Depreciation and Reserve Bcom Notes

Depreciation and Reserve Bcom Notes:-

In this post, I am giving you the notes of Bcom 3rd Year auditing, which is going to be very useful in your examination and you should share this post to all friends and all your groups so that your friends also read this post. Could. Depreciation and Reserve Bcom Notes

Depreciation and Reserve

The word ‘depreciation’ is used to refer to the decline in the value of an asset due to wear and tear caused by the constant use of the asset.

Depreciation is the gradual deterioration in the value due to use. It is the regular decrease in the value of the asset.

Depreciation and Reserve Bcom Notes

Meaning and Definitions of Depreciation

Like auditing, the word Depreciation is also derived from a Latin word ‘Depretium. The word ‘Depretium’ should be understood by understanding the words ‘De’ and ‘Pretium’, ‘De’ means decline and ‘pretium’ means ‘price’. Thus the word ‘Depretium’ stands for decline in the value or price of assets. In the modern context it stands for a gradual and continuous decline or reduction in the book value of the fixed assets due to wear and tear, obsolescenced effluxion of time or any other reason.

According to R. G. Williams: “Depreciation may be defined as a gradual deterioration in value due to use.”

According to Spicer & Pegler: “Depreciation may be defined as the measure of exhaustion of the effective life of an asset from any cause during a given period.”

According to Joseph Lancaster: “Depreciation is the actual physical exhaustion or consumption of an asset in the process of production.”

Depreciation and Reserve Bcom Notes

Characteristics of Depreciation

- Depreciation relates to fixed assets only.

- It denotes shunkage in the value of an asset.

- This shunkage is permanent.

- It is a gradual process.

Depreciation and Reserve Bcom Notes

Need of Provision for Depreciation

Or

Objects of Depreciation

There are certain objects for providing depreciation on assets, which are briefly discussed in following points:

- To ascertain the true cost of production

- To Ascertain the correct Profit or Loss

- Maintaining integrity of Capital and replacement of assets

- To Present a True and Fair View

- Legal Compliance

Some Accountants may argue that the depreciation should not be charged if conditions of the machinery and other assets are satisfactory and very good or some excess depreciation has been charged in the past. But these arguments against charging depreciation have no relevance for the simple reason that the genuine amount of depreciation is expected to be charged every year. (Depreciation and Reserve Bcom Notes) If there is some over-charge the adjustment or rectification entries can be passed.

The above discussion makes it clear that proper depreciation has to be charged in order to arrive at true profits, to keep the capital intact, to show the correct financial position and also to meet the legal requirements regarding depreciation as laid down in Section 205 of the Companies Act.

Depreciation and Reserve Bcom Notes

Causes of Depreciation

(1) Wear and tear: The value of assets decrease due to its constant use. The more the machinery is in use more will be the wear and tear. The wear and tear of a machinery in use for three shifts will be much more than the machinary being used in a single shift.

(2) Exhaustion: Certain assets lose their value with lapse of time as they are being used or consumed or something is taken out of them e.g. mines. The minerals in mines will be exhausted by constant extraction so also will be the case with plantations.

Depreciation and Reserve Bcom Notes

(3) Effluxion of time: The lapse of time also effects the value of an asset. The value of some of the assets is directly linked with lapse of time e.g., patents, leasehold property etc. A patent becomes useless after the expiry of the period of patent.

(4) Obsolescence: New innovations and technologies also bring a fall in the value of assets. The outdated technology becomes cheaper. (Depreciation and Reserve Bcom Notes) The loss in the value of assets on account of innovations and newer technology is called obsolescence.

(5) Weather etc.: Certain assets lose their value due to rain or change in weather. While determining depreciation, even these factors need to be taken into account.

(6) Permanent fall in the value of an asset: Many times the value of an asset declines permanently, which ought to be considered while determining the quantum of depreciation. However, a temporary decline cannot be treated as depreciation.

Depreciation and Reserve Bcom Notes

Methods of Depreciation

Fixed assets differ from each other in their nature to a large extent that one method of providing for depreciation cannot be applied to each case. Following are some of the principal methods of providing for depreciation:

- Fixed Percentage on Original Cost or Fixed Instalment or Straight Line Method: According to this method, a fixed amount or percentage is charged on the original cost of an asset year after year till the asset is reduced to zero or its break-up value. (Depreciation and Reserve Bcom Notes) The percentage to be charged is arrived at after taking into consideration the following points:

(a) original cost of the asset,

(b) its estimated life and

(c) its scrap value,

This method is suitable to provide depreciation for those assets, the working life of which can be easily estimated and do not need heavy repairs and renewals e.g., a lease, a patent etc. This method is very simple to implement and easy to understand. For example, if the cost, salvage and estimated life of a fixed asset are Rs. 10,500, Rs. 500 and 20 years respectively, the annual depreciation would be:

Annual Depreciation = Cost of the Assets – Scrap Value / Estimated Life of the Asset

= Rs. 10,500Rs. 500 20 = Rs. 500

The calculations will undergo a change when addition or disposal of assets take place.

