Auditing Meaning Objectives and Importance Bcom Notes

Auditing Meaning, Objectives and Importance Bcom Notes:-

In this post, I am giving you the notes of Bcom 3rd Year auditing, which is going to be very useful in your examination and you should share this post to all friends and all your groups so that your friends also read this post. ( Auditing Meaning Objectives and Importance)

Auditing: Meaning, Objectives and Importance

Meaning and Definition of Auditing

The word ‘Audit’ is derived from the Latin word ‘Audire’ which means to hear’. In olden days, there were only cash transactions. So in those days it was customary for persons responsible for maintenance of accounts to go to some impartial and experienced persons, ordinarily judges, known as ‘auditors’ who used to hear these accounts and express their opinion about their correctness or otherwise. (Auditing Meaning Objectives and Importance)

Thus, the field of auditing was limited only to the examination of cash receipts and payments. But now its scope has widened. It is now the verification of financial position as is revealed by the Balance Sheet and the Profit and Loss Account. It is an examination of accounts to know whether the balance sheet and profit and loss accounts give a true and fair picture of financial position and profit or loss of the business. The history of Auditing in India dates back to April, 1914 when the Indian Companies Act, 1913 came into force.

Auditing Meaning Objectives and Importance

Definitions of Auditing

According to Spicer and Pegler, “Audit is an examination of the books, accounts and vouchers of a business, as will enable the auditor to satisfy himself that the balance sheet is properly drawn up, as to give a true and fair view of the state of affairs of the business, and whether the profit and loss account gives a true and fair view of the profit or loss for financial period according to the best of his information and the explanation given to him and as shown by the books, and if not, in what rspects he is not satisfied.” (Auditing Meaning Objectives and Importance)

According to R. G. Williams, “Auditing may be defined as the examination of the books, accounts and vouchers of a business with á view to ascertaining whether or not the Balance Sheet is properly drawn up, so as to show a true and fair view of the state of affairs of the business.”

Features of Auditing

A close analysis of the above definitions bring out clearly the following features of Auditing:

(i) It is a scientific and systematic examination of books, and financial and legal records of an organisation.

(ii) The purpose of this examination is to ascertain how far they present a true and correct view of the state of affairs of a particular concern. (Auditing Meaning Objectives and Importance)

(iii) The auditor must satisfy himself with the authenticity of financial accounts prepared for a fixed term and ultimately report that:

- The Balance Sheet exhibits a true and fair view of the state of affairs of the concern;

- The Profit and Loss Account reveals the true and fair view of the profit or loss for the financial period; and

- The accounts have been prepared in conformity with the Law and accounting standards.

Auditing Meaning Objectives and Importance

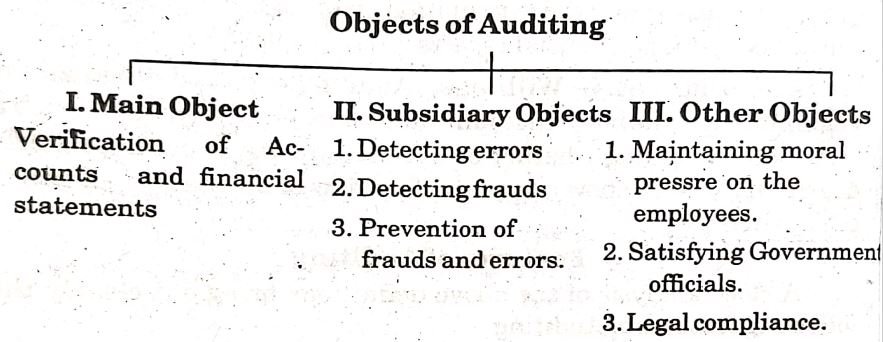

Objects of Auditing

The objectives of auditing are changing with the times. Earlier, the business was simple and object of auditing was only to check the correctness of receipts and payments. Now, with the advancement of business techniques, the objectives of auditing have also changed. The main object of auditing is to see whether the balance sheet and profit and loss account have been prepared properly in accordance with the provisions of the company law and whether they present a true and fair picture of the financial position of the company.

Auditing Meaning Objectives and Importance

Certain frauds and errors may be detected in the process of this ascertainment. However, the detection of errors, frauds and a irregularities is incidental to the main objective. It is a subsidiary s advantage or benefit flowing from the audit.

Objects of auditing can be depicted with the help of following chart:

Objects of Auditing

Auditing Meaning Objectives and Importance

Main Objects of Auditing

The main object of audit is to know whether the accounts are true and complete and have been maintained according to rules.

