The Reserve Bank of India Bcom Notes

The Reserve Bank of India Bcom Notes:-

In this post, you will get the notes of B.com 3rd year money and financial system, by reading this post you can score well in the exam, hope that this post has helped you with this post to all your friends and all groups right now I must share it so that every student can read this post and it can also be helped in this post. Reserve Bank of India Bcom Notes

THE RESERVE BANK OF INDIA

The Central Bank is the apex bank in a country’s monetary system. It is called by different names in different countries. The Reserve Bank of India is known as the Central Bank of India. The Reserve Bank of India Act, 1934 was passed to set up the Reserve Bank of India as the Central Bank of the country. Reserve Bank of India was established on April 1, 1935 and took over the function of issuing paper currency from the Central Government and the controlling of credit from the Imperial Bank of India. Reserve Bank was nationalised in 1949.

Reserve Bank of India is managed by Central Board of Directors. Presently this Board consists of 20 members.

Reserve Bank of India Bcom Notes

According to Vera Smith, “The primary definition of Central Banking is a banking system in which a single bank has either a complete or residuary monopoly of note issue.”

According to R. S. Sayres, “The business of a Central Bank as distinguished from a Commercial bank is to control the commercial banks in such a way as to promote the general monetary policy of the state.”

The headquarter of the Reserve Bank of India is in Mumbai For general direction, the bank has established local head offices and branches at different places. (Reserve Bank of India Bcom Notes) The State Bank of India and its subsidiaries act as RBI’s agents where there is no local office of the Reserve Bank of India.

Functions of the Reserve Bank of India

The various functions being performed presently by the Reserve Bank of India can be explained as follows:

Reserve Bank of India Bcom Notes

- Monopoly of Note Issue: The Reserve Bank of India has the sole authority for the issue of currency other than one rupee coins, one rupee notes and subsidiary coins. All the currency issued by the RBI is its monetary liability. The new notes are issued by the Issue Department after keeping reserve of 200 crore comprises of Gold worth Rs. 115 crore and foreign securities worth Rs. 85 crore.

- Bankers to the Government: The Reserve Bank of India acts as a banker to the Government the Central as well as the State Governments. It provides to the governments all banking services such as acceptance of deposits, (Reserve Bank of India Bcom Notes) withdrawal of funds by cheques, making payments as well as receipts and collection of payments on behalf of the government, transfer of funds and management of public debt. He acts as a advisor to the government on economic and financial matter.

- RBI as the Banker’s Bank and Supervisor: The RBI like all Central Banks can be called a banker’s bank because it has a very special relationship with the commercial and co-operative banks and the major part of its business is with these banks. The Bank controls the volume of reserve of commercial banks and thereby determines the credit creating ability of the banks. The banks hold a part of all of their reserve with the RBI. Similarly at the time of need, the banks borrow funds from the RBI. It is, therefore, called the bank of last resort or the lender of the last resort. On the whole, the the ultimate source of money and credit in India. (Reserve Bank of India Bcom Notes)

- RBI as Controller of Money Supply and Credit: A very important function of RBI is to control the total supply of money and bank credit. For this purpose the RBI adopts quantitative or general methods such as bank rate, open market operations and the powers to vary the reserve requirements of banks, but also extensive power of selective credit controls and direct action. (Reserve Bank of India Bcom Notes) By adopting such methods, the RBI tries to influence and control credit creation by commercial banks in order to stabilise the economic activities in India. Besides, the RBI also controls the money market through licensing, the regulation of branch expansion of Commercial and Co-operative banks, inspecting or auditing the accounts of banks etc.

- Exchange Management and Control: The Reserve Bank of India has the responsibility to maintain not only the internal value of the rupee, but also to maintain the external value of the rupee. For this purpose, the Reserve Bank sells and purchase foreign exchange at fixed rates through its Exchange Control Department. (Reserve Bank of India Bcom Notes)

Besides maintaining the rate of exchange of the rupee and holding India’s foreign exchange position, the RBI manages exchange control operations by supplying foreign currencies to importers and persons visiting foreign countries on business, studies etc. in keeping with the rules laid down by the Government of India.

Reserve Bank of India Bcom Notes

- Monetary Data and other Publications: The Reserve Bank acts as a source of all economic, financial and banking data which are essential for the critical evaluation of economic policies. (Reserve Bank of India Bcom Notes) For this purpose, the RBI collects and publishes these data continuously in its weekly statements in the Reserve Bank of India Bulletin (Monthly), trends and progress of banking in India in its Annual Report on Currency and Finance and other periodic publications. These publications provide valuable statistical information on the monetary and financial development in the economy and also on the working of the banking system.

