Management of Cash Bcom Notes

Management of Cash Bcom Notes:-

In this post, you will get the notes of B.com 3rd year Financial Management, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post.

Management of Cash

Meaning of Cash: Cash normally indicates only cash balance but for the purpose of financial management, cash includes cash in hand, cheques in hand, bank balance and near cash securities. Near cash securities includes marketable securities and Bank Fixed Deposits, etc.

In short, for cash management purposes, the term cash is used in the broader sense i.e., it covers cash, cash equivalents and those assets which are immediately convertible into cash.

Motives for Holding of Cash/Need for Cash Holdings: According to economic theory (precisely as propounded by keynes) there are three motives for holding cash: (1) Transactionary Motive, (2) Precautionary Motive and (3) Speculative Motive.

Besides the above, one more objective of holding cash, specially as bank balance, is what is called compensative/motive. Bank offers a number of services to its clients for which it compels its clients to leave a minimum balance in their accounts so that the banker may earn some interest and thus compensate to some extent its cost-free services to clients.

Factors Affecting the Level of Cash – (1) Nature of Business, (2) Terms of Purchase and Sale, (3) Credit Standing of the Firm, (4) Required Quantity of Stock, (5) Collection Policy, (6) Relation with Bank, (7) Managerial Policies and (8) Firm’s Capacity to Borrow in Emergent Situations.

Management of Cash Bcom Notes

MEANING AND DEFINITION OF MANAGEMENT OF CASH

No business can operate successfully and efficiently without adequate cash. At the same time, cash is an idle asset not anything in itself and therefore excessive cash would have negative effect on the profitability of the business. Therefore, business should keep optimal cash balance at every point of time. It should neither be in excess nor short of its requirements. The main objective of cash management is to maintain equilibrium between liquidity and profitability for maximising the profit of the enterprise. Cash and Cash-equivalent assets is managed under Cash Management.

According to James C. Van Horne, “Cash management involves managing the monies of the firm in order to maximize cash availability and interest income of any idle funds.”

In short, the term ‘Management of Cash’ includes:

(i) Determination of optimum amount of cash required in the business.

(ii) Keep the cash balance at optimum level and investment of surplus cash in profitable manner.

(iii) Prompt collection of Cash from receivables (i.e. from debtors and bills receivables) and efficient disbursement of cash.

FACETS OR DIMENSIONS OF CASH MANAGEMENT

I. Cash Planning and Control

(i) Cash Flow analysis

(ii) Cash Budget

(iii) Ratio analysis

(iv) Cash Management models.

II. Collecting and Disbursing Cash efficiently

(A) Speeding up collections through:

(i) Prompt Billing and Cash Discount

(ii) Reduction in deposit float

(iii) Decentralised collections:

(a) Concentration banking,

(b) Lock-box system,

(iv) Internal Control,

(v) Reducing bank accounts,

(vi) Special arrangement for cheques of heavy amount.

Management of Cash Bcom Notes

(B) Delaying the disbursements:

(i) Payment only through cheques

(ii) Complicated payment procedure

(iii) Setting a particular day or time

(iv) Avoiding cash discount

(v) Centralised payment

(vi) Payment float (Cheque kitting)

III. Determination of Appropriate Cash Balance

Management of Cash Bcom Notes

(i) Cash cycle model

(ii) Baumol model

(iii) Miller-Orr Model.

(iv) Stone model

IV. Investing Remaining Excess Cash Balance

(i) Default risk

(ii) Maturity

(iii) Marketability.

CASH MANAGEMENT MODEL

- Baumol’s Cash Management Model – William J. Baumol has given a formula to find out optimum cash level like E.O.Q. model of the inventory management. There are two types of costs involved in keeping cash balance in a business opportunity cost and transaction cost.(Management of Cash Bcom Notes)

There is an inverse relationship between the two costs. When one increases, the other decreases. Hence, optimum cash level will be at that point where the two costs are equal. The model is based on the assumption that the cash payments are made evenly throughout the period.