As per Section 227 of the Companies Act, 1956 the main object of auditing is to state whether the accounts give a “true and fair view” in case of balance sheet, of the financial state of affairs of the company at the end of financial year and in case of profit and loss account, of the profit or loss for its financial year.

The primary objectives of auditing may be stated as under:

Auditing Meaning Objectives and Importance

(1) The verification of the correctness of the books and records leading to a final account or statement submitted to the real proprietors.

(2) The ascertainment that the business has been carried on in accordance with statutory or other legal regulations.

(3) Ascertain that proper accounting principles and procedures and management policies are followed.

(4) Report on the Balance Sheet as to whether it reflects the true and fair state of affairs of the business and that the Profit and Loss Account shows the correct profit or loss of the business.

Auditing Meaning Objectives and Importance

Subsidiary Objects of Auditing

The subsidiary objects of audit may be stated as follows:

(1) Detection of Errors: Generally errors are the result of carelessness or ignorance on the part of the persons preparing the accounts. An auditor should be very careful about it, because sometimes, errors which might appear as innocent are the results of fraudulent manipulation. (Auditing Meaning Objectives and Importance)

For example, a debtor sends Rs. 5000 by bank draft and the accountant forgets to make an entry in the books; it is an error. On the other hand, if the accountant intentionally keeps the money with him and spends it for his own use and does not make an entry in the books it becomes a fraud. Thus, an auditor must pay particular attention to it. Errors may be of following types:

(i) Errors of Commission: An error of commission takes place when a transaction is incorrectly recorded, either wholly or partially. Such error might arise due to wrong postings, calculations, totalling and carry-forwards. For example:

(a) Goods worth Rs. 2,000 were sold to Monika but it is debited to the account of Swati.

(b) Wrong recording in the books of original entry i.e., tha amount of Rs. 322 might be entered as Rs. 233 in the book of original entry.

Auditing Meaning Objectives and Importance

(c) Posting of wrong amount to ledger account i.e., sales of R 1,000 to customer’s account as Rs. 100.

(d) Posting an amount on the wrong side of the ledger account instead of debiting an account it may be wrongly credited and vice versa.

(e) Posting a wrong entry in the original record.

(f) Errors in balancing ledger accounts.

Auditing Meaning Objectives and Importance

(g) Castings or carrying forwards of amounts by taking wrong balances of an account (errors in casting, subsidiary record of ledger accounts).

(h) Entry of the transaction twice in the books. Some of such errors will be detected by the non-agreement the trial balance while some errors of commission do not affect t trial balance.

(ii) Errors of Omission: Errors of omission arise due clerical mistake. If a transaction has not been entered in the books accounts, wholly or partially, it is an example of errors of omission Where a transaction is altogether omitted from the record, the error may be difficult to detect. (Auditing Meaning Objectives and Importance) Because, as the transaction has not be posted to the ledger, it will not affect the agreement of trial balance .

For example, if a credit purchase is not entered in the Purchas Day Book, it will not be posted to the related ledger account, name on the debit side of the Purchases Account and on the credit side the Supplier’s Account. The trial balance will not be affected by the omission. An error of this type can only be detected by an intensive checking of the Purchases Book and the Stock Book.

Auditing Meaning Objectives and Importance

However, if a transaction has been partially recorded in t course of its posting to the ledger, the error can be easily detect because it will throw out the trial balance. For example, if a credit sale has been credited to the Sales Account but not debited to f Buyer’s Account, the trial balance will show excess credit by amount of the sale and then it should not take long to discover the error.

(iii) Errors of Principles: When principles of book-keeping and accountancy are not followed in the treatment and recording items of a transaction, it is termed as errors of principle. These are sometimes committed intentionally to falsify and manipulate accounts with an objective of showing more or less profits than their actual figures. The following are some of the examples of such types of errors:

(Auditing Meaning Objectives and Importance)

(a) Where Items of revenue expenditure are shown as capital expenditure or vice-versa: For example, some furniture was purchased by a furniture merchant for the purpose of sale and the furniture account was debited. In this case, (Auditing Meaning Objectives and Importance) the furniture is purchased for the purpose of sale, so it is revenue expenditure, therefore, the purchase account should be debited instead of furniture account. Thus, in this case, the error of principle would arise.

(b) Posting an Item of Revenue or Expenditure to a Personal Account: If rent paid to landlord is posted to the debit of his personal account, it is an example of error of principle, due to which profits would be inflated and the Balance Sheet would be wrong.

Auditing Meaning Objectives and Importance

(c) Where valuation of assets is not as per generally accepted accounting pinciples: It may be done to overstate or understate the profits and financial position of the business concern.