Depreciation and Reserve Bcom Notes

- Diminishing Balance Method: It is also known as ‘Diminishing Value Method’ or Written Down Value Method’ or Decline Balance Method’. Under it a fixed percentage is written off every year on the reduced balance of the asset. The percentage of depreciation is not applied to the original cost but only to the balance which remains after charging depreciation in the beginning of a year. It remains fixed for all the years of the working life of an asset. (Depreciation and Reserve Bcom Notes) However, the actual amount of depreciation written off every year goes on decreasing with reduction in the value of asset, till this value is brought down to its scrap value.

In the case of assets which have fairly long life and which require plenty of repairs, e.g., plant and machinery; it is a useful method. However, it is not of much use for assets having short life for which depreciation has to be charged at a uniform rate.

Depreciation and Reserve Bcom Notes

- Annuity Method: This method is based on the assumption that the money spent in the purchase of the asset is an investment which should yield interests. Therefore, interest at a certain fixed rate is charged (debited) on the diminishing balance of an asset account and credited to the Profit and Loss Account every year.

The amount to be written off as depreciation is calculated from Annuity Tables. Normally, a certain fixed amount of depreciation is charged every year for the estimated life of the asset which will be reduced to nil or its residual value by that year. (Depreciation and Reserve Bcom Notes) In this method, the annual charge for depreciation or the amount written off as depreciation remains constant, while, interest taken credit for will become less year to year.

The method is suitable for those assets which have a long life and need a heavy investment. However, this method is not suitable where additions to the asset are made during the course of the year, as in those cases calculations are difficult to make.

- The Depreciation Fund or Sinking Fund Method: This method is also called Redemption Fund Method, Amortisation Fund Method. Under this method a fixed amount as depreciation is debited to the Profit and Loss Account each year, and credited to a Depreciation Fund Account. Simultaneously, the same amount is invested outside the business. The amount of annual depreciation is calculated with the help of Sinking Fund Tables. The instalment is computed keeping in view the estimated life of the asset and the rate of interest on investment. The investments are expected to produce the amount required for the replacement of the asset.

The asset account appears in the Balance Sheet at its original cost. The amount of depreciation is shown on the liabilities side as the “Depreciation Fund.” After the specified period the Depreciation Fund Account becomes equal to the Asset Account and then the Asset Account is written off by transferring it to the Depreciation Fund Account. Investment made for the purpose are then sold, and with the help of this money, new asset is purchased without drawing any money from the business.

The advantage of this method is that when the asset has to be replaced funds are made available by the disposal of the securities.

- Insurance Policy Method: Under this method, the amount of depreciation, instead of being invested in gilt-edged securities, is paid to an insurance company as premium every year. An endowment insurance policy is taken on the estimated life of an asset. At the end of the given period, the insurance company will pay the agreed sum with which the new asset will be purchased. The advantage of this method is that it is easy, simple and free from all possible risks and botheration as it involves regular payment of the premium as per the terms of the agreement with the insurance company. The policy amount is collected on maturity from the insurance company.

Depreciation and Reserve Bcom Notes

- Revaluation Method: This method is used only in the case of those assets, the working life of which cannot easily be ascertained like loose tools and livestock etc. Under this method, the amount of depreciation on these assets to be written off every year is determined by comparing the book value of these assets at the end of the year with their value in the beginning of the year. The appreciation in the value of such assets is never taken into account. The revaluation of these assets should be done by a competent technical person.

- Depletion Method: This method is specially applied in the case of wasting assets such as mines, quarries and sandpits etc. The potential of the mines is estimated in terms of tons and their cost is estimated. The depreciation in any year is calculated per ton of output of the year. For example, if a mine is purchased for Rs. 40,000 and it is estimated that the total quantity of minerals in the mine is 80,000 tons, the depreciation per ton of output comes to 0.50 per ton. If the output in the first year is 20,000 tons, the depreciation in the first year will be 20,000 x 0-50 Rs. 10,000. At times, a minimum annual charge is adopted where the extraction or production has not reached the minimum.

