Capital Structure Bcom Notes

Capital Structure Bcom Notes:-

In this post, you will get the notes of B.com 3rd year Financial Management, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. Capital Structure Bcom Notes

Capital Structure

MEANING AND DEFINITION OF CAPITAL STRUCTURE

The term ‘Capital Structure’ refers to the proportion between the various long-term sources of finance in the total capital of the firm. The major sources of long-term finance include ‘Proprietor’s Funds’ and ‘Borrowed Funds’. (Capital Structure Bcom Notes) Proprietors Funds include equity capital, preference capital, reserves and surpluses (i.e. retained earnings) and Borrowed Funds includes long-term debts such as loans from financial institutions, debentures etc. In the capital structure decisions, it is determined as to what should be the proportion of each of the above sources of finance in the total capital of the firm.

These sources differ from each other in terms in risk and their cost of the enterprice. Some sources are less costly but more risky whereas others are more costly but less risky. While deciding the proportion of finance raised from various sources, the financial manager weighs the pros and cons of various sources of finance and selects the most advantageous sources. A judicious and right capital structure decision reduces the cost of capital and increases the value of a firm while a wrong decision can adversely affect the value of the firm.

Capital Structure Bcom Notes

- The term capital structure is frequently used to indicate the long-term sources of funds employed in a business enterprise.”

-Robert Wessel

- “Capital Structure refers to the composition of long-term sources of funds, such as debentures, long-term debt, preference share capital and ordinary share capital including reserves and surplus (retained-earning).”

-I.M. Pandey

- Capital structure is the permanent financing of the firm, represented by long-term debt, preferred stock and net worth.” (Capital Structure Bcom Notes)

-Weston & Brigham

- Capital structure of a company refers to the composition or make-up of its capitalisation and it includes all long-term capital resources viz: loans, reserves, shares and bonds

-Gerstenberg

Conclusion: Capital structure represents the mix of different sources of long-term funds (such as equity shares, preference shares, long-term loans or debts like debentures or bonds, retained earnings, etc.) in the total capitalisation of the company.

FACTORS AFFECTING OR DETERMINING CAPITAL STRUCTURE

(A) Internal Factors: 1. Nature and Size of a Firm, 2. Desire to Control the Business, 3. Purpose of Financing. 4. Assets Structure, 5. Financial Leverage or Trading on Equity, 6. Cost of Capital. (B) External Factors: 1. Flotation Cost, 2. Nature and Kind of Investors, 3. Capital Market Conditions, 4. Statutory Restrictions. Optimum Capital Structure: The capital structure is said to be optimum when cost of capital is minimum and total value of the firm is maximum. (Capital Structure Bcom Notes) Hence, in order to achieve the objective of maximisation of shareholder’s wealth, the financial manager should determine an optimum capital structure for the firm.

FEATURES OR QUALITIES OF OPTIMUM CAPITAL STRUCTURE

An optimum or balanced capital structure must possess the following features: 1. Simplicity, 2. Flexibility, 3. Sufficient Liquidity. 4. Minimum Cost of Capital, 5. Minimum Risk, 6. Maximum Profitability, 7. Maximum Control. (Capital Structure Bcom Notes)

DECISIONS OF CAPITAL STRUCTURE

Broadly speaking, equity (owned funds) and debt (borrowed funds) are the two main sources of capital funds and hence such a decision virtually implies fixing levels of equity’ and ‘debt’ in the design of capital structure. A high proportion of the debt content in the capital structure increases the risk and may lead to financial insolvency of the company in adverse times. However, raising funds through debt is cheaper as compared to raising funds through shares. This is because interest on debt is allowed as an expense for tax purposes. The following considerations will greatly help a finance manager to take such type of decisions: 1. Trading on Equity, 2. Capital Gearing, 3. Financial Leverage, 4. Cost of Capital.