(d) Providing inadequate or excess depreciation: Such errors are not disclosed in the trial balance and these can be detected by thorough checking of each and every transaction.

(iv) Compensating Errors: A compensating error is one which is counter-balanced by another error or errors. In other words, when the effect of one error is nullified by another error, then it is called compensating error. If one account is over casted by say Rs. 100 and per chance if another account is under casted by the same, then it is considered as compensating error.

(v) Error of Duplication: If a transaction is recorded journal and also posted in ledger twice or more times, the trial balance will agree even though the error may not be disclosed.

Auditing Meaning Objectives and Importance

(2) Detection of Frauds: When something is being done with an intention to mislead, to deceive or to conceal the truth, it is called fraud.

According to SAP-4 issued by ICAI fraud refers to intentional misrepresentation of financial information by one or more individuals among management, employees or third parties. Frauds are more difficult to be detected than unintentional errors. To detect a fraud an auditor has to act very wisely and intelligently. He must know how many types of frauds can be and must kept them in mind while auditing.

Auditing Meaning Objectives and Importance

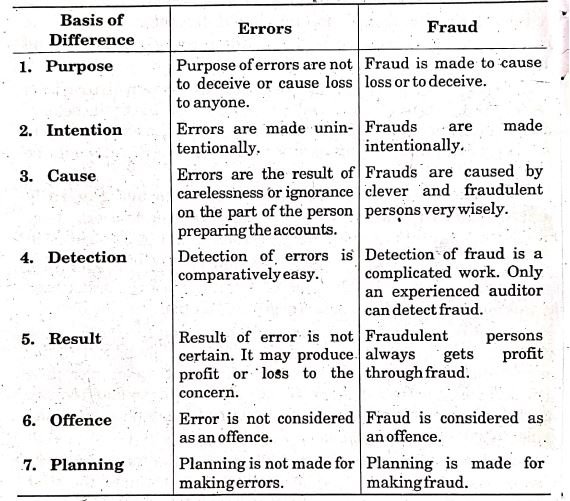

Distinguish between Error and Fraud

Fraud and errors are quite different from each other. The only similarity is that both fraud and error, do not reveal the true picture of the organisation. Main points of difference between fraud and error can be classified as follows:

Auditing Meaning Objectives and Importance

Business frauds or Embezzlements are of the following types:

(i) Mis-appropriation of Cash: Misappropriation of cash means wrongful conversion or fraudulent application of cash. This can be done by means of suppression of receipts and inflation of payments and wrong castings and embezzlement of cash. (Auditing Meaning Objectives and Importance) Thus money of the business will be fraudulently used to one’s own purpose. Misappropriation of cash may be committed in any of the following ways:

- Non-recording of cash sales.

- Making false entries in the accounts of customers as regards bad debts, discount, rebate, etc.

- Entering the cash received from one customer against another.

- Showing payments against purchases never made.

- Non-recording of credit notes for purchase returns. (Auditing Meaning Objectives and Importance)

- Non-recording of bills of exchange discounted.

- Non recording of cash received against unusual sales, e.g.,. sale of furniture, junk, substandard goods, etc.

- Non-recording of unusual money receipts such as donations.

- Recording payments which are never made.

(ii) Mis-appropriation of Goods: Misappropriation of goods refers to the use of goods of the business for purpose other than that of enterprise.

Auditing Meaning Objectives and Importance

Goods may be misappropriate only by those persons who are in any way connected with the purchase, storekeeping or issue or sale of goods. There may be misappropriate of goods in the following ways:

- Stock may be theft.

- False entry for purchase retrun is passed and the goods are misappropriated.

- False entry for sale is made and the goods as shown to be sold, are kept by the person committing fraud.

(iii) Misappropriation of Assets: This type of fraud is of many types, e.g., purchasing furniture for the concern and using it at home. To take off at home better quality or newly purchased assets and replace them by broken, torn and worn assets etc.

(iv) Misappropriation of Amenities: There are several types of frauds prevalent in respect of amenities and a special feature of such frauds is that they are generally not treated frauds. (Auditing Meaning Objectives and Importance) For example, using the office-car for personal work and the office telephone for personal calls.

(v) Misappropriation of Labour: Fraud of labour may be of many types. For example, deploying an employee of the office for personal works or unauthorized engaging an employee in domestic work, albeit he gets his salary from the office.

