Cost Audit Bcom Notes

Cost Audit Bcom Notes:-

In this post, I am giving you the notes of Bcom 3rd Year auditing, which is going to be very useful in your examination and you should share this post to all friends and all your groups so that your friends also read this post. (Cost Audit Bcom Notes)

Cost Audit

Meaning of Cost Audit

Cost audit was first introduced in India in the year 1965 by an amendment in the Companies Act, 1956. Cost audit is concerned with the audit of cost records to find out whether the cost accounts have been properly maintained according to the general principles of costing. It is an audit process for verification of the cost of manufacture or production of any article on the basis of accounts relating to utilisation of material, labour and other items of costs as maintained by an enterprise in accordance with the accepted principles of cost accounting.

Cost Audit has been defined in different ways:

According to Institute of Costs & Works Accountants of London, “Cost audit is the verification of the correctness of cost accounts and adherence to the cost accounting plans.”

According to Walter W. Bigg, “It is the verification of the correctness of cost accounts and of the adherence of the cost accounting plan.”

Cost Audit Bcom Notes

From the above-mentioned definitions we can say in the simple words that, “Cost audit is the detailed checking as well as the verification of the correctness of the costing techniques, systems and cost accounts.”

Objects of Cost Audit

- To determine whether cost accounts have been correctly prepared according to the systems and techniques employed by the organisation with a view to enforce cost control and proper cost ascertainment.

- To ensure that cost accounting plan is adhered to and the routines laid down are carried out.

- To detect and prevent errors and frauds in preparing cost records.

- To ensure the integration of cost accounting system and technique into the total system of the organisation.

- To verify that the proper process of cost accounting has been maintained by the management as per the requirements of the industry. (Cost Audit Bcom Notes)

- To ensure that the process of cost accountancy is adequate to the management for taking effective decisions.

- Ensuring optimum utilisation of human, physical and financial resources of the enterprise.

- Facilitating the fixation of prices of goods and services.

- Advising management on the basis of the comparison of inter-firm cost records where performance calls for improvement.

Section 233 B of the Companies Act prescribed following qualifications with regard to appointment of a cost auditor:

(i) The cost audit is to be done by a cost accountant only within the meaning of Cost and Works Accountant Act, 1959.

(ii) The chartered accountants possessing the prescribed qualification may be permitted to do cost audit.

Cost Audit Bcom Notes

Advantages of Cost Audit

Advantages of cost audit may be categorised as follows:

I. Advantages to Management

- Control on different elements of cost: Cost audit helps the management to keep a full control on the different elements of costs like material, labour and overhead charges. Wastage can also be checked by the different techniques of cost audit. (Cost Audit Bcom Notes)

- Check on the uneconomic units: By cost audit the management can abandon the less economic units of production and pay more attention to the more profitable units of production.

- Improvement in Efficiency: It can improve the efficiency of cost procedure introduced to avoid leakage of resources of the company, their theft, fraud and negligence.

- Test and Evaluation: It can test the effectiveness of cost control techniques and help to evaluate their advantages to the enterprise.

- Fixing Responsibility: Individual responsibility can be fixed for individuals in case of efficiency, less productivity, wastage, pilferage or theft. It can fix the responsibility of an individual or of the management wherever inefficiency or wastage is found.

- Test Checking: It can make test checking to important items of cost to find the accuracy of the items, cost figures and their reliability.

- Valuation of raw material and work-in-progress: It can be useful to check the evaluation of inventory and work in progress at various stages of completion especially at the close of the financial year.

- Internal control and check: It can help internal control and check that may in their turn be helpful to the financial auditor.

- Information: It can give the up-to-date information whenever required for any purpose.

Cost Audit Bcom Notes

II. To the Share-holders

- Fair return on Investment: The cost audit enables shareholders to determine whether or not they are getting a fair return on their investments. It reflects managerial efficiency or inefficiency of Board of Directors and other senior officials.

- Proper Informations: It tries to present a true picture of the company’s state of affairs. It reveals whether the resources i.e., plant and equipment and other resources are being properly utilised or not.

III. To the Consumers

- Helps in the fixation of the fair prices: Cost audit by increasing the efficiency and the production of the company reduces the price of the product and thus helps the consumers by providing the goods at fair prices.

- Increase in the standard of living: Cost audit helps the consumers in increasing their living standard by bringing a stability in the fair prices of the products.

Cost Audit Bcom Notes

IV. To the Government

- Cost audit assists the Tariff Board’ in deciding whether tariff protection should be extended to a particular industry or not.

- Cost audit gives guidelines to the Government to improve working of uneconomic industrial units from time to time.

- If the management of any company has got any fraudulent intentions, the cost audit gives the information to the man Government authority.

- Cost audit can guide the Government authority to decide any subsidy to be given to a particular industry for its development.

- Cost audit provides different cost statements and other relevant informations which may he helpful to the Government authorities in levying tax or duty on the cost of finished products.

- It also facilitates the settlement of trade disputes of the companies.

- Cost audit provides relevant informations, facts and data to the Government for fixing the ceiling prices of various commodities to control black marketing by the industries. (Cost Audit Bcom Notes)

- In case of cost plus percentage contract, cost audit by keeping a proper cost record can assist the government to decide the cost of work.

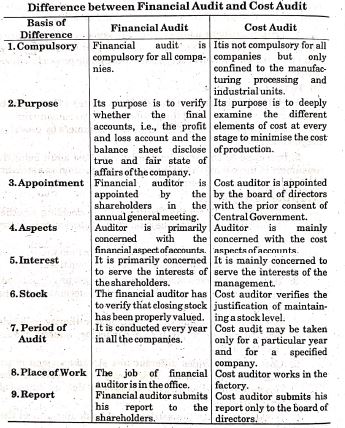

Difference between Financial Audit and Cost Audit

Cost Audit Bcom Notes

|

|||