- Machine Hour Rate Method: Under this method, the life of a machine is estimated in terms of its working hours instead of years. The total number of hours in which a particular machine will work effectively is estimated. The estimated number of hours is then divided by the cost of the machinery less residual value, if any, to ascertain the hourly rate of depreciation. For example, if the cost of the machine is Rs. 1,00,000 and the effective life of the machine is 20,000 hours, then the hourly depreciation will be 1,00,000/20,000-Rs. 5 (it is known as hourly rate of depreciation). If the machine in any year works or runs for 2,000 hours then the depreciation for that year will be 2,000 x 5 or Rs. 10,000. This method is very suitable for those assets, the use of which can be measured in terms of hours.

Depreciation and Reserve Bcom Notes

- The Use or Mileage Method: This method is very suitable for those assets, the use of which can be measured in terms of miles or kilometres i.e., cars, trucks and buses etc. It is exactly like the machine hour rate method. In this case, depreciation is calculated on the basis of the number of kilometres run by a particular vehicle multiplied by per kilometre rate of depreciation.

- Global Method: Under this method, all the assets irrespective of their nature and effective working life are grouped together and their depreciation is charged at a flat rate. It is an unscientific method as it does not distinguish between one type of fixed asset and another. Moreover, according to the Companies Act, under each head of the fixed asset, the original cost, the additions thereto, any deductions and total depreciation written off to-date have to be disclosed, which cannot be done in this system. This method of charging depreciation is not allowed under the Companies Act.

Depreciation and Reserve Bcom Notes

Duties of the auditor with regard to Depreciation

The auditor should see the following:

- He has to see that adequate provision for depreciation has been provided for and that relevant principles of accountancy have been followed in making provision for depreciation.

- He should see that the principles followed from year to year for providing depreciation are more or less the same and that the capital employed in the assets is being kept intact.

- He should see that the amount provided for depreciation renewals or diminution in the value of fixed assets has been separately stated.

- If he is not satisfied with the adequacy of depreciation, he should mention this fact in his report.

Depreciation and Reserve Bcom Notes

Some Arguments of Directors Against Depreciation

The directors of three different companies are convinced for depreciation but show objection on the basis of the following grounds: (a) The price of machine is increased in market, so, there is no need of depreciation. (b) Machine is working as new machine because of good repairing. (c) If depreciation is provided the rate of dividend will decrease and the value of shares will decrease.

(a) Increase in the market value of the asset does not mean an increase in the working life of the asset. An asset is purchased by the company not for re-sale but it is acquired for earning income by using it. In this process, it loses value gradually due to wear and tear. Hence, proper provision for depreciation should be made in the books without considering the increase in market price of the machine.

Depreciation and Reserve Bcom Notes

(b) Sometimes, directors argue that the repairs and renewals effected during the year have fully maintained the assets and they are in a very good working condition and hence there is no need of providing for depreciation. This argument of the directors lacks feasibility because repairs and renewals are maintenance expenditure, necessary to keep the asset in good working condition: whereas depreciation is a charge for the capital which has been consumed during the process of manufacture, the benefit of which has been already enjoyed. Depreciation is the cost of the machinery spread over its useful life. It is a regular feature and every limited company is under a legal obligation to provide for depreciation.

(c) Sometimes, directors of a company can put forward certain arguments and may impress upon the auditor not to insist upon making provision for depreciation. They may say that the company has not been able to make sufficient profit during the current year due to various unavoidable circumstances and if depreciation is provided for, it will further reduce the amount of profit.

As a result of that, the rate of dividend will decline and the reputation of the company may suffer a setback. But this contention is not sound because depreciation is a charge against the profits and not an appropriation of profits. Therefore, proper provision for depreciation should be made whether there has been any profit or not even if there is a loss; whether dividend may be distributed or not and shareholders are happy or not.

Depreciation and Reserve Bcom Notes

Meaning of Reserve

Reserve is that part of the profits, which is set aside for any known or unknown contingencies, liabilities or diminution in the value of an asset. It is that portion of the current profits or of accumulated profits which is not distributed as dividend, but is kept separate for purposes of meeting some known or unknown liabilities or for fulfilment of future needs.

According to American Institute of Accountants, “The use of the term ‘Reserve’ be limited to indicate that an undivided portion of the assets is being held or retained for general or specific purpose,”

Depreciation and Reserve Bcom Notes

Meaning of Provision

Provisions are always a charge against Profit and Loss Account. They are meant to meet some ascertained, estimated and expected contingencies or losses. (Depreciation and Reserve Bcom Notes) They can be used only to meet the specific liability for which they have been created while reserves can be used to meet any contingency excepting capital or specific reserves.

The term ‘provision’ means any amount written off or retained by way of providing depreciation, renewals or diminution in the value of assets retained by way of providing for any known liability the amount of which may not be determined with substantial accuracy. Some examples are provision for depreciation, provision for bad and doubtful debts, provision for taxation, provision for repairs and renewal, provision for contingencies.