Auditing Meaning Objectives and Importance

(vi) Manipulation of Accounts: Manipulation of accounts is usually perpetrated by the high-official of a business in collusion with its owners. Sometimes, employees of lower cadre do so in order to conceal their errors or the fraud of cash or goods perpetrated by them but such manipulations are of trivial nature and their impact on Profit and Loss Account and Balance Sheet is negligible. The manipulation of accounts by the top officials or owners is done either to show profits more than actual or less than actual.

(3) Prevention of Errors and Frauds: The auditor, while auditing, must keep all the possibilities of existence of frauds, misappropriations and irregularities in mind. (Auditing Meaning Objectives and Importance) He must put searching analytical questions and must examine the accounts analytically. The statement on auditing practices issued by the Research Committee of the Institute of Chartered Accountants of India states that “the auditor should bear in mind the possibility of the existence of fraud or other irregularities in the accounts under audit….. Further an audit under the companies Act is not intended and cannot be relied upon to disclose all defalcations and other irregularities, their discovery may be incidental to such an audit.”

The auditor cannot do anything directly to prevent errors and frauds. (Auditing Meaning Objectives and Importance) After completing the audit work, the auditor can advise his client by making suggestions regarding various ways to prevent errors and frauds in future if he is asked for that. To some extention the fear of audit minimises the chances of errors and frauds. Auditor’s visits to check accounts also keep a moral check on the employees engaged in preparing the accounting books. They remain careful because they know that accounts are to be finally audited and any fraud or error will be ultimately detected.

Prevention is better than cure. Auditing is got to be done with this view. Some frauds are committed deliberately and so cleverly that it becomes very difficult to detect them. If the auditor makes a detailed checking instead of test checking, he can surely detect frauds.

Auditing Meaning Objectives and Importance

Other Objects

Growing complexities in business and management have necessitated that audit may be used for varieties of purpose, such as audit of efficiency, management policies, (Auditing Meaning Objectives and Importance) performance, costs and so on. Hence, the objects of audit are largely based on as to why it is conducted and what is to be reported by the auditor.

Such objects are called other objects, which can be discussed as follows:

(1) Moral Pressure on Employees: The visit of auditor put a moral effect on the employees. They become alert and careful which will minimise the chances of errors and frauds. Auditing system proves helpful in developing the habit of working honestly and sincerely among the workers.

Auditing Meaning Objectives and Importance

(2) To satisfy the Government Authorities: The audited accounts of the company and firms are considered reliable by the officers of the government. Audited accounts are considered more reliable for the purposes of various types of taxation and during the course of assessment of income-tax, sales tax, etc.

(3) To Fulfil the Legal Requirement: For some institutions auditing has been made compulsory e.g. joint stock companies, banks, finance corporations, insurance companies etc. Thus, object of the audit of a company is to fulfil the provisions of the companies Act.

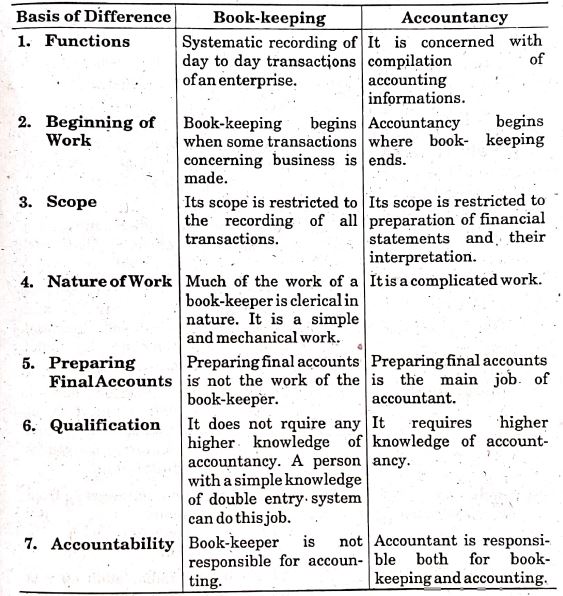

Book-keeping, Accountancy, Auditing and Investigation

In the earlier days Book-keeping, Accountancy and Auditing were considered as the three aspects of the term accountancy. This was the time when there was no demarcation between the duties of the book-keeper and the auditors. But now, it is very necessary to differentiate between Book-keeping, Accountancy, Auditing and Investigation. After this knowledge the meaning of auditing becomes more clear.

Auditing Meaning Objectives and Importance

Book-Keeping

Book-keeping is the art of recording day-to-day transactions systematically in the books of accounts. This part of work is performed by the book-keeper. His job includes journalising, posting, totalling and balancing of ledger accounts. Whole of the work of book-keeper is mechanical involving use of principles of double entry system. A person with simple knowledge of double entry system can perform this job.