- Promotional Functions: After 1948, the RBI has been playing an active role to promote and develop financial institutions, appropriate credit and monetary policies for economic growth and development in an era of planned economic development. The promotional role of the Reserve Bank in India’s economy are as follows:

(a) The RBI has expanded banking facilities in rural and semiurban areas, reducing inter-regional disparities.

(b) The RBI established the Bill Market Scheme in 1952. (Reserve Bank of India Bcom Notes)

(c) The RBI has helped the commercial and the co-operative banks by sponsoring and organising appropriate training course for its officers and personnel.

(d) The RBI has helped the establishment of an Export-Import Bank in India to provide finance to exporters.

(e) The RBI encourages and promotes research in the area of banking.

Reserve Bank of India Bcom Notes

(f) The Bank has helped the establishment of Financial corporations to provide credit to the agriculture and industrial sector of the economy.

Various Instruments of Monetary Policy Adopted by Reserve Bank of India

Credit has come to play a dominant role in the settlement of monetary and business transactions of all kinds and thus represents a powerful force to exert its influence on the price mechanism and the level of economic activities. It is, therefore, necessary for the Reserve Bank of India to regularise and control the entire monetary and credit system in order to bring about greater stability and sufficient encouragement to various business activities in accordance to the objectives and requirements of national planning.

Reserve Bank of India Bcom Notes

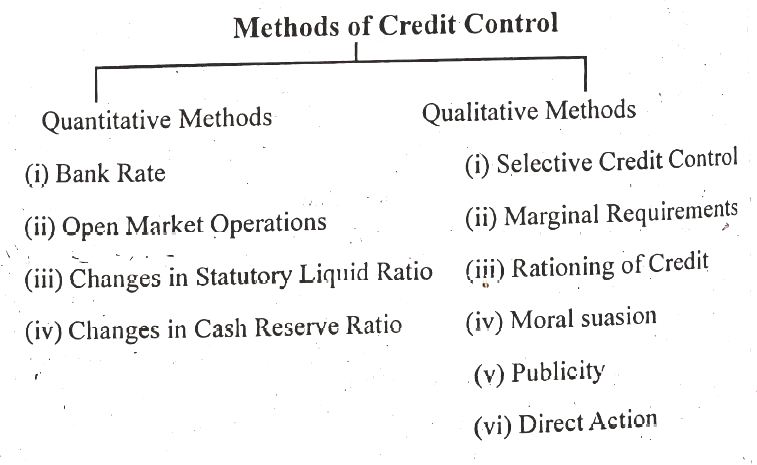

Methods of Credit Control

Reserve Bank of India Bcom Notes

The Reserve Bank of India can exerts a great influence on the whole range of credit system through its various measures of credit control.

(I) Quantitative Methods:

(i) Bank Rate: Bank rate is the rate at which the Reserve Bank rediscounts eligible bills of exchange or other commercial papers presented by commercial banks.

The Reserve Bank of India uses the bank rate as a weapon of monetary and credit control for discouraging excessive bank borrowings from the RBI through a sufficient increase in the bank rate. Whenever the Reserve Bank of India desires to reduce credit, the bank rate is raised and whenever the volume of bank credits is to be expanded, the bank rate is reduced. (Reserve Bank of India Bcom Notes) This is because by change in the bank rate, the RBI seeks to influence the cost of bank credit.

(ii) Open Market Operations: Open market operations refer to the delibrate and direct buying and selling of securities in the money market by the central bank. In the narrow sense, it refers to the purchase and sale of government securities only and in broad sense it imply the sale and purchase of any kind of eligible papers, like, government securities, bills and securities of private concerns etc.

Reserve Bank of India Bcom Notes

When the Reserve Bank purchases or sells securities in the open market, it brings changes in the reserves of the commercial banks. When RBI purchases securities, the reserves of the banks increase exactly by the same amount of the purchase. The bank will expand credit multiple times which will ultimately leads to an increase in the level of economic activity. Opposite effects will be obtained when the RBI sells securities. The policy of open market operations, by affecting the cash reserves of the commercial banks, attempts to influence the total volume of credit created in the system and ultimately the level of economic activity and the price level of the country.

The Reserve Bank of India has rarely used open market operations as a sharp weapon of credit control. In general, open market operations have been used in India more to assist the government in its borrowing operations and to maintain orderly conditions in the government securities market rather than for influencing the availability and cost of credit.

(iii) Cash reserve Ratio: According to the RBI Act of 1934, scheduled commercial banks were required to keep with the Reserve Bank of India a minimum cash reserve of 5 percent of their demand liabilities and 2 percent of their time liabilities.

The Amendment Act of 1956, empowered the Reserve Bank of India to use these reserve requirement ratios as a weapon of credit control by varying them between 5 and 20 percent on the demand liabilities and between 2 and 8 percent on the time liabilities.