The formula for determining optimum cash balance can be put as follows: Optimum Cash Balance = √2bt/i

where, b stands for Transaction fixed cost per transaction

t stands for Requirement or demand of cash.

i stands for Rate of interest on marketable securities in a certain period.

Management of Cash Bcom Notes

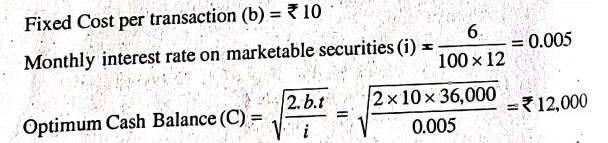

Illustration 1. Monika Ltd. estimated cash payment of ₹ 36,000 for a one month period. These payments are expected to be steady over the period. The fixed cost per transaction is 10 and the interest rate on marketable securities is 6 percent per annum. Calculate optimal cash transaction size.

Solution. Given: Estimated Cash Payment (t) = ₹ 36,000

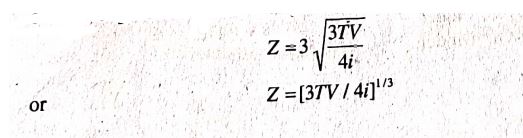

(2) Miller-ORR Model: The model has specified two control limits for cash balance. An upper limit (H) beyond which cash balance need not be allowed to go and a lower limit (L) below which the cash level is not allowed to reduce.(Management of Cash Bcom Notes) The cash balance should be allowed to move within these limits. According to Miller-Orr Model, the optimal cash balance (z) can be expressed symbolically as:

Or

Where

T = Transaction cost of conversion

V = Variance of daily cash flows, and

i= Daily % interest rate on investments.

Cash Budget:: A cash budget is an estimate of cash receipts and cash payments for a future period of time. It is prepared to forecast the cash requirement for a given period and indicates the surplus or shortage of cash during the budget period. There are two parts of cash budget:

- Cash Receipts: Cash is mainly received from cash sales, collection from debtors, income from investments etc.

- Cash Payments: Cash is mainly paid for cash purchases, payment to creditors, payment for expenses etc.(Management of Cash Bcom Notes)

By estimating the cash receipts and cash payments for a future period it can be estimated that in which months there will be surplus of cash and in which months there will be deficiency of cash resources.

“A cash budget is a forecast of future cash receipts and cash disbursements over various intervals of time.”

-James V. Home

“Cash budget is an estimate of cash receipts and disbursements for a future period of time.”

(Management of Cash Bcom Notes)

-Guthman & Dougal

“The cash budgets are plans for financing the budgeted activities of the company.”

-Malchman & Slavin

Methods of Preparing Cash Budget: (i) Receipt and Payment Method, (ii) Adjusted Profit and Loss Method or Cash Flow Method and (iii) Projected Balance Sheet Method. Out of the above three methods,(Management of Cash Bcom Notes) the first method is usually found suitable for short-term forecasting of cash while the other two methods are used for long-term forecasting of cash.

Illustration 2. Sales in February and March will be 90,000 and 96,000. 50% of sales are realised in the next month and balance in the next of next month. What would be the cash collection in April?

(Meerut, 2013 BP)

Collection in April = 50% of Feb. Sales + 50% of March Sales

= (90,000 × 50%) + (96,000 x 50%) = ₹ 93,000

Illustration 3. Sales for February 3,60,000; Sales for March = 3,84,000 and Sales for April 2,16,000. 50% of sales are collected in the next month and the balance in next to next month. What will be cash collection from sales in April?

Collection in April 50% of Feb. Sales + 50% of March Sales = (3,60,000 x 50%) + (3,84,000 x 50%) = ₹ 3,72,000

Illustration 4. Sales in the month of July and August are 3,00,000 and 3,50,000 respectively. 50% of the sales is collected in the month of ales on which a cash discount of 5% is allowed and rest in the following month. What would be the cash collection in the month of August?