According to Spicer and Pegler, “Book keeping is the art of recording business transactions relating to money, goods or services, in the books of original entry.”

Accountancy

Accountancy begins where book-keeping ends. Accountancy is concerned with: (i) checking the work done by the book-keeper, so as to ensure that all financial transactions have been correctly recorded in the books of account; (ii) preparing a trial balance to see that effect of each transaction has been recorded in relevant accounts in the ledger;

(iii) preparing financial statements such as Profit and Loss Account and Balance Sheet to communicate the results of business operations and financial condition to the interested parties; (Auditing Meaning Objectives and Importance) (iv) passing adjustment and rectification entries; and (v) designing a suitable accounting system to protect the business assets from unauthorised and improper use and to comply with legal requirements under the income-tax, sales-tax, company laws, etc.

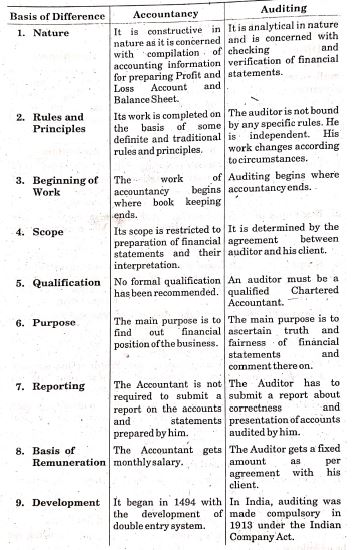

Auditing

“Auditing begins where accountancy ends.” After the accountant has completed his work, the auditor steps in. He has to verify the work done by an accountant. His duty is not to prepare the accounts. He is concerned only with critical examination and verification of accounts prepared by an accountant. (Auditing Meaning Objectives and Importance) This verification is done on the basis of documents, vouchers, information and explanations. Its object is to find out the real and correct financial position of the organisation. After completing his work, the auditor has to submit his report whether or not the profit and loss account and the balance sheet give a true and fair position of the business.

Thus, an auditor must have a thorough knowledge of the principles and systems of accounting and its practical aspects. Therefore, this work is done by a Chartered Accountant.

Investigation

Deep checking and examination of accounts for a special purpose is termed as investigation. According to Spicer and Pegler, “The term investigation implies an examination of the accounts of a business for some special purpose.” (Auditing Meaning Objectives and Importance)

An investigation chiefly consists in analysing, collecting and presenting facts in a manner which may enable parties for whom it is undertaken to know the essential facts regarding the matter under enquiry. The purpose of investigation may be to find out profit earning capacity of future years or the financial position of a concern or suspected fraud and the extent thereof or the admission of a new partner.

Auditing Meaning Objectives and Importance

An investigation may be undertaken on behalf of those parties who are interested in the activities of business. For example, where a company has asked for credit facilities from a bank, bank authorities may ask for the investigation of accounts by an independent person for finding out the creditworthiness of that company. It is therefore, not necessary that the investigation be conducted on behalf of the proprietors of the business.

Auditing Meaning Objectives and Importance

Difference between Book-keeping and Accountancy

In the beginning when the field of trading was limited and on a small scale, there was no difference between book-keeping and accountancy, but in the present age, the field of trading has vastly widened, so book-keeping and accountancy have come to be regarded as different. Main points of difference in book-keeping and accountancy can be discussed as follows:

Auditing Meaning Objectives and Importance

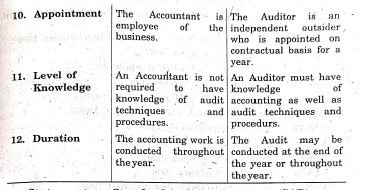

Difference between Accountancy and Auditing

The points of difference between Accountancy and Auditing can be as follows:

Auditing Meaning Objectives and Importance

Statements on Standard Auditing Practices (SAP) or Auditing and Assurance Standards (AAS)

With a view to imparting an international form to accountancy profession, International Federation of Accountants (IFAC) was set up in 1977. To establish auditing as a profession IFAC set up an International Auditing Practices Committee (IAPC). (Auditing Meaning Objectives and Importance) This committee propounded and issued international audit guidelines. The Institute of Chartered Accountants of India (I.C.A.I.) is a member of IFAC. It set up on its own an Auditing Practising Committee (APC) in 1982. The Committee revaluates the standards prescribed for present auditing practices and develops the statements of Standard Auditing Practices (SAPs) now renamed as “Auditing and Assurance Standards (AAS)”.

AASS are implemented in case of independent audit of an entity, which helps to facilitate the expression of the financial informations of it. It is the duty of every member of such an entity to furnish the auditor with the information of the lines suggested by AAS.

