Classification of Audit Bcom Notes

Classification of Audit Bcom Notes:-

In this post, I am giving you the notes of Bcom 3rd Year auditing, which is going to be very useful in your examination and you should share this post to all friends and all your groups so that your friends also read this post. Could. Classification of Audit Notes

Classification of Audit

Continuous Audit

Continuous audit involves the detailed examination of all the transactions by the auditor continuously throughout the year or at regular intervals say, fortnightly or monthly as fixed. Continuous audit enables the auditor to have a detailed examination and verification of the books of accounts and complete the audit work when the year comes to a close. This system of audit would be highly helpful where the volume of transactions happens to be more and complex.

According to R. G. Williams, Continuous audit is “one where the auditor or his staff attends at regular or irregular intervals during the period.”

Applicability: Continuous audit is applicable in the following

(1) Where it is necessary to prepare final accounts just at the cases: closure of financial year e.g., railways, banks etc.

(2) Where the transactions are large in number and it is considered necessary to assess them at regular intervals.

(3) Where statements of financial accounts are required to be produced before the management after every quarter or so.

(4) Where no satisfactory system of internal check is in practice.

Classification of Audit Notes

Advantages of Continuous Audit

(1) Early detection of errors and frauds: In a continuous audit, the auditor checks the accounts in a detailed manner at regular intervals. It is thus possible for him to detect errors and fraud, easily and quickly. If the accounts are audited after the end of the year, it will be difficult to locate an error or fraud from labyrinth of details, and the loss resulting to the business from the undetected errors or fraud may be sizable.

(2) Quick Presentation of Accounts: Since the accounts are checked throughout the year it becomes easily possible to presen the final audited accounts to the shareholders soon after the close of the financial year. Thus, the work of the auditor becomes more efficient.

(3) Moral Check on Client’s Staff: The regular visit performed by the auditor make the clerks alert to maintain the accounts up-to-date. The accounts thus, maintained are als accurately prepared by them.

(4) Familiarity with technical details: As the audito comes more and more in touch with the business affairs and it technical details, he can give valuable suggestions to his clients for improving the working of the business and the system a maintaining accounts.

(5) Relief to auditor: In continuous audit, an auditor ca perform his duties with ease. He can plan his work well and procee with confidence. Thus, he can be in a position to relieve himself of great undue burden which would otherwise have fallen upon him a the close of the financial year.

(6) Ease in declaring interim Dividend: Continuous audit helps in preparing interim accounts without much delay, where the directors of a company desire to declare an interim dividend Properly audited accounts help them to get an idea about the profit actually earned till the date of the declaration.

Classification of Audit Bcom Notes

Disadvantages of Continuous Audit

(1) Possibility of alteration in Figures: The auditor checks the accounts books in several visits. The employees of the client ma make some fraudulent alterations in the figures, which are already checked by the auditor during the previous days, because the auditor’s staff also keeps changing and the auditor cannot remember each and every figure. Thus, additional work of noting the key figures is increased at the end of the auditor’s work.

(2) Spoon-feeding: Frequent visits by the auditor and h staff may cause lethargy and indifference on the part of the client employees. They may not exert much to locate even min discrepancies in their books, thinking that it will in any case discovered by the auditor during his next visit.

Classification of Audit Bcom Notes

(3) Expensive: A continuous Audit is an expensive form of audit as the more frequent visits by the auditor mean higher fees.

(4) Possibilities of secret pact with employees: The frequent visits of the auditor may establish some unhealthy relationship between him and the clerks and there are chances of mitigating moral check upon them.

(5) Exhaustive and tedious work: In the continuous Audit, the auditor is required to take detailed notes about the work done by him at each visit. This makes the work of the auditor mechanical and his frequent visits may cause boredom to him.

(6) Interruption of Client’s Work: As the auditor visits the client’s office at regular intervals to check the accounts and records, these frequent visits may dislocate the work of his client.

(7) Loss of Link in Work: As the auditor comes at regular intervals to check the accounts the link between the past and present work cannot be maintained.

Precautions: The disadvantages of continuous audit can be mostly overcome if the auditor takes the following precautions:

Classification of Audit Bcom Notes

(1) Clear Instructions: The auditor should also issue clear instructions that the audited figures should not be changed without bringing it to his notice. If some alteration is necessary, it should be done by passing rectification entries in the journal.

(2) Complete specific job at one time: In each visit, the audit-staff should complete some specific job so as to finish up the checking up to the specified totals, so that the incomplete work cannot be left and he should note down the important figures in his audit note-book.

(3) Use of Audit note book: The auditor should keep a note of the balance of the accounts and should compare the same at the time of next visit. The totals must be inked.

(4) Examination of impersonal accounts at the end of the year: As it is relatively easy to perpetrate fraud in personal accounts by passing corresponding fictitious entries in the impersonal accounts, the auditor should leave the examination of impersonal accounts till the time of final audit.

(5) Explanations: The explanations of important questions which he finds unsatisfactory should be noted in his note books. (Classification of Audit Bcom Notes)

(6) Audit Programme: He should draw up the audit-programme, so as to work systematically and he should try to stick to it.

(7) Visit on irregular intervals: The auditor should arrange his visit at irregular intervals to avoid the client’s staff from knowing the exact date of his visit.

(8) Work Rotation: To prevent collusion between audit staff and client’s staff the auditor may rotate work among them in such a way that no audit clerk is allowed to check an account from beginning to end.