Depreciation and Reserve Bcom Notes

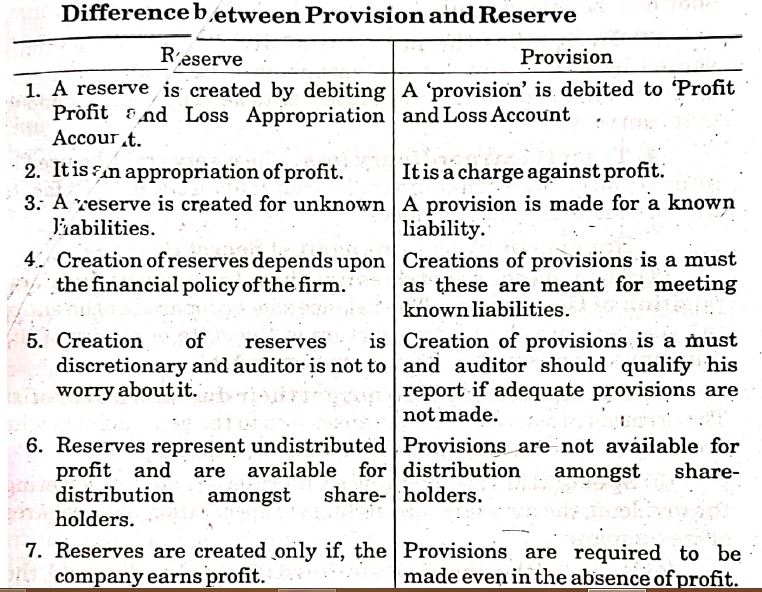

Difference between Provision and Reserve

Depreciation and Reserve Bcom Notes

Meaning of Secret Reserve

Sometimes, a company creates a reserve which is not shown in the balance sheet. Such a reserve is called a Secret Reserve. It has been defined as “any reserve which is not apparent on the face of the balance sheet.” This is also called ‘Hidden Reserve’ Internal Reserve’ or ‘Inner Reserve’. When secret reserves exist, the financial position of the company is actually better than what it would appear from the balance sheet. (Depreciation and Reserve Bcom Notes) The existence of such a reserve may be found only by a close and intelligent scrutiny of the company’s accounts. Secret reserve is not created by joint stock companies except banking companies, insurance companies and those companies into financial business.

Secret reserve is created by showing assets at lower value than their real value and liabilities at higher value than their real value.

Depreciation and Reserve Bcom Notes

Objects or Benefits of Secret Reserve

(1) Increase Working Capital: It increases the working capital and thereby strengthens the financial position of the company.

(2) Keeping off the competition: It can help in keeping off the competition from the rival companies as true profits is not shown in the balance sheet. (Depreciation and Reserve Bcom Notes)

(3) To equalise the payment of dividends: If the profits earned by a company are not enough in a particular year, the directors can make use of secret reserves to keep up the dividend in that lean year.

(4) To meet extraordinary loss: The reserve may be used in future to meet any extra-ordinary loss without disclosing this fact to the shareholders or the outsiders.

Depreciation and Reserve Bcom Notes

Dangers or Objections against Secret Reserve

(1) The balance sheet does not show the correct financial position of the concern: The balance sheet prepared at the end of the year will not show a true picture of the state of affairs of the company as is required under the companies Act.

(2) The shareholders do not get their due share of profit: The creation of a secret reserve causes loss to the shareholders who are the real owner as they do not get their due share of profit.

(3) Speculation: By creating secret reserve and thus lowering the dividend, the directors may indulge in speculation in the shares of the company. (Depreciation and Reserve Bcom Notes)

(4) Value of the shares goes down: Due to low dividend, the value of the shares goes down in the market.

(5) Loss in claims: If the fixed assets are undervalued for the purpose of creating secret reserve, and if there is a fire, the company will not be able to claim the full value of the assets.

(6) Improper use: Secret reserves may be used improperly by the directors to conceal their own weaknesses.

Depreciation and Reserve Bcom Notes

Auditor’s Duty Towards Secret Reserve

(1) If the company has created secret reserve, the auditor should have to disclose this fact to the shareholders.

(2) In case of financial companies such as banking companies and insurance companies where the creation of secret reserves is not prohibited legally, (Depreciation and Reserve Bcom Notes) he should try to find out the necessity of creating such a reserve.

(3) He should also study the articles of association to ascertain the legal implications of creating such a reserve.

(4) He should kept in mind the legal decisions related to secret reserve.

(5) He should examine that secret reserve is not used improperly by the directors.

Depreciation and Reserve Bcom Notes

Depreciation and Reserve Bcom Notes

|

|||