Reserve Bank of India Bcom Notes

This variability in cash reserve ratio (CRR) direct affects the availability and cost of credit. For example, the commercial banks keep 10% of their cash reserves with central bank. This means Rs. 10 of reserves would be required to supports Rs. 100 of deposits. To check inflation, the central bank raises the cash reserve ratio from 10% to 12% As a result of the increase in the cash reserve ratio, the commercial banks will have to maintain a greater cash reserve of Rs.12 instead of Rs. 10 for every deposit, of Rs.100 and they will now decrease their lending to get the additional 2% cash.

On the other hand, to check deflation, the central bank may reduce the cash reserve ratio from 10% to 8% and thus make available 2% excess cash reserve to the commercial banks which they utilise to expand credit.

(iv) Statutory Liquid Ratio (SLR): SLR is the percentage of a bank’s total demand and time liabilities, which it has to maintain in the form of liquid assets, i.e. cash, gold, unencumbered approved securities etc. Any change in SLR affect the creation of credit and it is used; (a) to restrict expansion of bank credit, (b) to augment banks’ investment in government securities and (c) to ensure solvency of banks. Like CRR, RBI also changed statutory liquidity ratio from time to time in accordance with requirements of monetary policy.

Reserve Bank of India Bcom Notes

(II) Qualitative Methods:

Selective Credit Controls: The quantitative credit control methods cannot be used effectively to control the use of credit in particular areas or sectors of the credit market. The selective credit controls are meant to regulate the terms on which credit is granted in specific sectors. They seek to control the demand for credit for different uses by (a) determining minimum down payments and (b) regulating the period of time over which the loan is to be repaid. Various selective controls are discussed below:

(i) Marginal Requirements: The marginal requirement is the difference between the market value of the security and its maximum loan value. If a security has a market value of Rs. 100 and if the marginal requirement is 60% the maximum loan that can be advanced for the purchasers of security is Rs. 40. Similarly, a marginal requirement of 80% would allow borrowing of only 20% of the price of the security and the marginal requirement of 100% means that the purchasers of securities must pay the whole price in cash. Thus, an increase in the marginal requirements will reduce the amount that can be borrowed for the purchase of a security.

Reserve Bank of India Bcom Notes

This method has many advantages: (a) It controls credit in the speculative areas without affecting the availability of credit in the productive sectors. (b) It controls inflation by curtailing speculative activities on the one hand and by diverting credit to the productive activities on the other.

(ii) Rationing of Credit: Credit rationing is a selective method of controlling and regulating the purpose for which credit is granted by the commercial banks. Rationing of credit may assume two forms: (a) the central bank may fix its rediscounting facilities for any particular bank; (b) the central bank may fix the minimum ratio regarding the capital of a commercial bank to its total assets. In other words, credit rationing aims at (a) limiting the maximum loans and advances to the commercial banks, and (b) fixing ceiling for specific categories of loans and advances.

Reserve Bank of India Bcom Notes

(iii) Moral Suasion: Moral suasion means advising requesting and persuading the commercial banks to cooperate with the central bank in implementing its general monetary policy. Through this method, the central bank merely uses its moral influence to make the commercial bank to follow its policies. For instance, the central bank may request the commercial banks not to grant loans for speculative purposes. Similarly, the central bank may persuade the commercial banks not to, approach it for financial accommodation. (Reserve Bank of India Bcom Notes)This method is a psychological method and its effectiveness depends upon the immediate and favourable response from the commercial banks.

(iv) Publicity: The central banks also use publicity as a method of credit control. Through publicity, the central bank seeks: (a) to influence the credit policies of the commercial banks; (b) to educate people regarding the economic and monetary condition of the country; and (c) to influence the public opinion in favour of its monetary policy. The central bank regularly publish the statement of their assets and liabilities; reviews of credit and business conditions; reports on their own activities, money market and banking conditions; etc. (Reserve Bank of India Bcom Notes)

From the published material, the banks and the general public can anticipate the future changes in the policies of the central bank. But, this method is not very useful in the less developed countries where majority of the people are illiterate and do not understand the significance of banking statistics.

(v) Direct Action: The method of direct action is most extensively used by the central bank to enforce both quantitative as well as qualitative credit controls. This method is not used in isolation; it is often used to supplement other methods of credit control. Direct action refers to the directions issued by the central bank to the commercial banks regarding their lending and investment policies.

Reserve Bank of India Bcom Notes

Direct action may take different forms: (a) The central bank may refuse to rediscount the biils of exchange of the commercial banks whose credit po is not in line with the general monetary policy of the central bank. (b) The central bank may charge a penal rate of interest, over and above the bank rate, on the money demanded by the bank beyond the prescribed limit. (c) The central bank may refuse to grant more credit to the banks whose borrowing are found to be in excess of their capital and reserves. (Reserve Bank of India Bcom Notes)

Reserve Bank of India Bcom Notes