(9) Sensible Allocation of Work: By a just and sensible allocation of work among its staff, the auditor can prevent the work becoming tedious or boring.. Periodical (Final or Annual) Audit

This is also known as final audit. In this system the auditor takes up his work of audit only at the end of an accounting period and the audit is commenced and completed in a single uninterrupted session. (Classification of Audit Bcom Notes) In a periodical audit, the auditor is given possession of the books of Account and these are returned to the client only after the audit has been completed.

According to Spicer and Pegler, “A final or completed audit is that which is commenced after the end of the financial year of within it relates.”

According to Lawrance R. Dicksee, “Periodical audit is that audit which is commenced after the end of that financial year to which it is related. It does not contain the benefit of continuous audit.”

This type of audit is suitable for small and medium sized firm It is also economical and less time consuming.

Classification of Audit Bcom Notes

Advantages of the Periodical Audit

(1) Convenient: It is more convenient to the client since it is done once in the accounting year.

(2) Smooth Flow of Work: There is no loss of link in the work as the entire audit is completed in a single continuous session.

(3) No alteration in Audited Work: Like the continuous audit there is no possibility of alteration of audited figures.

(4) Little Chance of Collusion: There is little possibility for the auditor to collude with accounting staff and commit fraud etc.

(5) Economical: This kind of audit is comparatively less expensive and, therefore, is the only viable form of audit available t small business houses.

(6) Saving of time: The auditor can plan to finish his work in lesser time as he gets full facts and materials for the conduct of his work.

Classification of Audit Bcom Notes

Demerits of Periodical Audit

(1) Difficulty in rectification of errors: Errors are pointed out but their rectification becomes very difficult, because there is sufficient gap between the commission of error, its detection and rectification. It is also possible that during this gap the undue benefits might have been substantially enjoyed by the employees of the client.

(2) Detailed checking not possible: The auditor will be left with little time for detailed checking of the Accounts.

(3) Delay in preparation of final accounts: As the work of audit usually takes a long time to be completed, the presentation of final accounts in the annual general meetings is likely to be delayed.

(4) Lesser moral check: As compared to continuous audit, less moral force is exercised on the employees of the client.

Classification of Audit Bcom Notes

(5) Unsuitability for large concerns: In large concerns where the number of transactions are voluminous and complex, periodical audit is not practicable and for this reason it is often not preferred by them.

(6) Planned Frauds Undetected: Frauds committed with due planning might go undetected, as the auditor cannot sense the intentions of the employees nor can be doubt their integrity as he comes for a short while once a year.

Statutory Audit

Statutory audit refers to the audit of accounts of business enterprises carried out compulsorily under the provisions of law. Statutory audit is carried out in the case of the following organisations:

(1) Joint stock companies, registered under the Companies Act.

(2) Public and charitable trusts registered under various religious and Endowment Acts.

(3) Co-operative societies registered under Societies Registration Act or State Co-operative Societies Act of the States. (Classification of Audit Bcom Notes)

(4) Banking companies regulated under Banking Companies (Regulation) Act of 1949.

(5) Insurance companies governed by Insurance Act, 1938.

(6) Public corporations formed under special acts.

When audit is not statutorily compulsory and depends on the will of the owners, it is termed as voluntary audit.

Government Audit

Audit of government offices and departments is covered under this heading. A separate department is maintained by Government of India, known as Accounts and Audit Department. (Classification of Audit Bcom Notes) This department is headed by comptroller and Auditor General of India. This department works only for government offices and departments. This department cannot undertake audit of non-government concerns. Its working is strictly according to government rules and regulations.

Cash Audit

In cash audit an auditor is appointed to conduct an audit of cash transactions only in order to find out whether there is any case of fraud.

Balance Sheet Audit

In the Balance Sheet Audit, the items appearing in the Balance Sheet i.e., assets and liabilities alone are audited.

Classification of Audit Bcom Notes

Casual Audit

It is conducted as a special event, normally in those organisations where routine audits are not taking place. For example, in a partnership firm when a new partner is to be admitted or where Government orders a special audit to investigate into certain matters.

Standard Audit

In the standard audit, certain items are checked completely and test checking is applied on remaining other items in accordance with general rule standards. Thus, it is a sample checking after a satisfactory and detailed checking of some of the items.

Interim Audit

When an audit is conducted between two annual audits, such audit is known as interim audit. It may involves complete checking of accounts for a part of the year. Sometimes it is conducted to enable the board of directors to declare an interim dividend.

Internal Audit

Internal audit is a constant review of accounts conducted continuously by the employees of the company. Professional qualification is not essential for the purpose of internal auditing.

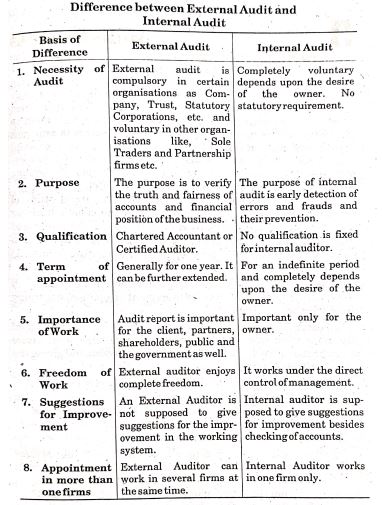

Difference between External Audit and Internal Audit

Classification of Audit Bcom Notes

Classification of Audit Bcom Notes

|

|||