Auditing Meaning Objectives and Importance

The Council of the ICAI has issued following Standard Auditing Practices (SAPS) [Now known as Auditing and Assurance Standards, (AASS)].

AAS 1 Basic Principles Governing an Audit (April, 1985)

AAS 2 Objective and Scope of the Audit of Financial Statements (April, 1985)

AAS 3 Documentation (July, 1985)

AAS 4 The Auditor’s responsibility to consider Fraud and Error in an audit of Financial Statements (Revised) (April, 2003)

AAS 5 Audit Evidence (January, 1989)

AAS 6 Risk Assessments and Internal Control (Revised) (April, 2002)

AAS 7 Relying upon the Work of an Internal Auditor (April, 1989)

Auditing Meaning Objectives and Importance

AAS 8 Audit Planning (April, 1989)

AAS 9 Using the Work of an Expert (April, 1991)

AAS 10 Using the Work of Another Auditor (Revised) (April, 2002)

AAS 11 Representations by Management (April, 1995)

AAS 12 Responsibility of Joint Auditors (April, 1996)

AAS 13 Audit Materiality (April, 1996)

AAS 14 Analytical Procedures (April, 1997)

AAS 15 Audit Sampling (April, 1998)

Auditing Meaning Objectives and Importance

AAS 16 Going Concern (April, 1999)

AAS 17 Quality Control for Audit work (April, 1999)

AAS 18 Auditing for Accounting Estimates (April, 2000)

AAS 19 Subsequent Events (April, 2000)

AAS 20 Knowledge of the business (April, 2000)

AAS 21 Consideration of Laws and Regulations in an audit of Financial Statements (July 1, 2001)

AAS 22 Initial Engagements-Opening Balances (July 1, 2001)

AAS 23 Related Parties (April 1, 2001)

AAS 24 Audit Considerations relating to Entities Using Service Organisations (July 1, 2003)

AAS 25 Comparatives (April, 2003)

AAS 26 Terms of Audit Engagement, (April 1, 2003)

AAS 27 Communications of Audit matters with those charged with Governance (April 1, 2003).

AAS 28 The Auditor’s Report on Financial Statements (April 1, 2003)

AAS 29 Audit in a Computer Information Systems Environment (April 1, 2003)

AAS 30 External Confirmations (April, 2003)

Auditing Meaning Objectives and Importance

AAS 31 Engagements to compile financial Information (April 1, 2004)

AAS 32 Engagements to perform agreed-upon procedures regarding Financial Information (April 1, 2004)

AAS 33 Engagements to Review Financial Statements

AAS 34 Audit Evidence-Additional consideration for Specific Items

AAS 35 The Examination of Prospective Financial Information (April 1,2007)

Auditing Meaning Objectives and Importance

Advantages and Importance of Auditing

Importance of auditing can be judged from the fact that Audit of accounts is carried out in almost in all forms of business organisations whether it is compulsory or not. Audit of business accounts has now become a necessity rather than being considered as a luxury.

The increasing size and sophistication of today’s enterprises, the complexities in business transactions, enormous increase in trade, commerce and industrial activities, the employment of hired accountants for writing up accounts, the legal requirements to maintain proper books of accounts for sales tax, income-tax and other purposes, the awareness of the public of the advantages of audit etc., have strengthened the force for audit of business acccounts. Advantages of auditing can be studied as folllows:

General Advantages: General advantages obtained by auditing are as follows:

(1) Verification of Financial Position

Auditing Meaning Objectives and Importance

(2) Detection and Prevention of Frauds & Errors

(3) Increase in the efficiency of the employees

(4) Helpful in tax-assessment

(5) Helpful in Insurance Claim

(6) Helpful in obtaining Loans (Auditing Meaning Objectives and Importance)

(7) Helpful in sale and purchase of business

(8) Advice for improvement in the financial policy

(9) Helpful in the declaration of bankruptcy

Advantages for the Sole-Trader: In addition to the above mentioned advantages, a sole trader has the following advantages:

(1) Helpful in comparative study: A big sole-trader can know the progress made in his business by making a comparative study of the audited accounts for two different periods.

(2) Evidence for the Court: In the case of a legal, dispute, audited accounts can be produced in the court provide an evidence.

(3) Helpful in admitting a new partner: When a sole-trader wants to make a partner in his business, then audited accounts proves helpful in the valuation of his business.

(4) Helpful in ascertaining income tax and other taxes: Audited accounts can prove helpful in ascertaining income tax and other taxes.

