Internal Check Bcom Notes

Internal Check Bcom Notes:-

In this post, I am giving you the notes of Bcom 3rd Year auditing, which is going to be very useful in your examination and you should share this post to all friends and all your groups so that your friends also read this post. Internal Check Bcom Notes

Internal Check

Meaning of Internal Check

Internal Check means the check imposed on day-to-day transactions, whereby, the work of one person is checked independently by another person. This system is adopted with the object of being prevention and early detection of errors and frauds and to ensure accuracy. It is an arrangement in which work is divided among members of staff in such a manner that the work performed by one person is automatically and independently checked by the other. Each employee operates independently but it does not involve duplicating the work of other.

Internal Check Bcom Notes

In this system, the division of work among the employees is done in such a manner that one employee does not perform a work or deal with a transaction from the beginning to the end. For example, one person enters transactions in the books, while others perform tasks relating to posting, handling cash and entering cash transactions into the Cash Book. Besides these, duties pertaining to writing up Purchases Book and its postings are not entrusted to a single person.

Possibilities of frauds, errors or irregularities can arise only in this system, when there become a collusion among the employees.

Some important definitions of Internal Check are as follows:

According to De Paula, “Internal check means practically a continuous internal audit carried on by the staff itself, by means of which the work of each individual is independently checked by other members of the staff.”

This system involves the following four things:

(1) The work is divided in such a way that all the duties are assigned to different employees.

(2) The employees get the work load according to their capabilities and qualifications.

Internal Check Bcom Notes

(3) Only one employee does not perform any single task from the beginning to the end.

(4) The work done by one employee is independently and automatically checked by another.

Features of an Efficient System of Internal Check An efficient system of internal check must have the following features:

(1) Division of work: Each work should be divided into several sub-parts and distribution of work is done among all the employees of the business according to their qualification.

Internal Check Bcom Notes

(2) Specified Responsibility: Responsibility of each individual must be properly defined and fixed. If at any time, any error or fraud is detected, the concerned person can be held guilty very easily.

(3) Completion: The work should be divided in such a way that no single person is allowed to complete the work solely by himself from the beginning to the end. However, there should be no duplication of work.

(4) Rotation of employees: A system of transfer or rotation of employees from one seat of work to another must be followed to minimise the frauds and errors.

(5) Automatic check: A good system of internal check must provide for an automatic checking of the work of one person by the other.

(6) Use of Mechanical Devices: To prevent loss or misappropriation of cash, mechanical devices, i.e., automatic cash registers, calculating machines etc., should be employed. The self-balancing ledger should be used and the total accounts should be under the control of a responsible official.

(7) Periodical Review: The system of internal check should be reviewed from time to time to introduce improvements.

Internal Check Bcom Notes

(8) Supervision: A strict supervision should be exercised to ensure that the prescribed internal checks and procedures are fully operative.

(9) Formal Sanction: The financial and administrative powers should be assigned very judiciously to different officers. No member of the staff should be allowed to take away goods without prior permission of some responsible official. (Internal Check Bcom Notes)

(10) No employee should be relied upon too much: No employees of the business should be relied upon too much. Persons having a physical custody of assets must not be permitted to have access to books of accounts.

Auditor’s Position in Relation to Internal Check

The existence of a good internal check system helps an auditor to a great extent in the conduct of his work. He may be relieved of the detailed checking of the transactions and can utilise the time thus saved in dealing with more important matters. Effective system of internal check makes the work of an auditor quite easy but does not reduce his legal liability. (Internal Check Bcom Notes) In the event of any mistake or fraud being discovered subsequently in the areas of account which the auditor has accepted to be correct, he may be guilty of negligence. He can not say that he relied on the internal check system.

Therefore an auditor should conduct his work with carefully, intelligently and precautionaly. The auditor must obtain a written description of the system of internal check from his client and study the nature of the business. He should see the procedures regarding different types of transactions and how the work among the employees has been divided accordingly. He should also make an intensive study of the work of each employee, of the change of work and of compulsory leave etc.

Internal Check Bcom Notes

To what extent should an auditor rely upon the system of internal check, the following things should be considered:

(1) If the system of internal check is not satisfactory at all and the entire work has been entrusted to a clerk who has full control over the books of accounts, it would be necessary for him to check all the transactions in detail from the beginning to the end. (Internal Check Bcom Notes) If he fails to do so, he will be held liable for all the mistakes.

(2) If the internal check system is efficient he can depend on it and may have faith on the accuracy of the accounts. Still he should test its existence and efficiency by checking a few items at random.

(3) If there are certain weaknesses in the internal check system, he has to check the records thoroughly specially in those directions where there are weak links. He should report to his client accordingly. He should not show any negligence in his duty.

Internal Check Bcom Notes

Advantages of Internal Check

Some of the widely accepted advantages of an efficient system of Internal Check are as follows:

(1) Early detection of errors and frauds.

(2) Increased efficiency

(3) Determina on of accountability

(4) Moral effect on employees

(5) Quick preparation of final accounts

(6) Smooth Flow of Work

Internal Check Bcom Notes

(7) Convenience to Auditors

(8) Accuracy of the accounts can be relied upon

(9) Increase in profits

Disadvantages of Internal Check

Following are some of the disadvantages of a system of Internal Check:

(1) Costly system for small business

(2) Carelessness on the part of the owner and high officials

(3) Risky for an auditor

(4) Possibility of frauds by collusion

(5) Disorder in the working of the business

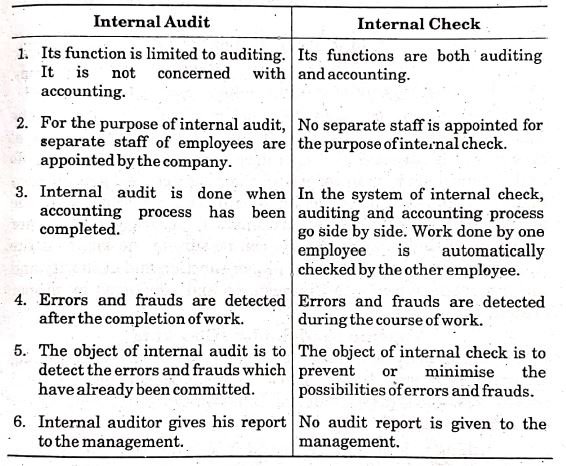

Difference Between Internal Audit and Internal Check

Main points of difference between internal audit and internal check can be summarised as follows:

Internal Check Bcom Notes

|

|||