Capital Structure Bcom Notes

TRADING ON EQUITY

Trading on equity indicates utilisation of non-equity sources of funds in the overall capital structure of the company in order to increase earnings available to the equity shareholders.

- “When a person or a corporation uses borrowed capital as well as owned capital in the regular conduct of its business it is said to be trading on equity.”

- “The use of borrowed funds, at a fixed cost for financing a firm is known as trading on equity.”

-Guthmann & Dougall

OBJECTIVES OF TRADING ON EQUITY

(i) To achieve control on more financial resources by taking maximum loan on the basis of minimum owned or equity share capital.

(ii) To retain full control over the business.

(iii) To increase the rate of dividend on equity shares.

IMPORTANCE OF THE POLICY OF TRADING ON EQUITY

- Distribution of more dividend: The foremost advantage of the policy of trading on equity is that the company can pay a higher dividend to its shareholders.

- Increase in the goodwill: Higher rate of dividend on equity shares also results in increased prices of shares of the company which increases goodwill of the company.

- Simplicity in obtaining loans: Due to increase in creditworthiness, the company can easily obtain loan on lower rate of interest.

LIMITATIONS OF TRADING ON EQUITY

- Irregularity and Uncertainty of Income: The device of trading on equity may not be suitable device in case of the companies having irregular or unstable earnings.

- Obtaining debt of successively higher rates: Every rupee of extra borrowings increases the risk and hence the rate of interest expected by the subsequent lenders goes on increasing.

- Sufficient Earnings: If the rate of return earned by the company by investing the debt capital is less than the one it is required to pay on the same, the trading on equity may prove to be fatal to the company.

- Sufficient Assets: Trading on equity may not be a suitable device unless the company is having sufficient tangible assets to offer as security.

ANALYSIS OF THE POLICY OF TRADING ON EQUITY WHEN CAPITAL STRUCTURE OF A PARTICULAR COMPANY IS GIVEN

In Such a case, we compute the following two rates to ascertain the profit derived by using the policy of trading on equity:

- Normal Rate of Return: We compute normal rate of return on the assumption that we have received the total amount of capitalisation by way of equity share capital only. Here, we ignore the contents of actual capitalisation that generally includes a composition of equity shares, preference shares and debentures etc. (Capital Structure Bcom Notes) In brief, we compute the normal rate of return by the following formula:

Normal Rate of Return = [Total Earnings after tax i.e., EBIT – Tax / Total Amount of Capitalisation] × 100

- Calculation of Earning Rate on Equity Share Capital: We use the following formula:

Earning Rate on Equity Share Capital:

= [Total Earnings available to Equity Shareholders / Equity Share Capital] ×100

Interpretation: By interpreting the above rates, there can be three conditions:

- Positive Trading on Equity: When the earning rate on equity share capital is greater than normal rate of return, it is the indication of positive trading on equity.

- Negative Trading on Equity: When the earning rate on equity share capital is less than normal rate of return, (Capital Structure Bcom Notes) it is the indication of negative trading on equity.

- Zero Trading on Equity: When the earning rate on equity share capital is equal to normal rate of return, it is the indication of zero trading on equity.