Auditing Meaning Objectives and Importance

(5) Helpful in ascertaining death tax: After the death of a sole-trader, audited accounts prove helpful for ascertaining death tax.

Advantages for Partnership Firms: (1) Create mutual trust among partners: All the partners of a firm do not take part in day to day activities of the firm. If the accounts of the firm make audited then the partners who do not take part in the activities of the firm, can easily trust on the partner who manage the affairs of the firm.

(2) Decrease the possibilities of disputes: Dispute over correctness of accounts and profits can be avoided through auditing of accounts. It create faith that the terms and conditions of the partnership agreement have been maintained and fulfilled.

(3) Admitting a new partner: Audited accounts proves helpful in the valuation of business which facilitates the entry of a new partner.

(4) Retirement or death of a partner: Audited accounts are useful in valuing goodwill and value of business on retirement or death of a partner. (Auditing Meaning Objectives and Importance)

(5) Advantage for the Sleeping Partner: Asleeping partner does not have full knowledge of the business. Audited accounts are very important for him. On their basis, he can know if the business is being run properly or not.

Advantages to Company: In addition to the general advantages, audited accounts give the following advantages to company:

(1) Trust in the performance of management: Shareholders, who do not know about day-to-day administration of the company, can judge the performance of management from audited accounts. They can value their shares on the basis of audited financial statements.

(2) Helpful in absorption and reconstruction: At the time of absorption and reconstruction, the audited accounts of the company are very helpful in removing many doubts. (Auditing Meaning Objectives and Importance) They are helpful in valuation of the business because audited accounts present a true and fair picture of assets and liabilities of the company.

(3) Helpful in raising capital: When company wants to raise capital, it issues prospects along with audited accounts. Public invest money in the shares on the faith of audited accounts.

(4) Helpful in dividend distribution: The auditor certifies the profit earned by the company. So, no doubt crop up in the distribution of dividend.

(5) Make trust in the general public: An auditor acts as a trustee of the shareholders in the case of a joint stock company and safeguards their financial interests. (Auditing Meaning Objectives and Importance) Shareholders are assured that the accounts have been properly maintained and the directors and managers of the company have not taken any undue advantage of their position and have conducted the company affairs in the interest of the whole body of shareholders.

Advantages for Others: Audit safeguards the interests of the owners, creditors, investors and workers. For example, it is generally seen that the audited accounts are useful for settling trade disputes for higher wages or for the payment of bonus to the workers.

Auditing Meaning Objectives and Importance

Accountancy is a Necessity While Auditing is Luxury

Some persons opine that “audit is a luxury while accountancy is a necessity.” To examine the truth of this statement, it is necessary to understand the meaning of “necessity” and “luxury”. A thing or situation is a necessity when we cannot do anything without it and absence of these, create a lot of hurdles and difficulties. On the other hand luxury stands for a thing, work or situation without which we do not suffer any loss, but which improves our efficiency.

Auditing Meaning Objectives and Importance

Arguments in Favour of Necessity of Accountancy

Accountancy is definitely a necessity for all types of business organisations. The following reasons can be cited for the necessity of accountancy:

(1) Limitation of Memory: Human memory power cannot remember each and every transaction concerning business for a long time. So accounting becomes necessary to record all transactions.

(2) Used as Evidence: Accounting statements and documents can be used as evidence in case of disputes.

(3) Knowledge of profit and loss: With the accounting records, profit or loss arising from operational activities at the end of the year can easily be found out.

(4) Knowledge of Financial Position: Every businessman wants to have a true and fair knowledge of the financial position of his business, which is possible only through accountancy.

(5) Plans for Progress: Properly maintained accounts can provide sufficient useful information for future planning of the business, which can be helpful for the progress of the business. (Auditing Meaning Objectives and Importance)

(6) Determination of Goodwill: Goodwill is valued on the basis of past performances of concern and past performance can be analysed on the basis of information obtained from accounting records.

(7) Assessment of Tax: If proper accounts are maintained, tax can be easily assessed and tax authorities can not charge tax discriminately and at their will. (Auditing Meaning Objectives and Importance)

(8) Comparative study: Comparative study of a firm’s performance over different years or different firms over the same period is possible only with the help of accounting records.

(9) Ease in getting loans: Sometimes, a businessman has to obtain loans from some bank or from any other organisation. Accounts maintained according to the rules and principles of accountancy help him to a great extent in this direction.

(10) Control over Employees: Account books, maintained properly and systematically, help a businessman to have a proper control over his employees. They cannot indulge in frauds and professional work goes on smoothly and systematically.