Management of Cash Bcom Notes

(Meerut, 2013)

Collection in August – 50% of July Sales + 50% of August Sales

= (3,00,000 x 50%) + (3,50,000 × 50% x 95%)

= 1,50,000 + 1,66,250 = ₹ 3,16,250

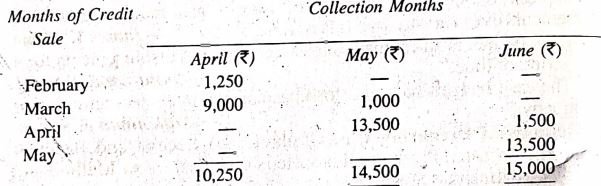

Illustration 5. Estimate the cash requirements of U.P. Fruits for April to June 2014, on the basis of data given below:

Roughly half the sales are for cash. 90% of credit sales are collected in the month following the month of sales and balance one month later Calculate collection from debtors for the month of April, May and June,

Management of Cash Bcom Notes

Solution:

Calculation of Collection form Debtors

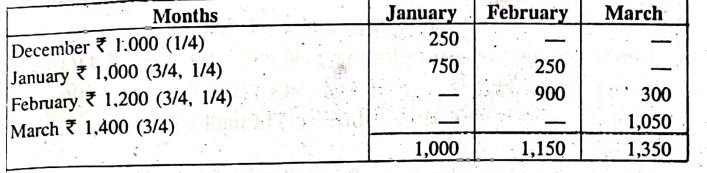

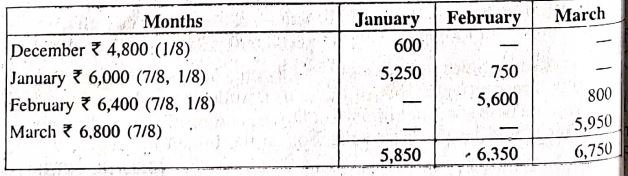

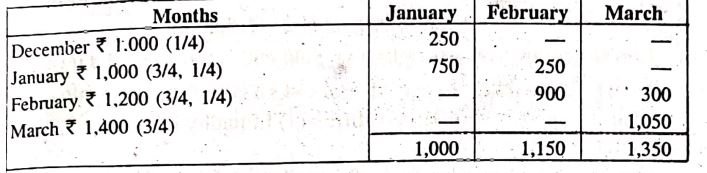

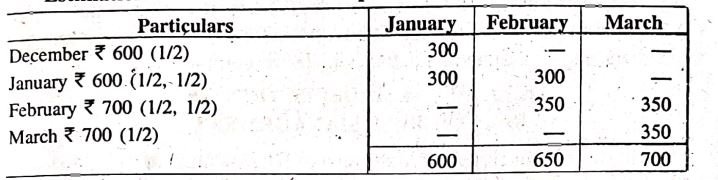

Illustration 6. In a firm, the forecasts relating to wages, factory expenses and administrative expenses are as follows:

The time-lag in payment of wages is 1/8 month, in case of factor expenses 1/4 month and that in case of administrative expenses 12 month. Estimate the amount of Wages, Factory Expenses and Administrative Expenses payable in each month January to March.(Management of Cash Bcom Notes)

Solution:

Estimation of Wage Payment (Time – lag 1 / 8 month) (₹)

Estimation of Factory Expenses (Time-lag 1 / 4 month) (₹)

Estimation of Administrative Expenses (Time-lag 1/2 month) (₹)

Management of Cash Bcom Notes

Illustration 7. Total Wages for Current month = 1,200; Payment for Wages in current month= 1,400; Lag in payment of wages = 1/8 month. What will be the wages for previous month?

Payment of wages for previous month

= 1,400 – (1,200 × 7 / 8) = ₹ 350

Wages for previous month = 350 × 8 / 1 = ₹ 2,800

|

|||