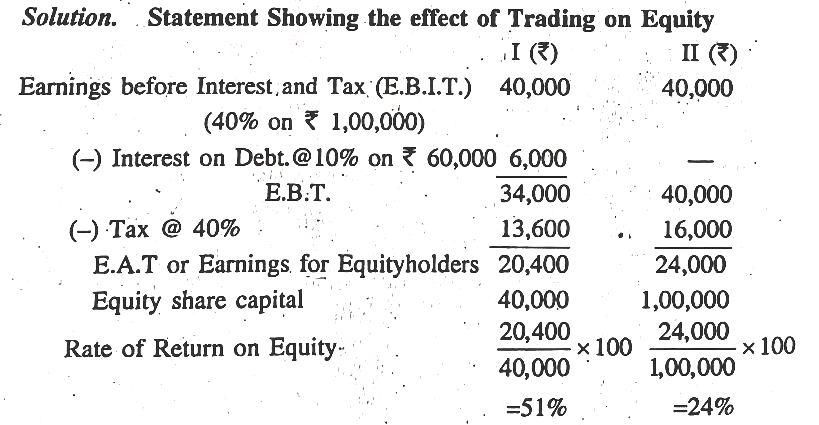

Illustration 1. X Ltd. desires to purchase a machine costing ₹ 1,00,000 for a project, whose financing is to be done by raising ₹ 40,000 through issue of shares and ₹ 60,000 as debt at a cost of 10%. Another alternative is to raise ₹ 1,00,000 through issue of shares. (Capital Structure Bcom Notes) Company’s tax rate is 40%. If the company’s earning capacity is 40% (before tax and interest) on total investment, examine the effect of trading on equity.

Solution. Statement Showing the effect of Trading on Equity

Interpretation: It becomes clear from the above calculations that there is favourable effect of the policy of trading on equity in option I.

Capital Structure Bcom Notes

CAPITAL GEARING

Capital gearing is of vital significance for maintaining a well devised capital structure and sound financial position of a business enterprise. The term capital-gearing refers to the ratio between equity share capital and fixed charge bearing securities. Some important definitions are as follows:

- “The relation of ordinary shares (Equity shares) to preference share capital and loan capital is described as the capital gearing.”

-J. Batty

- “The term capital gearing is used to describe the ratio between the ordinary share capital and fixed interest bearing securities of a company.”

-Brown and Howard

Capital gearing occupies the same place in the successful running of a business enterprise as gears occupy in the running of a motor car. The capital employed by a company may be put under three groups-(1) Fixed cost capital (2) Variable cost capital and (3) No cost capital. Whereas fixed cost capital includes preference shares and debentures having a fixed dividend and interest rates, the variable cost capital comprise of equity share capital having variable dividend rates depending upon the profitability of the business and the policy of the directors. On the other hand, no cost capital includes all such amounts which are used by the company without incurring any cost, e.g., unpaid expenses, reserve fund, business credit etc.

Capital Structure Bcom Notes

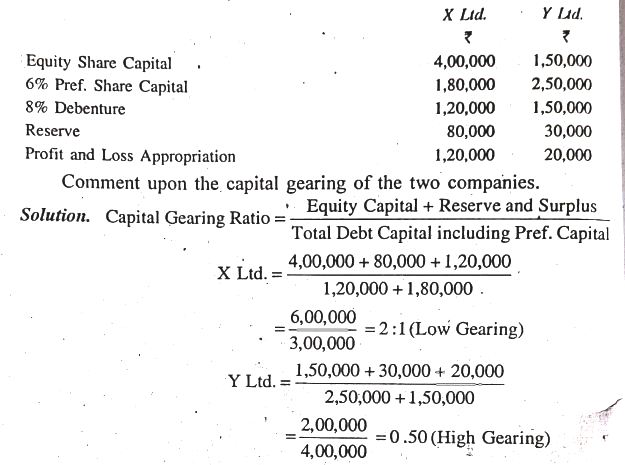

Capital Gearing Ratio

= [Equity Share Capital + Reserve & Surplus / Total Debt Capital including preference share Capital]

OR

= [Variable Cost Bearing Capital / Fixed Cost Bearing Capital]

TYPES OF CAPITAL GEARING

- High Gearing: When the proportion of fixed cost capital (debentures, preference shares, long-term debts etc.) is high in comparison to equity share capital in the total capitalisation, it is called high geared. Trading on Equity and High Capital Gearing both are the same. (Capital Structure Bcom Notes)

- Low Gearing: When the proportion of equity share capital is high in comparison to other securities in the total capitalisation, it is called low geared. The gearing ratio will be high in case of low capital gearing.

Illustration 2. The Capital Structures of X Ltd. and Y Ltd. are as under:

Capital Structure Bcom Notes

|

|||