(11) Helpful in attaining a Licence: Properly maintained accounting books proves helpful in attaining a licence as government grant licence to only those businessmen who have been running the business for a long time.

Auditing Meaning Objectives Importance

Auditing is Luxury

Some businessmen claims that, ‘Auditing is luxury’ due to the following reasons:

(i) More Expensive: Accounts are audited by a qualified auditor whose remuneration are normally high. That is why, it create an extra burden on businessmen.

(ii) Inspection of Accounts are unnecessary: Small businessmen normally prepares their accounts themselves or keep themselves in touch with the accountants. That is why they completely know about their accounts and there is no need for them to get their accounts audited.

(iii) Wastage of Time: When auditing is done, businessmen has to do certain additional work, e.g., preparation of debtors list and creditors list, replying the queries of auditors etc., (Auditing Meaning Objectives and Importance) which creates obstruction in the routine work and leads to the wastage of time.

(iv) Question of Dignity: Auditing will become a luxury, if it is introduced just to increase the prestige of the concern in the eyes of the business world, and not to serve any useful purpose.

(v) Remaining of frauds and errors inspite of auditing: Auditing cannot detect and prevent all the errors and frauds committed in the account books. Planned frauds committed by employees in collaboration with one another remain undetected even after auditing of accounts.

The above discussion brings out that while accountancy is a necessity auditing is a luxury for a small trader, but it is not so for a big business.

Auditing Meaning Objectives Importance

Auditing is not a Luxury

For big business houses, auditing is not a luxury for the following reasons:

(1) Auditing is not a luxury for joint stock companies. For joint stock companies, where there is divorce of ownership from management, auditing is absolutely necessary to assure the shareholders that the affairs of their company are conducted properly, and their investment is safe. It is for this reason that auditing is compulsory for a joint stock company.

(2) Auditing cannot be a luxury even for partnership firms. Audited accounts serve as evidence of proper management of the affairs of the business by the employees and the active partners. (Auditing Meaning Objectives and Importance) Further, audited accounts are of great help in the valuation of goodwill and settlement of accounts on the admission, retirement or death of a partner. Again, audited accounts minimise the chances of disputes among the partners.

(3) Auditing is not a luxury even for a sole trading firm which has been expanding its activities, and where the management of day-to-day affairs is delegated to paid employees. Auditing assure the proprietor that the affairs of his business are conducted properly by the employees and funds are properly utilised. That is why, today, audit is widely in use even in large sole trading concerns, though it is optional for them.

(4) Auditing of accounts is necessary for these concerns which receive grants and subsidies from the Government.

(5) In certain cases, auditing of accounts is necessary for securing various licences from the Government

(6) The numerous advantages of auditing, such as that loa and advances can be easily obtained, tax liability can easily determined, claims as to higher wages and bonus employees can be amicably settled, insurance claims can easily settled on the basis of audited accounts. (Auditing Meaning Objectives and Importance)

Conclusion: In brief, in the modern set up of business, f majority of businesses, auditing is not considered as a luxury. It considered as a necessity.

Every firm must maintain proper accounts and get the audited by some independent and qualified auditor. Hence, it wrong to say that “auditing is luxury, while accounting is necessity.”

Auditing Meaning Objectives Importance

Qualities of an Auditor

Only the qualified Chartered Accountant can be appointed auditor of a company. He must have certain qualities to perform h duties efficiently. In view of the same, the auditor needs t following qualities:

(1) Thorough knowledge of the principles of Accountancy

(2) Knowledge of Various Laws

(3) Honesty and Care

(4) Impartiality

(5) Skill and Tact

(6) Ability to Maintain Secrets

Auditing Meaning Objectives and Importance

(7) Courage and Ability

(8) Knowledge of Audit case laws

(9) Knowledge of Management

(10) High Moral Standards

(11) The auditor need not be unduly suspicious

(12) Industrious and Hardworking

Auditing Meaning Objectives and Importance

Limitations of Auditing

An auditor gives his report after checking the accounts ve cautiously, intelligently and carefully. But even after checking t accounts very efficiently, he sometimes, fails to detect errors a frauds. So persons who believe in the audited accounts and ta decisions accordingly, should also keep in mind the followi limitations of auditing:

(1) Audit is not a guarantee of cent percent truth

(2) Conceptual Restriction

(3) The auditor ignores small transactions or transactions carried out by lower class employees

(4) Dependence on Inside Information

(5) The auditor does not enjoy professional freedom in India

(6) Faulty Techniques

(7) The opinion of the auditor is not a divine declaration

Auditing Meaning Objectives and Importance

Auditing Meaning Objectives and Importance

|

|||