown in the profit and loss statement, but they are non-operating incomes. These items should be deducted from net profits to compute cash from operating activities.

Cash Flow Statement Bcom

In addition to the above, there are certain other items which are not shown in the profit and loss statement at all, but which result in increase or decrease of cash. These items must also be adjusted for calculating cash from operating activities.

In brief, the calculation of cash flow from operating activities by indirect method can be presented in the following format:

Cash Flow Statement Bcom

Calculation of Net Cash Flows from Operating Activities (Indirect Method)

Note: It is important that the same figure for net cash flow is derived by both the methods (Direct and Indirect). However, the use of method depends upon the information or direction given in the question.

Illustration 7.

(i) If the net operating profit of a business is ₹70,000 and the debtors have been decreased during the year by ₹20,000, then what will be the amount of cash from operations?

Cash From Operation = ₹70,000 + ₹20,000 = ₹90,000

(ii) Sales ₹50,000, Purchases ₹40,000, Expenses ₹5,000, Creditors at the beginning ₹10,000 and Creditors at the end ₹15,000. Find the amount of cash from operations.

Net Profit = Sales – Purchases – Expenses

50,000-40,000-5,000 = ₹5,000

Cash Flow Statement Bcom

Increase in Current Liability (creditors) = ₹15,000 – ₹10,000 = ₹5,000

Cash From Operations = Net Profit + Increase in Current Liability

= ₹5,000 + ₹5,000 = ₹10,000

(iii) If Profit is ₹40,000, Creditors at the beginning ₹10,000 and Creditors at the end ₹15,000, then find the cash from operations.

Cash from Operations = Profit + Increase in Creditors

=40,000 + (15,000-10,000)

= ₹45,000

(iv) Opening Debtors ₹50,000 and Closing debtors ₹1,00,000, Net Profit ₹2,50,000. Find the cash from operations.

Cash from Operations = Net Profit – Increase in Debtors

= ₹2,50,000 – (₹1,00,000 – ₹50,000)

= ₹2,00,000

(v) If profit earned during the year is ₹10,000 and increase and decrease in current assets is ₹5,000 and ₹4,000 respectively then find the cash received from operations.

Cash from Operation = Earned Profit + Decrease in Current Assets – Increase in Current Assets

= ₹10,000 + ₹4,000 – ₹50,000 = ₹9,000

(vi) Net Profit ₹3,20,000, Opening Stock ₹60,000 and Closing Stock ₹80,000, find cash from operation.

Cash from Operation = Net Profit – Increase in Stock

= ₹3,20,000 – (₹80,000 – ₹60,000) = ₹3,00,000

- Cash Flows from Investing Activities: Investing activities include the purchase and sale of long-term assets such as land, buildings, plant and machinery etc. not held for resale. These activities also include the purchase and sale of such investments which are not included in cash equivalents. Cash flow from investing activities discloses the expenditures incurred for resources intended to generate future income and cash flows. Examples of cash flows arising from investing activities are:

(a) Cash payments to acquire fixed assets (including intangibles);

(b) Cash receipts from sale of fixed assets (including intangibles);

(c) Cash payments to acquire shares, warrants or debt instruments of other enterprises (other than payments for those instruments considered to be cash equivalents);

(d) Cash receipts from sale of shares, warrants or debt instruments of other enterprises (other than receipts for those instruments considered to be cash equivalents).

Cash Flow Statement Bcom

(e) Cash advances and loans made to third parties. In case of financial enterprises these will be treated as cash flows from operating activities;

(f) Cash receipts from the repayment of advances and loans made to third parties. In case of financial enterprises these will be treated as cash flows from operating activities;

(g) Cash receipts of insurance claim for property involved in accident; and

(h) Cash receipts of interest and dividend. In case of financial enterprises these will be treated as cash flows from operating activities.

Illustration 8.

Opening balance of investments 1,02,000 and closing balance of investments 84,000. During the year company had sold 40% of its investment held in the beginning of the year at a profit of? 25,000. Calculate cash flows from investing activities.

Solution.

Amount recd. from sale of investments:

= (1,02,000 × 40%) + 25,000 = ₹65,800

Purchase of Investments:

= (84,000+ 65,800) – (1,02,000+25,000) = ₹22,800

Cash Flow from Investing Activities 65,800 – 22,800

= ₹43,000 outflow

- Cash Flow from Financing Activities: Financing activities are those activities that result in change in the size and composition of owner’s capital (including equity and preference share capital in the case of a company) and borrowings of the enterprise. It includes proceeds from issue of shares or other similar instruments, issue of debentures, loans, bonds, other Short-term or Long-term Borrowings and repayments of amounts borrowed.(Cash Flow Statement Bcom)

In short, Cash Flow from Financing Activities is ascertained by analysing the change in the Equity and Preference Share Capital, Debentures and other borrowings.

Dividend paid (in all enterprises) and interest paid (in the case of non-financing enterprise) are also included in Financing Activities.

It is important to note that an increase in share capital due to bonus issue will not be shown in the Cash Flow Statement, since it is the capitalisation of reserves. When shares are issued at a premium, the Cash Flow Statement reflects the total cash generated by the issue (e.g., Face Value of Shares + Premium).

When does the Flow of Cash Arise ?: Cash Flow arises when the net effect of a transaction either increases or decreases the amount of Cash or Cash Equivalents. Any transaction which affects either:

Cash Flow Statement Bcom

- A Current Account (other than the Cash and Cash Equivalent Account) and the Cash/Cash Equivalent Account, e.g., cash received from debtors.

Or

- A non-current Account and Cash/Cash Equivalent Account, e.g., purchase of goodwill, causes a change in cash position.

Preparation of Cash Flow Statement

Following steps may be followed to prepare a cash-flow statement:

Step 1. The cash flows under each activity (Operating/Investing/ Financing) are shown in the Cash Flow Statement.

Step 2. Find out the aggregate net cash flows from all these three activities i.e., operating, investing and financing activities. Aggregate of these three activities will be either an increase or decrease in cash and cash equivalents.

Step 3. Cash and cash equivalents balance in the beginning will be added to the net increase or decrease in cash equivalents as we have calculated in Step 2. Resulting figure will be cash and cash equivalents at the end.

Cash Flow Statement Bcom

|

|||